There are only two ways in which money making is done:

- Hard work makes money

- Money makes money

Investing is the art of employing money to multiply it.

Those in need of capital for setting up, or for expanding a business are always willing to pay some premium for the much needed capital. Their hope is to make a higher return on this capital compared to the premium that they pay for it (i.e. profit).

Equity and Fixed Income

When you buy shares in a company, this premium is the return generated on the invested money itself. This return comes to you, the investor, in proportion to your investment in the company.

How does money reach those in need of it?

There are many ways in which money can be channeled to those in need. Banks move money between businesses and investors for a commission. Stock Exchanges are a great platform for channelizing money from investors to businesses. In either case, the underlying objective is to invest and make your money work for you.

Besides the fact that money multiplies itself, another reason as to why you should invest which people often overlook is the effect of ‘inflation’. The rate at which the prices of goods and services rise (i.e. Inflation) causes money to lose its value over time. So your money will not buy the same amount of goods or services in future as it does now or as it did in the past.

For example, if prices rise at a rate of 6% for the next 20 years, a Rs. 100 purchase today would cost Rs. 321 in 20 years. So remember, if your money doesn’t grow at a rate higher than the inflation rate, its value decreases over time.

Where all can you invest?

- Bank deposits or FDs, government bonds, shares, property, gold etc.

Which one is the best for you?

There are no easy answers to this. It all depends on your appetite for risk and you time horizon, as also your age and your expected need for cash in future. It is generally believed, that fixed income investments like bank deposits are safer in comparison to equity investment.

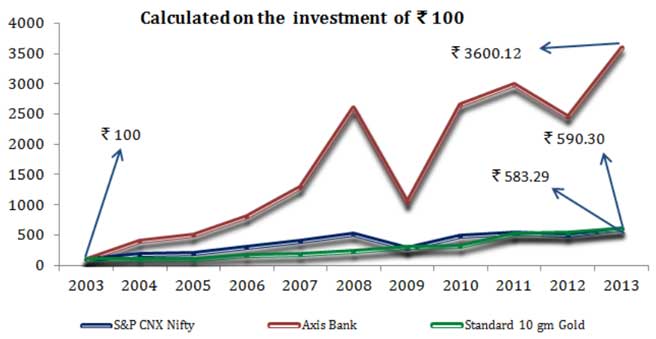

100 Minus Age Rule

While I may believe that equities are the best place to invest your money in India, someone else may choose the safer option of a debt fund. A traditional corporate finance professor may well tell you the 100 minus your age rule (i.e. subtract your age from 100 – that’s the percentage of your portfolio that you should keep in stocks). I have broadly followed this rule so far. Perhaps the rule is premised on the fact that while in the short term, it is extremely difficult to predict the movement of stock prices, if you compare the returns generated by various asset classes over a longer period of time, Stocks generate the highest investor return.

While I like to spend a lot of time talking about equity evaluation and investing in fundamentally strong businesses; for a moment let’s just talk about the very basic of fixed income investments. Take the example of a simple fixed deposit (“FD”) with a bank. How do banks make money on your FD?

It’s simple, no? The primary function of banks is to put their depositor’s money to use, by loaning it out to others. In the process, the bank keeps the difference in the interest rate it charges on loans and the interest rate it pays on deposits. So the fixed interest income which you earn on your FD, is a little below what the bank earns by extending your money further.

Many fail to realize that banks don’t create money, they just move it around, and every time they move it, they charge a commission. There is absolutely no art or science here. Return on equities on the other hand essential depends on how well the underlying business will do in future. When you invest in equities, you become part owner in the company and are entitled to the profits generated by its business. Companies can either return the profit to the shareholders as dividends or accumulate the profits in reserves if the management feels that it may be able to utilise the money better and earn an even higher rate of profit in future by capacity expansion, making an acquisition or by new product launches. Of course, the management could also do a bit of both (i.e. pay part dividend and transfer the rest to reserves).

Also consider tax consequences: When you compare fixed income investments with equity investment, keep in mind that the return from FDs is taxable as per the income tax bracket of the investor and the effective post tax return rarely matches the inflation rate of about 7%.

For example, for someone who is in the 30 % tax bracket, a fixed deposit with a 9.5 % interest rate is effectively only about 6.5%. This is why it is absolutely imperative that you invest a portion of your savings in equities as they not only provide a hedge against inflation but also tax advantaged, in that you pay no tax either on dividends or long term appreciation in the value of equities.

Let me tell you an interesting way of looking at equities and fixed incomes – Your fixed income investments with a bank are technically being loaned out to the promoter of a company who is convinced that he can make a higher rate of return that the rate of interest he pays the bank for using that money. If you can find such a business (or such a promoter) yourself, why then would you not invest directly in the equity of such a company? The reason is that such investment involves a higher risk. While banks secure their loans with a charge on the assets of the company, as a promoter or shareholder, you are the owner of the business and while you can make unlimited profits, you must also be ready to suffer a loss. Risk is ingrained in the nature of every business.

The question then becomes if the rewards of equity investment outweighs its risk? Forget all fundamental principles, and invest randomly in the 30 companies which constitute the S&P BSE Sensex. You will make a far higher return over a period of time than what you will make by investing in fixed income products.

Nevertheless, the art of investing is in finding companies run by competent and honest people, which operate with extreme efficiency, have good business models and are likely to continue generating high shareholder returns.

The refinement of this ongoing search is what establishes the principle of ‘value’. Much has been written about the principles of value since Ben Graham and David Dodd, brought the concept of value investing to the mainstream with their 1934 book, “Security Analysis”, which remains one of the most iconic pieces of financial literature ever written. Their idea was simple; buy securities that trade below their ‘intrinsic or fair value’.

A lot more work has been done in devising ways to calculate the intrinsic or fair value (i.e. real worth) of a stock. Fundamental Analysis is the principal approach used by value investors in finding this intrinsic or fair value. Analysts have devised numerous simple and complex techniques to conduct such analysis. No matter what approach one follows, the underlying theme remains the same, to investigate whether the market price of a stock is below its intrinsic value or real worth.

To explain with an example: would you buy a diamond studded Mont Blanc pen for Rs. 100,000? Would you buy the same pen for Rs 6,000. May be? Your need, and the utility of the pen, both remain same but the price of the pen changed in each scenario. In the latter, you thought that the diamond studded pen offers great value at Rs. 6,000.

Things are not very different with stocks. Price is what you pay, value is what you get. The only difference is that in case of stocks, the concept of need and utility gets replaced by future cash flows. You buy a stock which you think is available for a price less than what it should be. Hence it offers value. How much value would make you buy the stock? Again, coming back to our Mont Blanc example, would you buy the pen for Rs. 6000? 10000? 14000?

I am sure you will do some research of your own to find out the market price of the pen. May be quickly call a shop which sells original Mont Blanc pens. What if the actual market price of the pen is Rs. 21,000? I leave it to you to decide the price at which you will be willing to buy the pen after knowing its market price. Some may buy it for Rs. 20,000 (Rs. 1,000 below the MRP) while someone else may not buy it unless it is available for at least Rs 10,000 cheaper. This may again be for various reasons mostly your need for a pen.

One extremely smart colleague of mine came up with yet another valuation technique. He said, he will buy the pen at a price less than what he can sell it at, so he will first try to sell the idea of the ‘great pen bargain’ to prospective buyers, and once he finds someone willing to buy it for (let’s say) Rs. 18,000, he will be happy to pay Rs. 17,000 for the pen, and will immediately make a trade. What need? What utility? He asked me. Since that day he has gained immense importance in our office and unusually great respect in my eyes. All financial decisions of the office are now routed through him. These enterprising people exist in the stock markets as much as they do elsewhere.

The point to take away is that your research is what helps you discover the intrinsic or fair value. In stock investing, you need not come up with an exact and definitive fair value figure for a stock. You need only ascertain whether the current price is ‘reasonable’, based on future growth potential and expected cash flow from the company. Some basic valuation techniques will help you formulate a view as to ‘a reasonable price’ of the stock. How far below that reasonable price can you buy the share, is what forms the core of value investing. Your target should be to buy stocks which are available far below their fair or intrinsic value.

Often the market price of well established and well managed companies, with strong financial and business track record decline for little or prolonged period(s) of time. Such declines could happen for a variety of reasons. Difficult economic environment, a temporary setback in business, a bad management decision or something as unpredictable as weather problems in the oil producing OPEC region could have a negative impact on stock prices. Value investors seek to take advantage of these price movements to select fundamentally strong stocks which fall below (or may be far below) their intrinsic value.

How far below the intrinsic value should you buy a stock?

Once you come up with ‘a reasonable price’ for a stock, should you buy it below that price?

Future is anything but predictable, unforeseen circumstances and errors of judgment could spoil your future price targets. For this reason, it is extremely important to keep a Margin of Safety (i.e. margin of error). Buy stocks which are available reasonably below their intrinsic or fair value.

Key Points:

-

In the long term, equities give you the highest rate of return.

-

The only correct way of investing in equities is after conducting your own research as to ‘a reasonable price’ for the stock and keeping a margin of safety before buying it.

-

Practice: Principles of value are easy to state, but hard to master. It is easy to understand how financial statements are prepared but it takes analyzing lots of them to refine the art of application.

-

While every single investor buys a stock hoping that it will trade higher in future; their definitions of ‘future’ differ. Some have a 2-3 month horizon, while others look as far as a few years. It is important to have a well defined time horizon in mind before investing.