I usually don’t write about these things, but not only for retail investors, also for the most sophisticated investors, Systematic Investment Plans or SIPs are the best way of making money over a longer term. I have seen investor behaviour for close to 2 decades and what I have learnt is that no matter how sophisticated investors are, they tend to do better when they invest systematically. Perhaps this is why, their self-managed portfolios always underperform managed portfolios.

It reminds me of a story of a famous Indian fund manager. This is what he told me –

“I like to keep things diversified, every month a part of my professional fee goes into 4 different funds; He went on . . . only about 15% of my investments are in the fund that I manage, balance is in other funds”.

I will not name this man but you all know him. 85% of his money was being managed by other managers in a systematic way. His reason was simple – separate emotion from investing. When it’s your own money, either you should put it in a fixed deposit or give it to a manager. The last thing you want to do is to get emotional about your money and try to manage it yourself. In fact, as he said “ I don’t even let them get emotional and so I make sure that they receive a limited amount to invest every month and not more or less based on what they think of market conditions.

Stay the Course with your SIPs – SIP investments make money after many cycles in the market.

When you decide to start a systematic investment plan, make sure you stick to it for at least 5 years. If you are going to stop your SIP in 2-3, even 4 years, you are just being disingenuous to your own portfolio. I have had clients who have started and stopped SIPs in less than a year. I think they emotionally manage their own money through someone else. This may be better than managing it yourself but still not as good as leaving it to an advisor. Then there are those who stop in 2 or 3 years. Given the dynamic nature of markets, at some point in the first 3 years or so, you will see negative returns on your overall portfolio. Few make the cut of 5 year investing, which explains why few make money.

Why things will just not work when you start and stop your SIPs based on market levels?

The very basic premise of starting an SIP is that it is hard to predict the market. How then can you start and stop SIPs based on market levels? In past few months, I have heard the same or similar query from many clients –

“Should we stop our SIPs since markets are at an all-time high? We can start again or increase the SIP amount when markets will fall”.

I answer all such queries with a similar reply – You will do neither.

There really are 2 difficulties with starting and stopping your SIPs based on market levels.

First, you will be wrong in most cases. Markets typically follow Murphy’s law. They will go against your predictions. So you will find yourself looking silly in most cases.

In fact, I have noticed that people who are successful with their SIPs are invariably successful with investing.

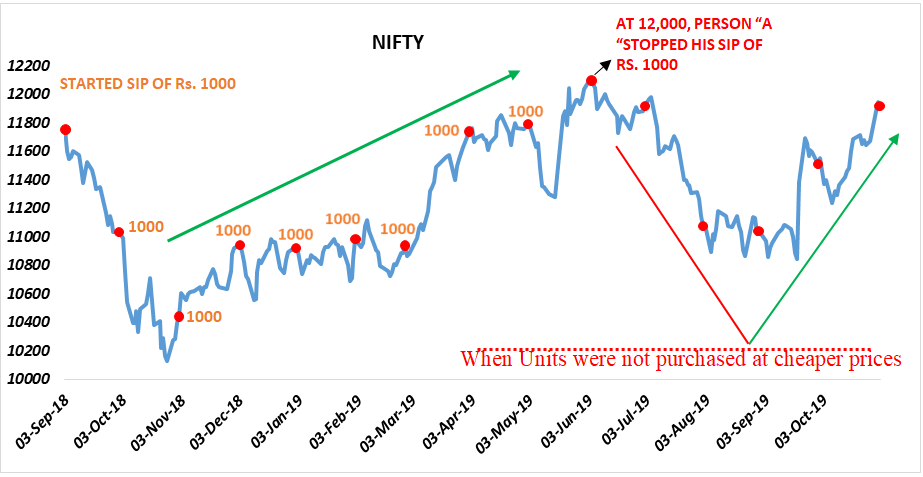

Second, in case you are right, you will not know when to start or increase your SIP amount as markets will still be as unpredictable as ever. Consider the chart below. This is a classic case of people losing out on long term returns by stopping their SIPs when Nifty had hit 12,000 levels (on 4 June 2019) and waited to start again when it fell. Nifty did fall to 10,704 level before reaching back close to 12,000 level on 4 November 2019 but no one who closed their SIPs in June would’ve started again anytime in the 5 month period from 1 June to 1 November. All they did was to reduce their long term growth trajectory by a few percentage points. Yes this percentage hit will always reflect in their portfolios unless they again get Nifty at 10,700 and invest twice the amount this time. Difficult isn’t it?

Bottom line – I hope it’s clear?

Nice Great Information!!