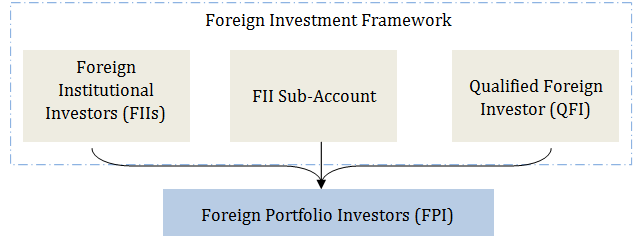

In order to have one integrated policy on foreign investment, the Indian securities market regulator i.e. Securities Exchange Board of India (“SEBI”) has introduced the Foreign Portfolio Investors Regulations (FPI), 2014. The FPI Regulation, 2014 replace the existing Foreign Institutional Investor Regulations, 1995 (FII regulation applicable to institutional investors, such as mutual funds, pension funds, banks and insurance companies) and the Qualified Foreign Investors (QFI) regulations, applicable to non-institutional investors such as individuals, corporate, trusts and family offices.

The FPI Regulations have been introduced to make the Indian market more attractive as an investment destination and include easier entry norms and operational framework for the foreign entities. In this regime, FIIs, Sub-accounts and QFIs are merged together to form the new investor class, namely Foreign Portfolio Investors. The FPI regulation has came into effect on – June 01, 2014.

Key Points on Foreign Portfolio Investors Regulations, 2014

- Existing FIIs, Sub-accounts and QFIs: All existing foreign institutional investors (FIIs) along with sub-accounts and qualified foreign investors are clubbed together to create a new investor category called Foreign Portfolio Investors (“FPIs”). All existing QFIs and FIIs may continue to buy or sell for up to a period of 1 year from the date of notification of the FPI Regulation. In the meantime, they have to make efforts to obtain FPI registration.

- Exclusions from the FPI: Non-Resident Indians (NRIs) and Foreign Venture Capital Investors (FVCI) are excluded from the purview of this definition.

- Eligibility Criteria of FPIs:

- The applicant should be a person who is resident outside India. A non-resident Indian is not eligible to be registered as a FPI. Note that an NRI can trade/ invest in Indian equities in ways discussed on this page (click here).

- No person/ entity shall trade in securities as a FPI unless it has obtained a certificate, granted by the Designated Depository Participant (DDP), who are approved by the SEBI.

- A FPI should be resident in a country which is signatory to the IOSCO[1] MMoU[2] or has signed a bilateral MOU with SEBI and should not be resident in a country identified in public statement of FATF (Financial Action Task Force).

- The person should be legally permitted to invest in securities outside the country of its incorporation or establishment or place of business.

- The person should have sufficient experience, good track record, be professionally competent, financially sound and meet the fit and proper person criteria specified by SEBI.

Categories of Foreign Portfolio Investors

FPIs are classified into 3 categories based risk profiles:

| Category of FPI | Type of Investors |

| Category I(Low Risk) | Government and related investors such as central banks, Governmental agencies, sovereign wealth funds and multilateral organizations etc. |

| Category II(Moderate Risk) |

|

| Category III(High Risk) | All others not eligible under Category I and II FPIs such as endowments, charitable societies, charitable trusts, foundations, corporate bodies, trusts, individuals and family offices |

Investment Options for Foreign Portfolio Investors

A FPI can invest in the following –

- Securities in the primary and secondary markets including shares, debentures and warrants of companies, listed on a recognized stock exchange in India;

- Mutual Fund Units, whether listed on a recognized stock exchange or not;

- Derivatives traded on a recognized stock exchange; Treasury Bills and dated Government Securities;

- Commercial Papers issued by an Indian company;

- Rupee denominated credit enhanced bonds

- Security Receipts issued by Asset Reconstruction Companies;

- Listed and unlisted non-convertible debentures/bonds issued by an Indian company in the infrastructure sector;

- Non-convertible debentures / bonds issued by Non-Banking Finance Companies;

- Rupee denominated bonds or units issued by Infrastructure Debt Funds;

- Indian Depository Receipts.

Issuance of Certificate by Designated Depository Participant (DDP): Single window clearance:

FPI registration is to be undertaken and granted by Designated Depository Participants (DDPs)[3] on behalf of SEBI. DDPs carry out all the necessary due diligence and KYC (Know Your Customer) before registering an entity as FPI. A DDP will register FPI within 30 days from receipt of application for registration, complete in all respects. In the event of any grievance for seeking registration, the FPI may approach SEBI for appropriate instructions.

Conclusion

The FPI Regulations are a step in the right direction towards rationalizing and simplifying portfolio investments in India for foreign investors, with a view to encourage foreign investment in the Indian securities markets. With the ease in registration requirements, the new FPI regulation is likely to boost portfolio investments in India by foreign investors. Granting of permanent registrations to FPIs shall not require them to approach the DDPs time and again for the same, thus, providing them a more supportive environment for investment in India. Meanwhile, with the delegation of work to DDPs, SEBI can now focus on more important issues and perform its regulatory role more effectively. It can be argued that the shift to the new regime, for all classes of investors that have been merged, shall be a comfortable one particularly because a buffer period has been given to them to operate without needing them to immediately comply with the formalities and process for conversion to and operation as FPIs.

[1] International Organization of Securities Commission

[2] Multilateral Memorandum of Understanding

[3] DDPs are either Authorized Dealer Category-1 bank authorized by RBI, or Depository Participant or a Custodian of Securities registered with SEBI.

Considering FDI I would like to add a point that currently, there’s a boom in infrastructure companies of the middle-east. And also the big companies of the middle-east are searching various markets to invest abroad to make their future secure. Recently MFAR invested 150 million dollars in Maldives resort.