Eicher Motors Limited (“Eicher Motors” or the “Company”) is a leading player in the Indian automotive space. It operates in three distinct business verticals – Motorcycles, Commercial Vehicles and Personal Utility Vehicles.

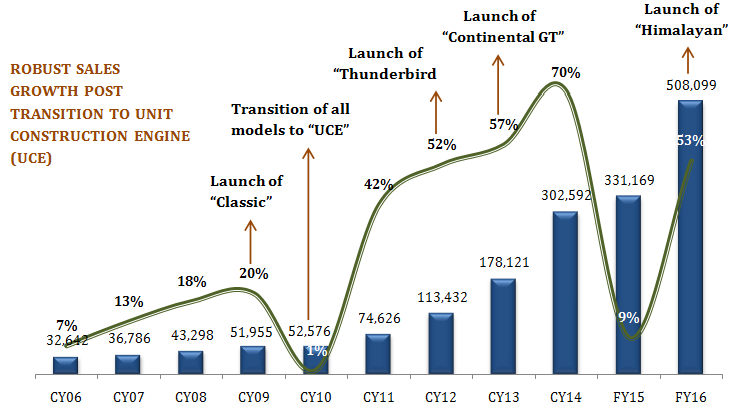

[1] Motorcycles– EicherMotors owns the iconic Royal Enfield motorcycle business, which leads the premium motorcycle segment in India. Royal Enfield is the oldest motorcycle brand in continuous production world-wide. In FY 2016, Royal Enfield demonstrated an impressive performance with sales of 5, 08,099 units, recording a growth of 53.4% as compared toprevious year.

[2] Commercial Vehicles – The Company operates its commercial vehicles business under VE Commercial Vehicles Limited (VECV), a joint venture with the Volvo Group. In FY 2016, VECV sold 52,025 units, recording a growth of 24.4% as compared to previous year.

[3] Personal Utility Vehicles–In June 2015, Eicher Polaris (50:50 JV between Eicher Motors and US-based Polaris Industries) launched personal utility vehicle ‘Multix’ in India at a starting price of Rs. 2.32 lakhs.

WHAT’S DRIVING THE STOCK

Strong Financial Position

Eicher Motors has shown consistent growth over the last five years (i.e. 2010-11 to 2015-16). Its net revenue from operations over this period grew at an impressive CAGR of 21.8 %. For FY 2016, income from operations increased by 39.8 % to Rs. 13,120.65 Cr. from Rs. 9,382.11 Cr. and PAT increased by 62.2% to Rs. 1,235.66 Cr. from Rs. 761.86 Cr. The Company’s reserves are in excess of Rs. 3,437.13 Cr (FY 2016), and it operates with ZERO debt on its books.

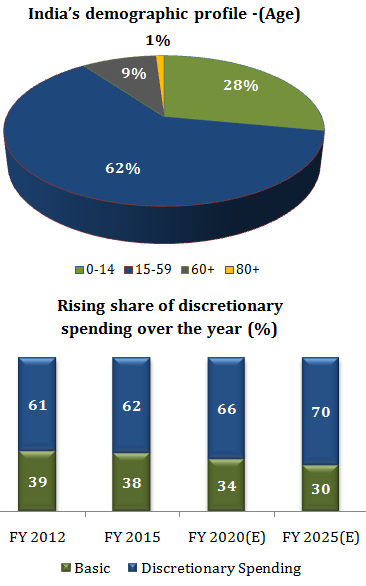

Long Term Growth Driver – India’s Demographic Advantage

India’s two-wheeler industry will continue to experience increase in demand, for many reasons. Firstly, the country’s aspirational youth and their high disposable income is a significant growth driver. Secondly, growing rural income across India has increased the two-wheeler sales. Finally, poor public transport and an urgent need to avoid urban congestion have increased need for a quicker and more affordable mode of transport.

Royal Enfield – Oldest Motorcycle Brand in Continuous Production

Royal Enfield range of motorcycles is able to address a unique mix of appeals – from its traditional customer base to urban, aspiration-driven youth. Royal Enfield’s product line up in India includes the Bullet, Classic and Thunderbird models in 350 and 500cc along with Continental GT 535 cc and the newly launched Himalayan powered by the new 411cc engine. Royal Enfield operates through 14 company-operated stores and more than 605 dealers in all major cities and towns in India, and exports to over 50 countries across the world including the USA, Japan, UK, several European and Latin American countries, as well as the Middle East and South Asia.

Royal Enfield commands 96 % market share in the 250cc and above category of motorcycles, but hold less than 6% market share in the overall motorcycle industry in India.

The Company is planning to increase its capacity to 6, 75,000 units in FY 2017 and 9,00,000 units by FY 2019.

International Market – Next Big Opportunity for Royal Enfield

Royal Enfield is targeting to lead and grow the under-served global mid-sized motorcycle segment (250-750cc), priced at U.S. $3000-7000. This segment is currently ~1 million units globally (excluding India), dominated by sports/street biking segment.India exports ~0.5million units of premium motorcycle per annum, of which ~42% contribution is from Bajaj Pulsar.

Currently, Royal Enfield exports a very small portion (~9000 units) of its annual volumes due to capacity constraint and limited relevant product portfolio for exports market. Eicher Motors has recently started executing its export strategy, and is opening exclusive stores in markets of Latin America, Indonesia, London, Paris, Madrid etc. We believe that export market can be a meaningful contributor to volumes in the coming years given the huge opportunity size and differentiated positioning of Royal Enfield.

New Product launches in Commercial Vehicles (CV) segment

The Government of India has been focusing on improving road infrastructure through the National Highway Development Project (NHDP) and Pradhan Mantri Gram SadakYojna (PMGSY). Under the NHDP, the plan is to upgrade, widen and strengthen 55,000 km of road network. The PMGSY envisages development of 368,368 km of rural roads.

This improved connectivity presents a significant opportunity for Eicher Motors with its wide product range in commercial, utility and passenger vehicles. Also, there is positive effect in terms of demand for both cargo and passenger segments from newly connected rural areas. Further progress in road development work including sanction of new projects will help to sustain growth in the CV industry. During Q2 FY 2017, Eicher Motors launch several new products.

- Light to Medium Duty (5 -15 ton) – forayed into the sub 5ton category with Eicher Pro 1049;

- Eicher Heavy Duty Trucks (16 ton +) – launched Eicher Pro 6031 with BSIV technology and 20.16XP R Cowl with 113kw 6 Speed Engine;

- Buses – launched Skyline Pro AC BSIII & BSIV range buses and launched 10.75 CNG ranges buses in Delhi NCR & other metro cities,

In the coming years, Eicher will be launching more new variants of Eicher Pro 6000 series of heavy-duty trucks and Eicher Pro 3000 series of light and medium duty trucks, to cater to the fast growing segments in the market.

Strong Dealership Network & Minimum Marketing Expense

Eicher Motors has a wide distribution network spanning across India. Currently, it has a distribution network of 467 dealers in India. Royal Enfield operates through 14 company-operated stores and more than 605 dealers in all major cities and towns in India, and exports to over 50 countries across the world including the USA, Japan, UK, several European and Latin American countries, as well as the Middle East and South Asia.

Further, in India the Company spends negligible amount on television and print advertisements and yet has created for itself a powerful brand recall, thanks to the self-serving brigade of Royal Enfield bikers.

WHAT’S DRAGGING THE STOCK

Capacity Constraint

Eicher Motors faces inability to timely ramp-up its production to meet market demand and planned growth. Royal Enfield waiting period for Classic (which accounts for ~65% of domestic RE volumes) stood at ~ 3 months while other models had a waiting period of 1-1.5 months on an average.

Growing competition in bike segment may slow down demand of its premium bikes

Any major competition in the 350cc-600 cc bike category by other players like Bajaj Auto, Hero Motocorp and many foreign players like Harley Davidson etc., may affect the demand of the Company’s product provided the price gap is not more in comparison to Royal Enfield bikes.