What exactly should you be concerned about before diving into a business, either to buy or to operate as your own?

What do you have to do to run a fund house? A brokerage firm? A small scale manufacturing unit? Or, a service oriented business? Equally important is to understand the laws, rules and regulations which apply to a given business.

The need to hire consultants and advisors who can give you deeper insight into the functioning of businesses has never been greater. It is extremely critical to understand the nuances of your own business and of businesses with which you intend to work.

Financial Analytics: Meaning

Many firms conduct financial research and present their results as per client requirements. The idea is to give the client a better understanding about factors which increase revenue, reduce cost, create efficiency and help in transforming available data into timely, actionable information with a view to improving business performance.

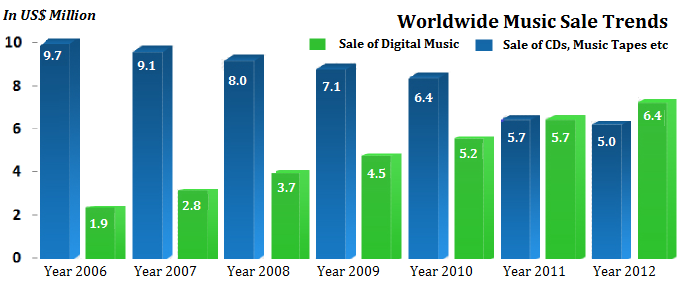

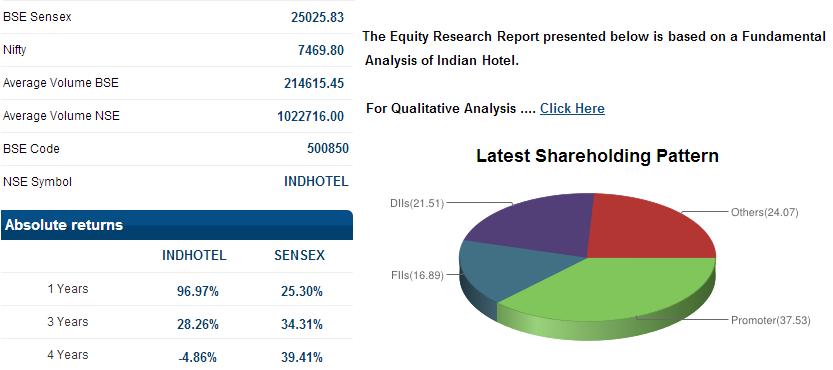

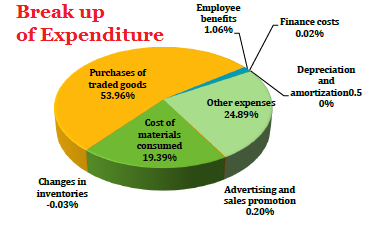

The results are mostly presented in the form of charts and graphs which help in understanding complex information, monitoring performance, analyzing specific metrics, and then comparing them to budgets or performance benchmarks. A more sophisticated term for such tasks is ‘financial analytics’.

Important aspects of financial analytics:

- Product profitability – which product /services bring in the most profit, market share

- Customer Profitability – the type of customers who provide maximum business to the firm and their geographical concentration.

- Geography – which region brings in the most profit.

- (Heads of) expenses vis-a-vis revenue break up to spot areas of inefficiency.

- Compliance charts – to help understand the regulatory environment in which the business and the firm operates.

How can Financial Research work for you?

Business insight: understanding how a business or an industry works.

Segment specific expense and revenue – where does money get spent in a particular business line. What is the biggest driver of revenue? What products sell and which ones do not?

Areas of potential high growth + areas that are putting pressure on efficiency. It will throw light on the most obvious areas where problems exist and where improvements could be made.

Legal & regulatory requirement to set up/ operate a business – Probably the most important aspect of financial research is the type of licenses and regulatory approvals that are needed to start operating a particular business.

Comparison – Compare where your competitors are spending their money vis-à-vis you.

Financial Research: collecting data and presentation

There are 2 parts to conducting good financial analytics. First is to compile data sourced from various places such as – annual report, company presentations, analyst coverage and primary market research. The key to benefiting from financial research is to present it in a way so as to highlight the points above and gives meaningful insight into the functioning of the business operations.

If you wish to discuss your requirements and would like for us to help you with analytics, please write in to us at – priyanka@sanasecurities.com or call us at 011 – 41517078.