| Public Provident Fund (PPF) | Equity Linked Savings Schemes (ELSS) |

|

| Type | Bank Account | Mutual Fund |

| Exemption | Up to Rs. 1,50,000 investments per year are exempt from Income Tax under section 80CC | Up to Rs. 1,50,000 investments per year are exempt from Income Tax under section 80CC |

| Lock in | 15 years – withdrawals are allowed after 5 years. | 3 Years – there is no lock in for amounts invested more than 3 years prior to the date of withdrawal. |

| Risk Profile | Very safe | Volatile and risky in the short term |

| Return calculation | 8.1% (annual guaranteed return) | Market driven returns

Expect 15% return over a longer term period |

| Example | For Investor A, whose Income for the year was Rs. 9,50,000. If he invests up to Rs. 1,50,000 in his PPF account, his Taxable Income for the year will be Rs. 8,00,000. Further the 8.1% p.a. interest income that he will make, will be exempt from income tax. When Investor A withdraws his corpus, the entire sum in his hand will be tax free. | For Investor A, whose Income for the year was Rs. 9,50,000. If he invests up to Rs. 1,50,000 in ELSS units, his Taxable Income for the year will be Rs. 8,00,000. 3 years later when Investor A sells his ELSS units, any profit that he makes on the transaction will be tax free. |

For anyone who invests the entire Rs. 1,50,000 annually in a tax saving instrument under section 80C, AND wants to keep doing it for long term, ELSS is far ahead of all other options.

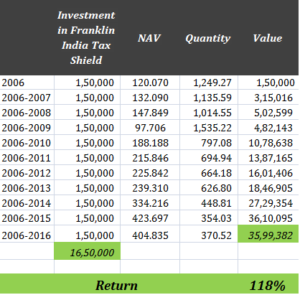

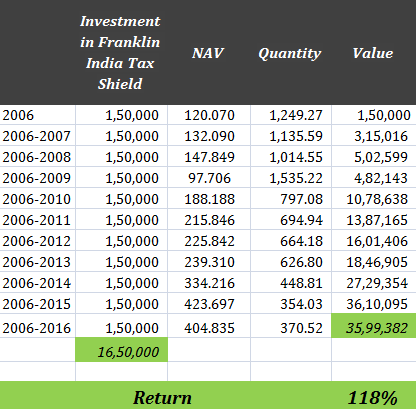

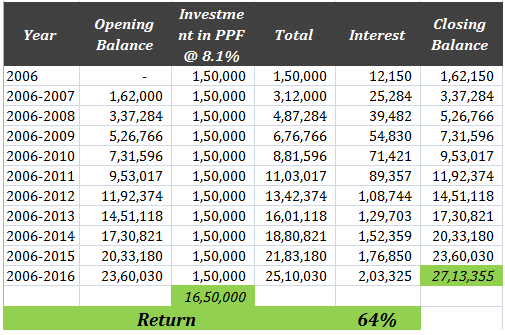

Here’s a look at actual performance for someone who started investing in Franklin Templeton’s ELSS scheme in 2006, compared with a similar investment in a PPF account. Keep also in mind that, ELSS schemes invest almost entirely in equity stocks of companies. The last 10 years have been particularly poor for equity markets in India and around the world and yet when compare an ELSS vs PPF schemes, the returns are quite startling.

10 Year avg. year on year return for ELSS = 14.8%

10 Year avg. year on year return for PPF = 8.1%

As thumb rule, invest in ELSS only when you are certain that you can continue the practice for at least 5+ years. For investments of shorter duration, you may choose PPF accounts. For this reason, investors who are young and in their working years are often advised to look at ELSS over PPF compared to older investors/ retirees.

Hello, I do believe this is a great blog. I stumbledupon it I am going to come

back once again since i have saved as a favorite it. Money

and freedom is the greatest way to change, may you be rich and continue to guide others.

Is it advisable to do SIP in ELSS?

Absolutely… it is the best thing to do 🙂