Read: Insurance Planning – 5 Basic Factors to Think About

Different Types of Life Insurance Policy Available

[1] Term Insurance Plan – Term Life Insurance is a 100% risk cover in that it pays benefit only in case the insured person dies. Since there is no saving element in case of a term life insurance, and it only covers the event of death, the premium payment is relatively low.

For Example – You purchased term insurance plan with a basic life cover of Rs. 1 Cr. and a 30 year term.

Click here to Calculate Your Term Insurance Premium*

*Premium amount is calculated based on your age, medical history and factors like smoker or non smoker etc.

In case of death any time during the policy term, your nominee will receive Rs. 1 Cr. as a one-time Lump Sum payout. The policy will end after the payment is made.

Different insurance companies sell term insurance plans with some additional features, for example Future Generali offer 2 additional plans under the same category:

- Fixed Income Protection – under this, investor can pay a small premium to choose a Fixed Income Protection payout of lets say Rs. 50,000 per month.

In case, if death happens anytime after beginning of policy, his nominee would start receiving Rs. 50,000 every month, similar to your monthly Income, for a period till the investor would have attained 60 years of age or for 120 months from the date of death, whichever period is higher.

- Increasing Income Protection – under this, the investor can choose Increasing Income Protection payout option of Rs. 50,000 per month for a 30 year term.

In case, death happens after commencement of policy, his nominee would start receiving progressively increasing amounts every year, at a simple rate of 10% of the monthly payout chosen at inception, for a period till the investor would have attained 60 years of age or for 120 months from the date of death, whichever period is higher.

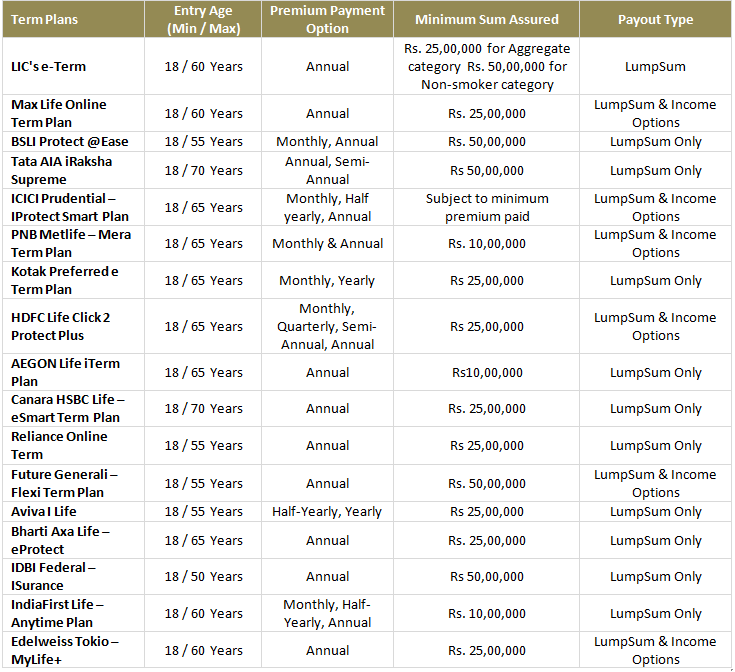

Some of the Term Insurance Available

[2] Unit Linked Insurance Plan (ULIPs)

ULIPs provide risk cover for the policy holder along with investment options to invest in investments such as stocks, bonds or mutual funds. ULIPs provide both market linked returns with a life insurance cover.

Types of Unit Linked Insurance Plans:

Unit linked insurance plans can be classified into various types depending upon the asset class in which it invests:

| Type of ULIPs | Nature of Investments | Risk Category |

| Equity Funds | Primarily invest in stock market | Medium to High |

| Income and Bond Funds | Invest in corporate bonds, government securities and other fixed income instruments | Medium |

| Cash Funds | Also known as Money Market Funds — invest in cash, bank deposits and money market instruments | Low |

| Balanced Funds | Combine equity investment with fixed income instruments | Medium |

Charges Involved in ULIPs

- Fund management charges – Management fees levied as a percentage of fund value. It is usually in the range of 0.5% to 2%.

- Premium Allocation Charges – This is deducted from the premium upfront. It is a percentage of the premium appropriated towards charges such as distributor fee and the cost of underwriting before allocating units under the policy.

- Policy Administration Charges – This charge is deducted towards administrative expenses such as cost of paperwork, premium intimation etc incurred by the company towards maintenance of the policy.

- Mortality Charges – Mortality charge is charged for compensating the insurance company in case a policyholder does not live to the assumed age. These charges differ according to the lifestyle and age of policyholders.

- Discontinuation Charge – This charge is borne by the customer in case he/she decides to discontinue with the ULIP scheme even before the lock-in period of 3 or 5 years.

- Surrender Charge – A surrender charge is levied in case of premature full or partial withdrawal of units.

- Fund Switching Charges – ULIPs provide flexibility to choose fund option as well as switch between them in case you want. A fee for switching is charged for switching your fund type.

Which is better – ULIPs or ELSS?

| ULIPs | ELSS | |

| Lock-In Period | Mandatory lock-in of 5 years | Mandatory lock-in of 3 years |

| Tax Benefit | Eligible For Section 80C Tax Benefits. In addition, returns continue to be tax free. | Eligible For Section 80C Tax Benefits. gains from ELSS funds will be taxed at 10% . |

| Charges Applicable | There are complex and multiple charges like policy administration charges, premium allocation charges, mortality charges, etc.

· Allocation charges – Ranges between 2- 5 % annually · Policy Administration charges – anywhere between Rs 700 – 1,000 per annum. · Mortality charges – ranges from 1 to 12 per thousand sum insured (which is very high in higher age groups). · Cannot be withdrawn before FIVE years. · Discontinuation charges before five years, ranging between 2- 6%. · They avail a benefit of tax free maturity under section 10(10) D. · They have free switches without paying any taxes short term/ long term gains · It is only beneficial if you want it for at least 10 years + |

Exit load and fund management fee or expense ratio which is around 3% and the cost is adjusted in the NAV of the scheme, not charged separately.

· No Allocation Charges. 100% invested in markets · No Administration charges · No Mortality charges · Cannot be withdrawn before THREE years. · LTCG 10% and STCG 15% · Switch is counted as redemption and is subject to capital gains · It is beneficial and beats ULIPs in short term of 5 to 6 years . |

In the next article, I will be discussing other insurance plans like Money Back Plan, Assured Income Plan.