Embassy Office Parks, a joint venture between the Bengaluru-based property developer and private equity firm Blackstone, has placed 33 million square feet of office and hospitality assets under its proposed REIT, which comprises seven business parks and four city-centric buildings spread across Mumbai, Bengaluru, Pune and Noida.

What are REITs?

REITs are securities linked to real estate that can be traded on stock exchanges once they get listed. The structure of REITs is similar to that of a mutual fund. Just like mutual funds, there are sponsors, trustees, fund managers and unit holders in REITs.

As per REITs guidelines, 80% of the company’s assets must be invested in completed projects, and only 20% will be in under-construction projects, equity shares, money market instruments, cash equivalents, and real estate activities. To ensure regular income to investors, it has been mandated to distribute at least 90% of the net distributable cash flows to the investors at least twice a year.

Read More – Real Estate Investment Trusts (REITs) in India

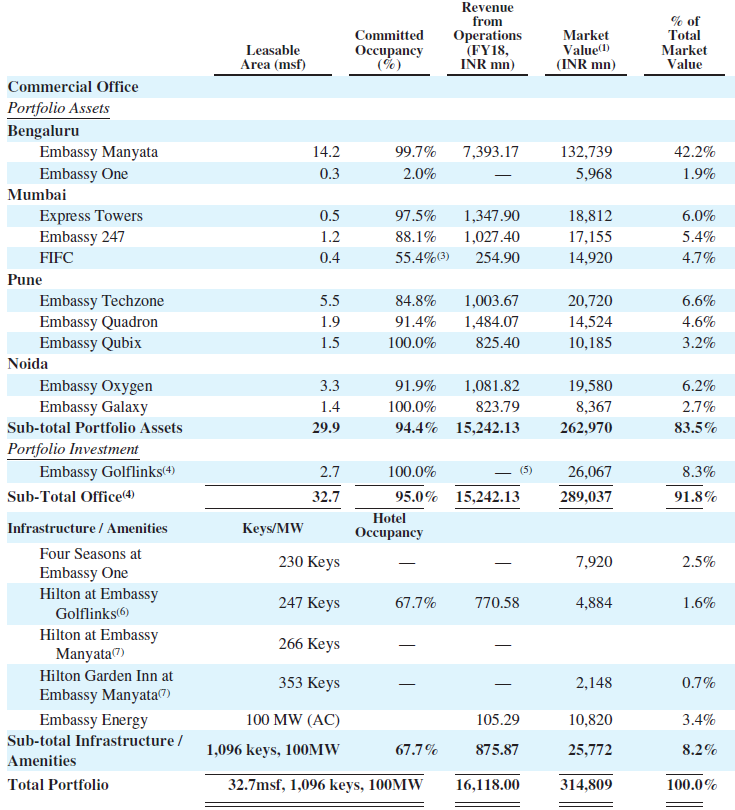

Embassy Office Parks have invested India’s top office markets of Bengaluru (60%), Pune (14.4%), Mumbai (16.2%) and Noida (8.9%). The market value of its total leasable area is Rs 31,480 Cr.

Of the 33 million sq ft, about 24 million sq ft is operational, 3 million sq ft area is under construction and 6 million sq ft is in the pipeline.

Portfolio as of December 31, 2018:

Its top clients are IBM, Cognizant, PwC and Nokia, together making up about a third of its total gross rentals. The top 10 tenants contribute 42.3% of our Gross Rentals.

| Tenant | Sector | % of Gross

Rentals |

| IBM India | Technology | 13.9% |

| Cognizant Technology | Technology | 10.8% |

| Cerner Healthcare Solutions | Healthcare | 2.6% |

| PwC | Consulting & Analytics | 2.5% |

| Nokia | Telecom | 2.4% |

| JP Morgan | Financial Services | 2.3% |

| NTT Data Information | Technology | 2.2% |

| Lowe’s Services | Retail | 2.0% |

| McAfee Software | Technology | 1.8% |

| Atos | Technology | 1.8% |

| Top 10 Total | 42.3% |

Embassy’s occupancy rate of rental assets stood at 95% as of December 2018 and has maintained occupancy greater than 93.4% in the past three fiscal years.

In the geographies where the Company operates its properties, there is a huge gap between the rents charged by the Company (Rs. 62 psf) and the rent these markets charge (Rs. 83 psf).

About Embassy Office Parks REITs IPO

Embassy Office Parks, a joint entity of realty developer Embassy Group and US private equity major Blackstone, is looking to raise Rs 4,750 Cr. through the issue.

Issue Snapshot:

| Issue Open | March 18 – March 20, 2019 |

| Price Band | Rs. 299 – 300 |

| Total Issue Size | 15.833 Cr. units |

| Net Issue Size | 12.91245 Cr. units (Net of Issue to strategic investors of 2.9208 Cr. units) |

| Offer Size | Rs.4,750 Cr. |

| Bid size | 800 units and in multiples of 400

units thereof |

Anchor investors include Radhakishan Damani, Kotak Mahindra Life Insurance Company, and foreign investors like Morgan Stanley, Fidelity Funds, DB International, National Westminster Bank, Citigroup, Wells Fargo, Japan Trustee Services Bank, etc.

Object of the Issue

- The object of the issue is Partial or full repayment or pre-payment of bank/ financial institution debt of certain Asset SPVs and by the Investment Entity;

- Payment of consideration for acquisition of the Embassy One Assets currently held by Embassy One Developers Private Limited;

- For General purposes.

Financial Details

| Particulars | FY16 | FY17 | FY18 | 9M FY19 |

| Revenue (In Rs. Cr.) | 1,397.02 | 1,484.92 | 1,611.80 | 1,375.98 |

| Growth | – | 6.29% | 8.54% | -14.63% |

| EBITDA (In Rs. Cr.) | 1,228.77 | 1,239.97 | 1,240.84 | 1,138.59 |

| EBITDA Margin | 87.96% | 83.50% | 76.98% | 82.75% |

| EBIT (In Rs. Cr.) | 912.98 | 915.60 | 918.02 | 869.92 |

| EBIT Margin | 65.35% | 61.66% | 56.96% | 63.22% |

| PBT (In Rs. Cr.) | 228.77 | 279.76 | 382.79 | 439.98 |

| PAT (In Rs. Cr.) | 93.18 | 177.06 | 256.91 | 285.11 |

| PAT Margin | 6.67% | 11.92% | 15.94% | 20.72% |

| Shareholder funds (In Rs. Cr.) | 3,171.72 | 3,396.02 | 3,478.93 | 3,767.44 |

| Minority Interest (In Rs. Cr.) | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt (In Rs. Cr.) | 5,068.56 | 5,825.28 | 7,945.92 | 7,976.17 |

| Cash (In Rs. Cr.) | 171.45 | 372.64 | 217.95 | 261.37 |

| RATIOS | ||||

| D/E | 1.60 | 1.72 | 2.28 | 2.12 |

| Interest Coverage | 1.73 | 1.79 | 1.97 | 2.20 |

| ROCE | 11.08% | 9.93% | 8.04% | 7.41% |

| ROE | 2.94% | 5.21% | 7.38% | 7.57% |

POSITIVES FOR EMBASSY OFFICE PARKS IPO

Strong Clientele – Embassy Office Parks has diversified customer mix comprising blue chip multinationals and Indian corporate, such as IBM India, Google India, Microsoft, Goldman Sachs Services, DBS Bank, McKinsey & Company India, Tata Consultancy Services and Rolls-Royce India. The top 10 tenants contribute 42.3% of its gross rentals.

Diversified Geographic Presence – Embassy Office Parks REIT own 7 office parks and 4 prime city-center office buildings totaling 32.7 msf of Leasable Area. Its portfolio is strategically located in India’s four key office markets of Bengaluru, Pune, Mumbai and Noida.

Almost 89% portfolio of Embassy REIT is operational where the income is already coming in. Further, its portfolio consists of commercial real estate spaces (that earn higher rents) and not residential.

The commercial space has seen 95% committed occupancy and weighted average lease length is of seven years. Quality of tenants, high occupancy and long-term lease contracts offer earnings stability and minimal or nil chances of default.

NEGATIVES FOR EMBASSY OFFICE PARKS IPO

Intends To Obtain External Debt Financing – Embassy Office Parks REIT is expected to borrow Rs 4,000 Cr. to refinance a portion of the existing debt of the Asset SPVs through repayment of existing loans, deferred payment obligations and to fund construction of certain projects after the listing of the Units. The terms of this financing may limit the ability to make distributions to the unit holders.

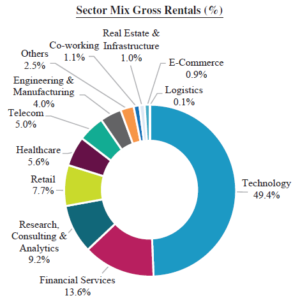

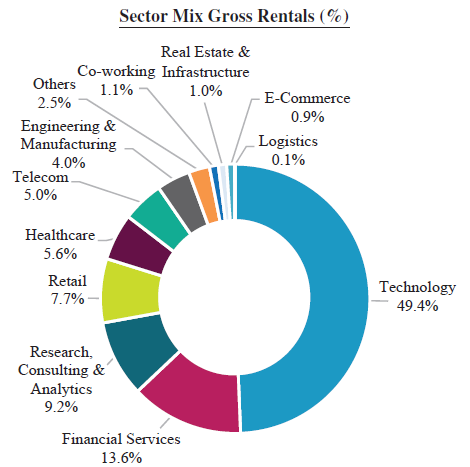

Revenue Concentration – Technology companies form nearly half the gross rentals, followed by financial services and research consulting. In addition, Bengaluru-based Embassy Manyata accounts for 14.2 MSF out of 32.7 MSF leasable lands. It also accounts for 42.2% of the market value of Embassy REIT asset portfolio.

Do not provide any assurance or guarantee of any distributions to the unit holders: There is no assurance or guarantee of any distributions to the unit holders. Distributions to unit holders will be based on the net distributable cash flows available for distribution.

The REITs Regulations impose restrictions on the investments made by it and require it to adhere to certain investment conditions, which may limit its ability to acquire and/or dispose of assets or explore new opportunities.

Embassy Office Parks REITs focuses primarily on real estate projects in the commercial segment of the real estate industry. Going forward, the success of its projects depends on the general economic growth of and demographic conditions in India.

PROS/CONS of Investing in REITs IPO

| PROS | CONS |

| REITs offer investors, with Rs 2 lakh in capital, an opportunity to invest in the commercial real estate market. Through REITs, investors can invest in diversified portfolio of commercial projects in different cities. | New instrument and untested. May share the same story as by the two listed InVITs, which are currently trading below the issue price. |

| The management has indicated that, it will distribute 100% of the surplus cash flows with unit holders and the distribution will be quarterly. | Negligible capital appreciation as I believe that price will get adjusted according to the dividend payments.

Please note that the portfolio of REIT has to be revalue every six months. If there is capital appreciation in the portfolio value, it would mean higher net asset value (NAV) and an increase in the listed unit price. |

| If the income distribution is in the nature of a dividend, then there won’t be any dividend distribution tax or any tax in the hands of unit holders. | If it’s the rental income that it is passing on, then it will be added to your overall income and get taxed at your income-tax rates. |

| No direct dealing with the tenants. | No trading opportunity. Can be considered as fixed income scheme. |

View – It is the first REITs Offer. So, investors can put a small amount and then see how it goes. Investors could expect yield of 7.4-8.3% pre-tax in FY20, according the projected cash flow in the RHP. This is quite comparable with fixed deposits offered by several banks.