The fact that money lying in trading accounts does not earn any interest income is often a big problem for those who trade in multiple trading accounts, particularly asset managers, stock-brokers and their authorized persons who may not be able to transfer funds between client accounts and their trading account on a short notice. This is not in the interest of the client nor is it in the interest of the asset manager.

Often when the person managing the accounts has negative view on stocks in the short term and does not want to invest in equities, the unutilized amount lying in trading accounts of clients can be huge on consolidated basis [See Footnote 1].

[I] Fixed Income Focused Mutual Funds

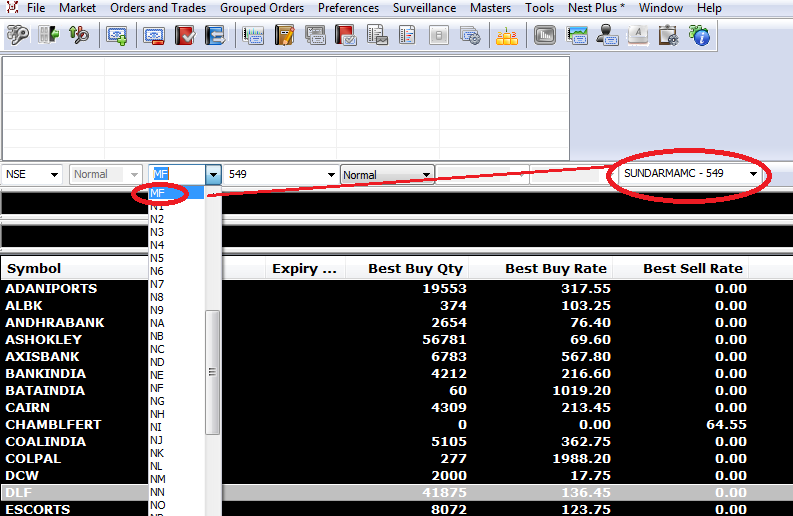

All mutual funds are listed on the stock exchange. You need to check with your stock broker about how you can buy them from their trading platform. For NSE Now and NEST, you will be able to find all mutual funds under the category MF in the CM segment. See image below:

It’s fairly similar to buy mutual funds if you use the ODIN platform or a customized one provided by your broker.

Select any good debt based (fixed income) mutual fund to generate interest on your unutilized cash. Choose mutual funds where returns are based on interest based products. I have a list set up within my trading console based on high interest rates, dividend, risk arbitrage funds and mutual funds which invest in government bonds. Look for their past performance before selecting based on consistency and low volatility.

If you want to earn fixed rate of interest in stock markets without withdrawing funds from your brokerage/ trading account, you can consider the options listed below.

[II] Exchange Traded Funds (ETFs)

To explain in the simplest way – ETFs are a bucket of stocks, bonds and other money market instruments expressed as a single unit. Every time a single ETF unit is bought/ sold, the underlying assets are bought and sold in proportion of their weight-age.

Due to lack of trading and illiquid nature of the market for government bonds and other fixed income products, ETFs based purely on fixed income products are not very popular in India. This however is likely to change and within the next 1-3 years and we are likely to see a few pure fixed income ETF’s on Indian stock exchanges.

That said there are many listed ETF’s on the NSE and the BSE which closely resemble the return generated by an underlying asset like Gold, an equity index (including foreign equity indices). The problem however is about finding those products which have high liquidity i.e. where it is possible to trade without much impact on the buy / sell spread.

For example with the N100 where the underlying asset is the Nasdaq 100 stocks – theoretically you can invest in the Nasdaq market of the U.S. but practically you won’t be able to since there is not enough liquidity in that ETF. (For N100 Look for symbol – N100 on NSE and 533385 on BSE or just search N100 in the financial quote section of a website).

All ETFs are available on the capital market (CM) segment of the exchanges.

Can You buy Nifty or the Bank Nifty in The cash market?

Yes. Besides buying Nifty and Bank Nifty lots in the future and option market, you can actually buy an ETF which resembles the performance of these indices.

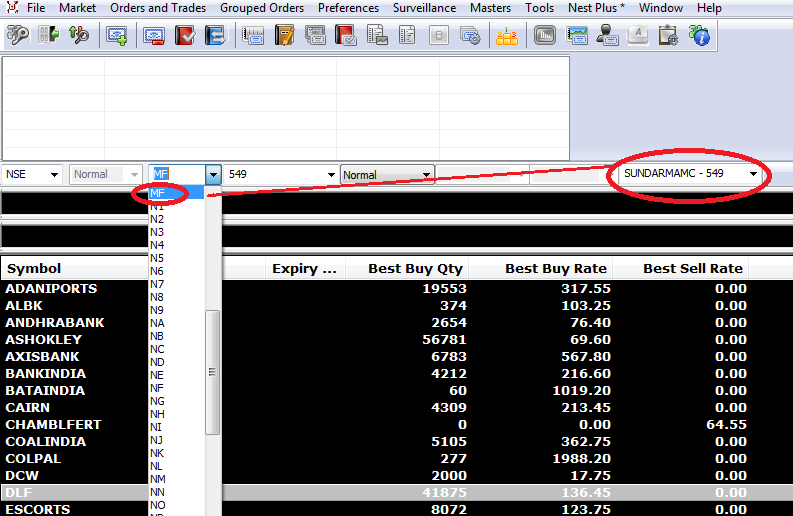

Just like Nifty BeES, there is an ETF based on the Bank Nifty – Bank BeES. The image below will show you all ETFs which you can buy in the CM segment along with the codes which you must enter to get them on your trading screen.

An example of a popular ETF- Nifty BeEs

Nifty BeES

Nifty BeES is an exchange traded fund which matches total returns with the return generated by the Nifty.

Each Nifty BeES unit is 1/10th of the Nifty index value. So, for example if Nifty is at 8,380 level then Nifty BeES would be approximately at 838 levels. It replicates the shares that are in the Nifty index and hence it moves in line with the Nifty.

Nifty BeES can be bought / sold like a share through any NSE terminal at prices available on the screen. The performance of Nifty BeES is simply the result of performance of shares in the Nifty index and the prevailing demand & supply in the market. There is no fund manager working behind this.

Nifty BeES gives you the most diversified exposure. Investing in 1 of Nifty BeES gives exposure to 50 companies of the Nifty index.

Nifty BeES – Top 10 holdings as of 27 April 2015.

| Company | Weightage (%) |

| ITC Ltd | 7.33 |

| ICICI Bank Ltd | 7.30 |

| Infosys Ltd | 6.80 |

| Housing Development Finance Corporation Ltd | 6.37 |

| HDFC Bank Ltd | 6.36 |

| Reliance Industries Ltd | 5.24 |

| Tata Consultancy Services Ltd | 4.67 |

| Larsen & Toubro Ltd | 4.36 |

| State Bank of India | 3.44 |

| Tata Motors Ltd | 3.18 |

[III] Fixed Income Bonds Traded in Capital Markets (CM) Segment

Many corporate bonds with fixed coupon rates are listed on the capital market segment of the NSE and the BSE. You can buy/ sell these listed bonds just like you buy any other stock. Use this link to see details of bonds listed on the capital market segment of the NSE.

Also note that when you search for any stock on NSE‘s website, you will see details of all instruments related to that company which are listed on the exchange.

Note: While you can buy bonds listed on the exchange, most of these are not very liquid (i.e. no trading happens in them) and this will not be a good option if you wish to invest larger amounts of money.

Also see: Why does the price of a fixed coupon rate bond move unevenly?

[Footnote 1]

Stock Brokers/ APs and portfolio managers have one consolidated limit with which they trade. This consolidated limit is based on the total fund size they handle (i.e. the sum of all monies extended to the manager by his clients). Because of this, small asset managers often end up overbuying into equities instead of preserving cash.