In 2014, hedge funds invested millions of dollars into Indian start ups. This trend is likely to continue and higher investments are likely in 2015 and beyond.

Whether you are someone who wants to understand the basics of hedge funds (i.e. how they are different from other forms of investments) or you are someone who wants to set up a hedge fund of your own, this post will be of great help.

Note: If you are looking at setting up a fund – there may be better avenues available to you than creating a hedge fund, particularly if your total investment amount is not very large – see end of this post.

What is a Hedge Fund?

The term ‘hedge fund‘ first came into use in the 1950s to describe any type of investment fund which used techniques like short selling and buying and selling of securities with margin funding to generate higher returns. Over time, hedge funds started diversifying their investment portfolios to include all sorts of financial instruments and started engaging in a wider variety of investment strategies.

Hedge funds are actively managed, pooled investment vehicle that are open to only limited group of investors. Their performance can be measured in absolute return units.

How do Hedge Funds work?

Think about a mutual fund. Hedge funds are similar in terms of pooling money from different investors money to invest in stocks, derivatives and bonds. The collected pool of money is invested as per the funds instructions and returns are distributed among the unit holders. But the similarity ends here.

The investment strategies involved in hedge funds are often much more complex. Hedge funds use strategies far more complex than mutual funds which focus on generating returns through simple asset allocation. Unlike mutual funds, hedge funds can invest in futures, options or in any other high risk class of equity as defined in the formation document of the fund.

Hedge Funds Strategies – Hedge funds aim is to generate higher return with minimum risk. That said, the risk element is often more than what an investor undertakes when investing in fixed income or in a mutual fund. Hedge funds employ many complex strategies and at the same time are also free to generate returns using arbitrage opportunities. They mostly rely on statistical tools and models to build portfolios. Hedge funds may concentrate on any one particular asset class or they may diversify their strategies / investments by investing across equities, fixed income, commodities and currencies. The basic idea is to invest wherever the fund manager can spot an opportunity without being bound by strict rules which apply to mutual funds.

Hedge Funds in India

In India, hedge funds are registered with SEBI under the Securities and Exchange Board of India (Alternative Investment Funds) Regulation 2012 (AIF Regulation). The regulation was created to ensure greater transparency and visibility in the functioning of alternative funds and alternative investments.

SEBI has defined hedge funds as:

Alternative Investment Funds (AIF) which employ diverse or complex trading strategies and invest and trade in securities having diverse risks or in complex products including listed and unlisted derivatives.

Eligibility & Registration requirement for Hedge Funds

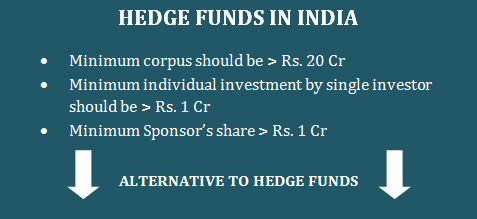

- A Hedge Fund should have a minimum corpus (i.e. total investment) of Rs. 20 Cr. and minimum investment of Rs.1 Cr by each investor/ member of the fund.

- The sponsor or manager of the fund is required to maintain an interest in the hedge fund of – 5 % or 10 Crs. whichever is lesser. This means that for the smallest possible hedge fund (i.e. of Rs. 20 Cr), the sponsor or manager must invest at least Rs. 1 Cr.

Hedge fund performance in India

Hedge fund performance in India

Since their inception in 2012, hedge funds in India have raised a cumulative amount of Rs. 2,311.34 Cr.

| Hedge Funds | Return (%) |

| The India Insight Value Fund | 78% |

| The Mayur Hedge Fund | 49% |

| The Malabar India Fund LP | 48.6% |

Source: Eurekahedge Report 2014

Alternatives to creating a hedge fund – Naturally, not many money managers will have a commitment of Rs. 20 Cr from investors on the day they start, let alone investors with a minimum ticket size of Rs. 1 Cr. Further, not many may may be able to commit Rs. 1 Cr. of their own at the beginning of their careers. If you have done some looking around, you will realize that neither a partnership structure nor a corporate structure will be feasible until you have a minimum of Rs. 5+ Cr. in client commitments, may be Rs. 10 Cr will be ideal.

All those structures will require you to register either an NBFC (with minimum capital requirement of Rs. 2 Cr – hence an expensive registration fees) or pay a huge Portfolio Management Service (PMS) fees. The simplest way to start out on your own will be to just get affiliated with a stock broker as an Authorized Person and bring your own clients with whom you can set a profit sharing arrangement or charge them a higher brokerage for managing their money (keep in mind – legally, the maximum brokerage a broker can charge is 2.5%).

That said, once your investments under management cross Rs. 5 Cr, you should seriously start looking at a more appropriate structure to run your business. Feel free to write in to me with your questions.

Update: Also read (for other similar funds and tax considerations)- http://192.46.215.17/venture-capital-firms-india/

Hedge fund performance in India

Hedge fund performance in India

Dear Rajat,

I read your article on Hedge Funds. My question is if someone has a 1 Crore or 2 Crore corpus initially as AUM is there a pooling mechanism available?. As you know when you start as a entrepreneur you will not immediately get a big corpus to manage till you prove your worth.How good is a LLP structure for pooling? Is that medium tax efficient?

Regards,

P.Vinayakam

9886255897

For tax – Its a good point which I should cover. I will try to update the above.

Fund size – whether you try to register an LLC or a pvt ltd company – for pooling, especially when you are trying to run a smaller/ streamlined fund – number of investors is more important as an issue than investment amount. Meaning that you will have a higher chance of finding willing managers (for pooling) if your 1 cr or 2 cr comes from 2-3 or at most 5 big investors rather than 50 small retail investors.

Keep your number of investors as small as you can initially.

Can hedge funds also invest in unlisted or private businesses that are young still.

Yes they can. . . but typically that will be a VC firm. In fact let me do a post on venture capital firms and update it here.

Hi Rajat, Can an Indian start the offshore Hedge fund to invest in International Commodity; Say in Singapore.

Yes.

Business Model- Pooling money from investors to invest in share market like hedge funds.

(For starting this business, a bank current account linked with d-mat and trading account is required.)

Queries regarding Individual Current Account:

1. Can I start this business on a small level with Individual Current Account?

2. Is there any legal problem with this business structure?

3. Will I have to pay income tax on receiving money from investors to invest in share market?

4. What should I treat investors’ money as?

5. How much should be the AUM so that I can decide about other business structure?

Some business structures for starting this business are mentioned below (in order of difficulty to start and operate):

A. Individual Current Account

B. Current Account in the name of Sole Proprietor Firm

C. Current Account in the name of Partnership Firm

D. Current Account in the name of Limited Liability Partnership Company

E. Current Account in the name of Private Limited Company

Queries regarding business structure:

6. Which business structure is most suitable for this business from legal and tax perspective to start on a small level?

7. What are tax liabilities and benefits for Company, Investors and Owner in each of the above mentioned cases?

8. If a company sells shares 3 years after purchase, then does it have to pay income tax on notional profit after every year or on actual booked profit after 3 years? What about taxation of dividend income from shares?

9. Are there any legal, tax or other risk associated with these above structures?

10. Is there any eligibility criteria for owner and company to start this business?

11. Is license required from SEBI or RBI to start this business on a small level?

Queries regarding Partnership or LLP business structure:

12. Which among partnership and LLP is a better choice?

13. How much AUM and how many investors would be appropriate to start partnership or LLP?

14. Can an employee of private company or MNC become a silent or limited investment partner from legal perspective? Will limited partners have to file return showing capital gains as business income?

15. What are the legal requirements to be fulfilled when a new limited partner comes in or when an existing partner brings additional money or redeem existing money? Will it not become tedious and complex task for a small level business?

16. Can I register partnership or LLP at Ranchi address and run the business in Mumbai? Will I and other limited partners have to go to Ranchi to make necessary changes in case a new partner comes in, etc.?

did u found the answers to your question. pls forward them to my mail if u found them.

You can write in to me for a fee quote to give you a legal opinion on these aspects on – rajat@sanasecurities.com

What are the qualification and eligibility Criterion required to get into Hedge fund for a beginner?

The answer to that could take a few hours of explaining. Write in to me for a fee quote at rajat@sanasecurities.com

HI

What is the options available for retail investor to invest in hedge fund in India?

Is there any mutual fund available through which retail investor can invest?

How can a small time retail investor in India invest in hedge fund.

In short – he can not and should not for his own good.

Your content has impressed me beyond words. Thank you for all your valuable input on this topic.