Price: Rs. 40.50

Disclosure: Invested

The below analysis of Everest Kanto looks at concerns around falling revenues and EPS (including why the EPS is currently positive).

Founded in 1978, Everest Kanto Cylinder Limited, together with its subsidiaries, develops, produces, and sells industrial and compressed natural gas (CNG) cylinders primarily in India. The company offers high-pressure gas cylinders for compressed industrial gases, such as oxygen, hydrogen, nitrogen, argon, helium, air, etc.; cylinders for CNG vehicles; breathing air cylinders; jumbo cylinders; medical gas cylinders; seamless cylinders for fire-fighting and beverage applications; and accumulators. It also provides allied products, including cylinder valves; valve protection guards; valve protection caps; trolleys for extinguishers and hospital use; medical equipment comprising high-altitude breathing apparatus, oxygen masks, and Boyle’s apparatus for anesthesia; industrial equipment consisting of cylinder cascades and quads for the storage and transportation of high-pressure gases; and purge bottles/double necked cylinders. The company exports its products to approximately 25 countries, which includes countries in South East Asia, the Middle East, Africa, the United States, Europe, South America, and the Commonwealth of Independent States. The company is headquartered in Mumbai, India.

EKC has grown to become pioneer in development and production of industrial & CNG Cylinders with 1.5 million High Pressure gas cylinders and 6.00,000 CNG cylinders in service.

The company has three manufacturing plants in India at Aurangabad, Tarapur and Gandhidam and one in Middle East (UAE) JAFZA in Dubai.

Major Concerns:

Falling Revenues: Major concern with the company is that its revenue has been continuously falling owing to its scale up. Also, company’s total expenditure is very high as compared to the revenues earned. This can be depicted from the below table:

| Mar-17 | Mar-16 | Mar-15 | Mar-14 | Mar-13 | Mar-12 | Mar-11 | |

| Total revenue | 567.7 | 506.2 | 498.7 | 454.4 | 585.0 | 735.0 | 747.6 |

| Total Expenses | 590.9 | 502.1 | 466.9 | 465.8 | 597.1 | 655.7 | 597.9 |

| % of expenditure from revenue | 104% | 99% | 94% | 103% | 102% | 89% | 80% |

Why are Expenses so High?

Everest Kanto imports approximately 90% of its raw materials. Also, for its requirements of stores and spare parts it is dependent on indigenous sources.

Why Does EPS look Positive for a Loss Making Company?

In order to recover losses, Everest Kanto has sold of its tangible as well as non tangible assets in FY 2017 because of which the EPS is positive on 4 trailing quarter basis (and for FY 2017)

Further, while the company has been making constant losses, the EPS for FY 2017 is positive on account of positive EPS for one of the past 4 quarters due to exceptional items (i.e March Quarter for FY 2017):

| Mar 17 | Mar 16 | Mar 15 | Mar 14 | Mar 13 | |

| Profit/Loss Before Exceptional, ExtraOrdinary Items And Tax in Rs. Crore. | -16.17 | -110.68 | -117.91 | -141.98 | -112.75 |

| Exceptional Items | 95.01 | -12.06 | 19.56 | 3.97 | -10.28 |

| Profit/Loss Before Tax | 78.85 | -122.73 | -98.36 | -138.02 | -123.03 |

| Basic EPS (Rs.) | 7.00 | -12.00 | -9.00 | -13.00 | -12.00 |

Exceptional items: Note 16 to consolidated Financial Statements for FY 2017, gives out a list of items to arrive at an overall exceptional item figure of Rs. 95 Crore. Primarily this is on account of sale of land, building and electronic installations at Gandhidham. For full details, refer to Note. 16 of consolidated accounts here. Naturally, this is a one time event.

Reserves for the company have been constantly falling since March 2011 till March 2016. It’s increased for 2017 due to the foreign currency translation and overseas consolidation. Reserves have doubled to more than Rs. 125 Crores (on standalone basis).

Debt Equity Ratio

Debt Equity ratio has sharply risen over the years.

| Mar-17 | Mar-16 | Mar-15 | Mar-14 | Mar-13 | Mar-12 | |

| Debt Equity ratio | 1.00 | 1.50 | 1.22 | 0.99 | 0.70 | 0.53 |

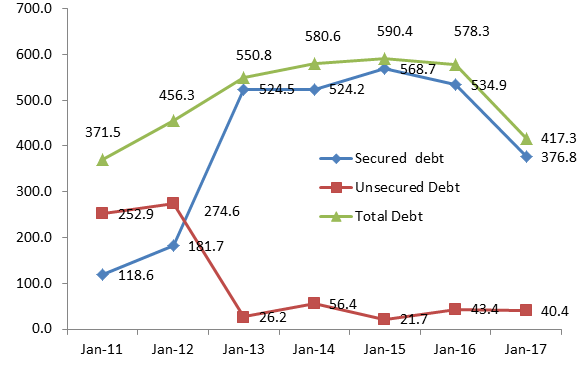

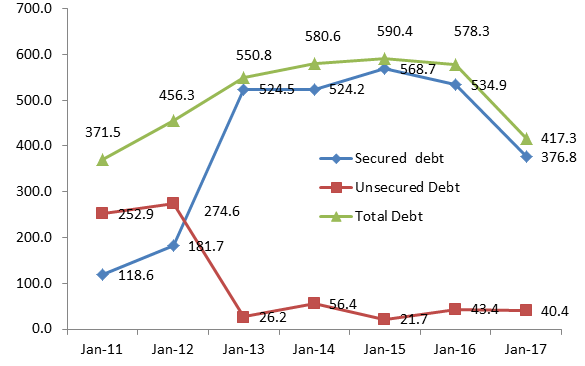

We go through the securitization of the debt, 90% of the debt is secured against the assets of the company and rest is unsecured. In the debt portfolio, the secured section has substantially increased and the unsecured have dropped down. From 2011 to 2016, the quantum of debt has been constantly rising for the company.

___________

I am invested in and positive on the stock on account of increased demand and capacity and increasing free cash flows for the company. For detailed analysis and to discuss the stock, reach out to me at rajat@sanasecurities.com