Price – Rs. 2279

Date – 16th May, 2019

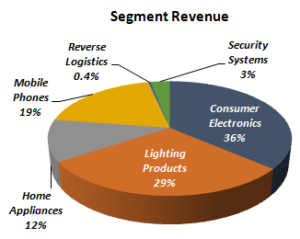

Their diversified product portfolio includes:

- Consumer electronics like LED TVs

- Home appliances like washing machines

- Lighting products like LED bulbs and tubelights, downlighters and CFL bulbs

- Mobile phones like feature phones and smartphones

- Security Surveillance Systems like CCTV & DVRs.

The Company also provides solutions in reverse logistics i.e. repair and refurbishment services of set top boxes, mobile phones and LED TV panels.

The Company operates through nine state-of-the-art manufacturing facilities which are strategically located in the states of Uttar Pradesh, Uttarakhand and Andhra Pradesh.

Dixon Technologies got listed at Rs 2,725 on BSE, 54% premium to issue price on 18th September, 2017.

Financial Position

| Particulars | FY14 | FY15 | FY16 | FY17 | FY18 |

| Revenue (In Rs. Cr.) | 1,093.72 | 1,201.34 | 1,389.42 | 2,457.03 | 2,841.63 |

| Growth | – | 9.84% | 15.66% | 76.84% | 15.65% |

| EBITDA (In Rs. Cr.) | 25.99 | 32.21 | 58.69 | 91.23 | 112.68 |

| EBITDA Margin | 2.38% | 2.68% | 4.22% | 3.71% | 3.97% |

| EBIT (In Rs. Cr.) | 20.65 | 25.31 | 50.25 | 80.52 | 97.50 |

| EBIT Margin | 1.89% | 2.11% | 3.62% | 3.28% | 3.43% |

| PBT (In Rs. Cr.) | 18.23 | 17.25 | 50.60 | 66.39 | 88.23 |

| PAT (In Rs. Cr.) | 13.51 | 11.86 | 42.57 | 47.57 | 60.90 |

| PAT Margin | 1.24% | 0.99% | 3.06% | 1.94% | 2.14% |

| EPS (In Rs.) | – | – | 37.59 | 42.00 | 53.77 |

| EPS Growth Rate | – | – | – | 12% | 28.0% |

| Historic P/E (Closing Price of 31st March) | – | – | – | 68.84 | 61.20 |

| CURRENT P/E (based on price of 16th May – Rs. 2279 and EPS TTM –Rs. 53.99) | 42.21 | ||||

| Shareholder funds (In Rs. Cr.) | 73.61 | 84.85 | 122.82 | 197.07 | 314.97 |

| Minority Interest (In Rs. Cr.) | 2.09 | 2.99 | 0.00 | 0.00 | 0.00 |

| Debt (In Rs. Cr.) | 86.86 | 79.87 | 77.05 | 42.95 | 40.64 |

| Cash (In Rs. Cr.) | 4.63 | 6.89 | 7.46 | 15.33 | 44.12 |

| D/E | 1.18 | 0.94 | 0.63 | 0.22 | 0.13 |

| Interest Coverage | 2.31 | 3.27 | 4.48 | 5.87 | 8.38 |

| ROCE | 12.70% | 15.09% | 25.14% | 33.55% | 27.42% |

| ROE | 24.77% | 20.33% | 41.20% | 33.69% | 28.01% |

Quarterly Performance

| Quarterly Results | Q3 FY 2018 | Q2 FY 2019 | Q3 FY 2019 | TTM | Q-o-Q % | Y-o-Y % |

| Revenue (In Rs. Cr.) | 677.80 | 738.85 | 793.97 | 2,723.34 | 7.46% | 17.14% |

| EBITDA (In Rs. Cr.) | 26.09 | 32.97 | 39.02 | 125.42 | 18.35% | 49.56% |

| EBITDA Margin | 3.85% | 4.46% | 4.91% | 4.61% | ||

| PAT (In Rs. Cr.) | 15.24 | 16.43 | 17.64 | 60.93 | 7.36% | 15.75% |

| PAT Margin | 2.25% | 2.22% | 2.22% | 2.24% | ||

| EPS (Rs.) | 13.68 | 14.51 | 15.58 | 53.99 | 7.37% | 13.89% |

WHAT’S DRIVING THE STOCK?

Diversified Product Portfolio

LED TVs, washing machine, lighting products (LED bulbs &tubelights, downlighters and CFL bulbs) and mobile phones.

| Consumer Electronics | LED TVS – 19’’ to 65’’ and 4K2K technology Home theatres – 2.1 and 4.1 channel |

| Lighting Products | CFL Lamps, Ballast, Tube lights, Batten, CFL PCB, Downlighters, CFL/LED Drivers |

| Home Appliances | Semi-automatic washing machine ranging from 6.2kg to 8.2kg |

| Mobile Phones | Feature and smart phones (2G, 3G, 4G/LTE, VoLTE & CDMA) |

| Reverse Logistics | Repair and refurbishment – set top boxes Repair – mobile phones, LCD/LED TVs, LED panel, home theatre and computer peripherals & other devices |

Leading market position

The Company is the second-largest EMS (electronic manufacturing services) player in India with a market share of 9.3%. Dixon has strong leadership in three segments, namely LED TVs (50.4% market share), semi-automatic washing machines (42.6% share) and LED lights (38.9% share).

Strong Clientele –

- Consumer Electronics – Panasonic is the anchor customer of Dixon in LED TVs accounting for 72% of this segment’s revenues. Other customers include ReConnect (in-house brand of Reliance Digital, Lloyd, Koryo (in-house brand of Future group), Vice (in-house brand of Vijay Sales), Mitashi, Marq (in-house brand of Flipkart), Haier, Akai and Intex. In Oct 2018, the Company entered into agreement for manufacturing of LED TVs for Xiaomi.

- Lighting – Philips is the anchor customer of Dixon, accounting for 82% of FY18 lighting revenues. Other customers include Wipro, Panasonic, Anchor, Crompton, Usha, Jaguar, Bajaj, Syska and Orient.

- Home Appliances – The segment has a diversified customer profile with Intex, Panasonic, Samsung, Godrej and Haier being the top five OEM brands accounting for 74% of total sales. Other customers include Lloyd, Micromax, Weston etc.

- Mobile Phones – Gionee, Panasonic, Karbonn and InFocus

The Company started manufacturing mobile phones under its 50-50 JV, Padget Electronics in FY 2016. The segment contributed to ~14% of revenues of Dixon in 9M FY2019. On 12 April 2019, Dixon acquired its partner’s 50% stake in Padget Electronics for a total cash consideration of Rs. 270 million, thus making Padget Electronics its wholly-owned subsidiary. The key drivers for the acquisition are:

- Likely surge in the domestic mobile phone market.

- Imminent addition of a strong mobile brand as its customer.

- Backward integrated business model which offers higher value addition to customers and margin enhancement to Dixon.

- The management has given revenue guidance of Rs. 6.5 bn to Rs7 bn and EBITDA/PBT margin of 3.5%/3%, respectively, for the mobile phone segment in FY20.

Backward Integration To Improve Value Addition

In the consumer electronics segment (LED TVs), Dixon is shifting its manufacturing operations from Dehradun to Tirupati by building a much advanced and completely backward integrated assembly line. The Company expects its value addition to rise by 70%-80%.

WHAT’S DRAGGING THE STOCK?

Dependence on Customer’s Business Plans And Performance

The Company’s revenues are closely linked to the business plan and performance of its principals. A major part of the Company’s revenues and operating profitability is derived from its top two customers – Philips and Panasonic.

Intense Competition

The Company faces competition from other EMS players which limits its pricing flexibility and bargaining power with customers, thereby putting pressure on margins in segments like CE and mobiles.