What is an Equity Mutual Fund?

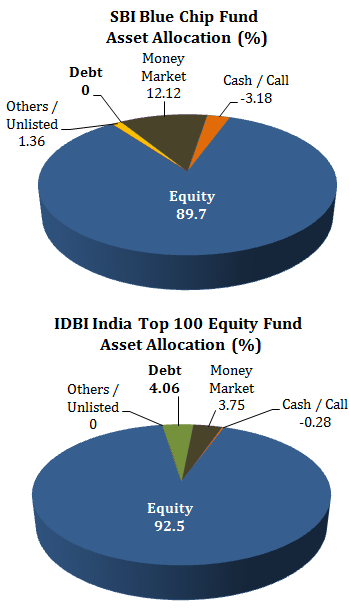

While it may sound like the name given to a fund which invests only in equities (i.e. stocks) this may or may not be true. A fund must have a minimum of 65% in equity stocks in order to qualify for tax benefits as an equity-oriented fund. These funds may have a small allocation to debt or any other asset class to reduce equity related risk. These types of funds are suitable for investors with a long-term outlook and higher risk appetite.

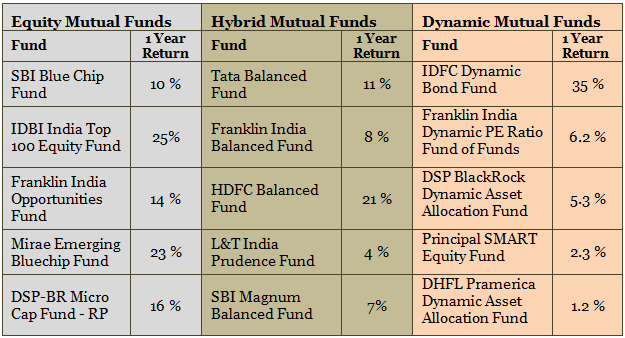

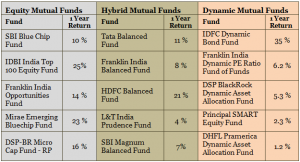

EXAMPLES

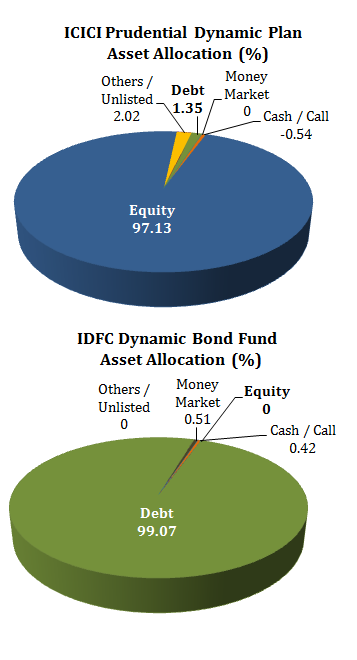

Dynamic Funds

These funds have the flexibility to invest 0% to 100% in equity and debt depending upon the fund manager’s view of the market conditions. The objective of these funds is to make profits while maintaining the flexibility of getting out when equity markets are not doing well.

Each mutual fund has certain key characteristics including- (i) investment objective, (ii) strategy; and (iii) investment pattern (i.e. debt, equity, gold etc). For more details on this and on the various types of mutual funds, visit here.

Sensex or CNX Nifty P/E levels are considered as a good indicator of valuation and are used to balance the fund portfolio. In favorable economic environment, these funds invest more in equity and less in debt and hold lesser cash. As the economy starts showing signs of deterioration, these funds sell equities and increase their exposure to debt products and to cash. Dynamic funds are ideal for investors who seek consistent returns with limited risk.

EXAMPLES

Major Drawback – Investors will have to forgo the tax benefit in case the fund is debt oriented i.e. the fund has less than 65% equity exposure.

Hybrid Funds

How Are Dynamic Funds Different From Hybrid Funds?

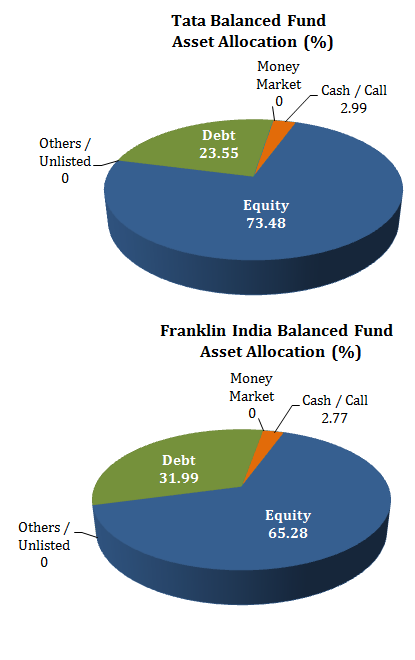

Hybrid or Balanced Funds – Invest in BOTH equities and debt in line with the per-determined investment objective of the fund. In a hybrid fund, the investment objective is based on the belief that when one asset class is not performing well, money should be moved to some other asset class which is performing well. This will neutralize the negative effect of under-performance.

Fund managers of hybrid funds always maintain at least 65% of their investments in equities to take tax advantage.

There are 2 types of hybrid funds – Debt-oriented hybrids and Equity-oriented hybrids. An equity oriented hybrid fund is one in which equity exposure is 65-100% while the debt component is 0-35%. Debt-oriented funds allocate 5-25 % funds to equity and the rest to debt.

EXAMPLES

**Return as on Nov 16, 2015

Tax Treatment of Mutual Funds

Equity Mutual Funds

Mutual funds that invest at least 65% in equity stocks qualify for treatment as equity funds. Long term gains from equity funds (i.e. after a holding period of 1 year) are tax exempt. However, short-term capital gains (i.e. holding period of less than 1 year) are taxed at 15 %. Another feature of an equity fund is that its dividends are not taxed.

Debt Mutual Funds

All gains from debt mutual funds are subject to tax. Long term gains from debt funds are taxed at 20% with indexation*.

Further Note: In the case of debt funds, the definition of long-term is 3 years and not 1 year as in the case of equity funds.

Gains from investments held less than three years would be considered short-term gains and will be added to your income and taxed as per the tax slabs rate applicable.

*Indexation means that the cost of acquisition is adjusted upwards to reflect the impact of inflation. The government comes out with an index number for every financial year to facilitate this calculation.

| Long Term Capital Gain Taxation | |

| Equity-oriented schemes | Nil |

| Debt-oriented schemes | 20 % with indexation + 3 % cess |

| Short Term Capital Gain Taxation | |

| Equity-oriented schemes | 15% + 3 % cess |

| Debt-oriented schemes | As per investor’s tax slab |

| Dividend Distribution Tax | |

| Equity-oriented schemes | Nil |

| Debt-oriented schemes | 25 % + 12 % surcharge + 3% cess |

Determination of Type of Fund

One question that comes to mind is with regard to determination as to whether a fund would qualify as equity or debt for tax treatment purposes. Typically, the allocation between equity and debt will keep changing based on market conditions. Take the example of a hybrid fund with 65% exposure to equity and 35% to debt. If the stock markets fall, the fund’s equity exposure will drop to the extent of the fall, leaving the fund manager with no option but to buy more shares to maintain the 65% equity level. Similarly, in a rising market, equity allocation may well move up to 70-80%.

Also see: Example of how mutual funds maintain the ability to move money in and out of equity.

From the point of view of an investor, each fund will identify the nature of investments and explain the tax treatment on investments. Read carefully before investing!

If you wish to discuss any fund for investment, write in to me at – rajat@sanasecurities.com or post your question under this post.

Is it a good idea to invest in Nifty or Sensex Index funds? What are the pros and cons?

Let me do another post on this sometime but my broad view – No.

Which Hybrid fund would you recommend at this stage?

please write in to me at rajat@sanasecurities.com with what you are looking for?