With debt fund returns falling, a lot of investors are selling their fixed income fund. With rising inflation, the chances of another rate cut look dim, because of which there has been little (and in some cases, negative return in debt funds). At first I believe that long term investors should not worry too much about lesser returns in the short term. On the contrary, I think it is a good time to add on to your fixed income fund portfolio, particularly if you are someone who can wait for a crash and are not easily excited by everyday price movement of stocks. That said, there are options outside of long and short term debt funds within the fixed income sphere that you can consider if you find stocks to be overvalued and / or are looking to diversify your portfolios.

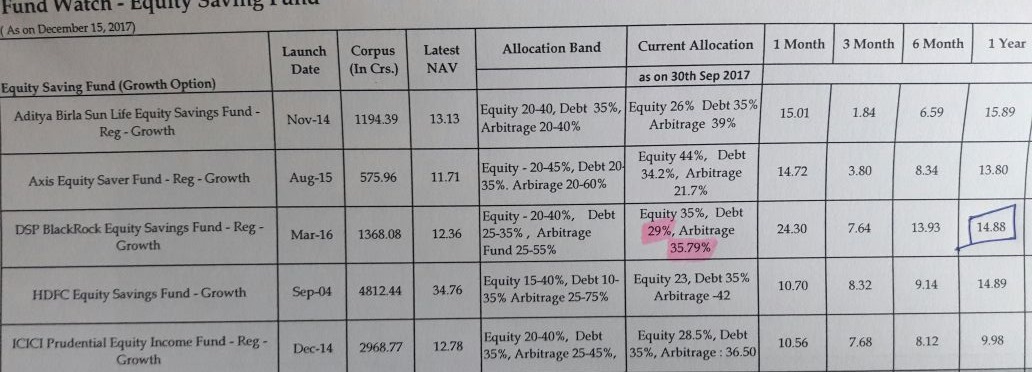

One of the funds where I have allocated client money is the Equity Savings Category:

CLICK ON IMAGE TO ENLARGE

Advantages of Equity Savings Fund

To discuss this, let me take the example of one of the above funds – the DSP BlackRock Equity Savings Fund.

Assuming above allocation of (34% equity | 30% debt | 36% arbitrage) and that the equity tranche will outperform the market by 5% both on the upside and downside. Further, in all cases below, I will assume that the arbitrage and debt portion makes 7%. This is how your returns will look one year from now.

- Assume for next 1 year, market goes up by 10% – You will make 9.65%.

- Assume market remains flat – You will make 6.25%.

- Assume market falls 10% – you will still make 2.80%

Keep in mind that this is based on 1 year returns. In the short term, you may make much better (or worse) returns. This is because, the equity tranche is far more sensitive to market prices than the arbitrage or the debt segment.

In each case above your returns will be tax free.

Compare this with a long term debt fund, where you make 7% irrespective of stock market movement; which will effectively be 4.9% in hand post payment of capital gains tax of 30%. Not very relevant but, Ill add this – Equity savings fund, if sold before 1 year will only attract 15% short term capital gain tax. For this reason, I find Equity Savings Fund better. Even then, if you would like to stagger your investments over time, I suggest that you split your money between the 2 funds, choosing one from the short term debt category; while I remain biased towards the above Fund.

Comparison with Pure Arbitrage Funds

In arbitrage funds, you will make returns very similar to short term debt funds and in a more tax efficient manner (i.e. arbitrage fund returns are tax free if the fund is held for longer than a year (i.e. arbitrage funds get equity taxation where LTCG = zero).

On the downside, in a pure arbitrage fund, these days you will make a maximum of 7%. In general, annual returns will vary between 5.5% – 7% (tax free). Currently the top performing fund in the arbitrage category (i.e. the ICICI Pru Equity Arbitrage Fund) is generating 6.4% on an annualised basis.

| ICICI Pru Equity Arbitrage Fund – Annualised Returns (DIRECT PLAN) | ||

| 1 Year | 2 Years | 3 Years |

| 6.4% | 6.9% | 7.2% |

Between the above 2, I would prefer the Equity Savings Category, also because there is a dynamic component to it in that, the pure equity portion in this category can float between 20-35% and the rest is split between debt and arbitrage. This gives the fund manager, flexibility to reduce/ increase exposure to equities based on market circumstances.

___________________

Fixed income fund categories purely on the debt side – Liquid/ Money Market Funds | Ultra Short Term Funds | Floating Rate Funds | Income and Gilt Funds (both of which can be short, medium and long term duration) | Bond Funds

I want to know about the income tax about equity investment gains such as long term , short term etc. Pls send me mail about this.

Second I want to know about saving mutual funds investment and income tax about these investments calculations.