Since I started my firm 6 years back, I have come across all sorts of clients – those who prefer to invest in mutual funds and PMS schemes and those who prefer to invest directly in stocks.

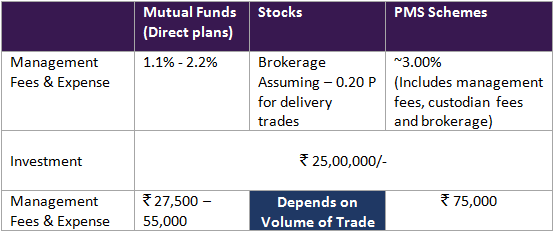

From the perspective of both – a financial advisor and the client; so long as they can maintain some degree of investing discipline, buying stocks directly saves a lot. Here’s a breakdown of fees and expense structures in each case:

A first look at the above table will naturally make you wonder

Why should I pay management fees / expense particularly when I can replicate the performance of most mutual fund managers (i.e. by buying the same stocks in very same percentages as disclosed in mutual fund fact sheets).

Will you not make ~1.1 – 3.0% more doing that? Of course you will.

To match up to the management fees and expense of a mutual fund or PMS Scheme, the investor would be churning (i.e. buying + selling) his portfolio value of Rs. 25,00,000 by 4 to 12 times (considering brokerage charges of 0.20 p and standard STT and service tax on that).

To be honest, if as an investor you are churning your portfolio more than 4 times its value, then that in itself should be a reason to consider funds and PMS schemes irrespective of brokerage and expenses.

A good part of our firm’s revenue comes from brokerage business and within that from the cash segment.Going forward, I expect more and more investors to use financial advisory of this nature. Not only is it cheap, it also gives you the flexibility of getting financial advisory irrespective of your portfolio size. Further, you can structure your portfolio based on advisory while exercising your own discretion if you so choose.

If you choose to work with us, start by opening a trading/ demat account with us – call 011-41517078 for brokerage and other details.

Rajat, I believe that “Management Fess & Expense” are charged on a daily basis. So effectively, how much do we pay? Also, as per my understanding, the AMCs sell the units (i.e. when an investor buys MF Scheme units) at a slightly higher price compared to NAV & buys (i.e. when an investor sells MF scheme units). This is in place of charging Entry Load & Exit Load.

Could you please throw some light on the above?

Also, the figures shared by you is for Direct Plan. What about Regular Plan – what are the charges in this case?

buys (i.e. when an investor sells MF scheme units) at a slightly lower price compared to NAV*