Like Chinese goods, the Chinese Bull Run came with no guarantees. It also met with a similar end. As the world looks for a new growth engine, can India provide an alternative?

Over the last few months, metal stocks in India have taken an absolute hammering. This has more to do with a slowdown in China than any domestic problem in India. The government of India is vociferously pursuing its development agenda, infrastructure construction companies are adding fresh orders and automobile sales are picking up and yet metals are bleeding.

| Base Metal Companies from the S&P BSE 200 Companies |

Price on 27 August 2014 | Price on 27 August 2015 | % change |

| Jindal Steel | 244.05 | 70.15 | (71.26%) |

| Vedanta | 276.55 | 91.15 | (67.04%) |

| Tata Steel | 522.85 | 225.85 | (56.80%) |

| Hindalco | 172.00 | 80.60 | (53.14%) |

| Nalco | 52.60 | 29.05 | (44.77%) |

| NMDC | 169.10 | 97.05 | (42.61%) |

| JSW Steel | 1,253.25 | 930.50 | (25.75%) |

| Hindustan Zinc | 163.80 | 130.05 | (20.60%) |

During the above period the S&P BSE 200 index went up by 4.1%.

What’s Wrong With Metal Stocks?

consumption of base metals depends upon the performance of global economy. If the economy is expanding, there will be increased demand for commodities. This can be best understood by keeping in mind where base metals are used:

- Steel: from homes to factories, automobiles and various infrastructure equipments, steel is a widely used base metal.

- Copper: next time you see any wires, air-conditioning and refrigeration equipment, microwaves; and pipes used in basically anything, you can be assured it was made using copper.

- Aluminum: aircrafts, automobiles, vessels and cans of all your aerated drinks (this is a huge market – think of coca cola cans) etc.

- Zinc: batteries (car and home), fuel cells, die castings and making brass.

There are many other uses to which these metals can be put. Further, there are other metals like led, nickel etc, consumption patterns of all of which are good indicators of economic growth.

What happens when the economy is growing? – More homes, highways, roads and factories are built, more cars and aircraft are sold. People buy new televisions, refrigerators, microwaves and other consumer durable. All of this leads to high demand for base metals which leads to high prices.

Low metal prices could be because of 2 reasons:

- Oversupply – more capacities are built than required;

- Demand Shortage – lack of liquidity in economy i.e. lower purchasing power.

Typically, demand shortage is followed by an oversupply.

Case Study – Steel

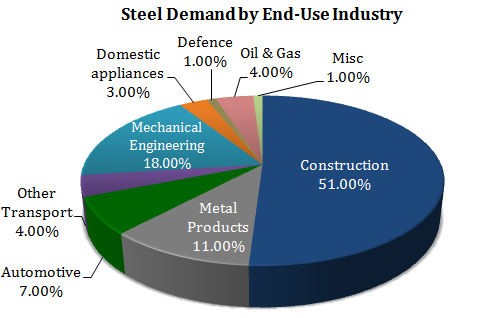

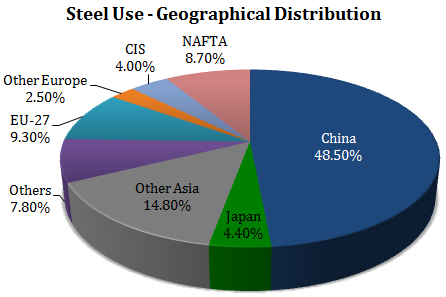

Of the ~ 1550 million tons of steel produced worldwide ~ 48% is both produced and consumed in China. Notice the geographical distribution and the pattern of use for steel.

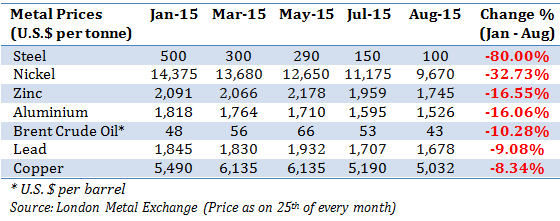

A rational person would argue that the huge oversupply in steel (and other base metals) is due to a demand slowdown in China. This in turn is leading to the current slowdown in metal prices because of which companies engaged in mining these metals are struggling. That this is likely to continue until the oversupply in the system is not completely absorbed.

This is a fair argument.

[I] What leads to Oversupply?

Naturally – too much mining. Again, many reasons why this may happen. For example – before 2008, the world was on a consumption overdrive. Everyone was buying homes, automobile companies were adding capacities to manufacture more cars, more metals were being mined, more power and energy was being consumed. After the 2008 real estate crash, trillions of dollars of cash disappeared from the system. Suddenly, people did not have the money to purchase cars or own homes.

Think about what happens to the additional capacities that were built (or were being built) in the boom years?

Not only do companies have to pay interest on the additional debt they took to build new factories and plants, they now face slower off-take i.e. sale volumes and hence the profitability declines, sometimes leading to bankruptcies. Many pre-2008 high flying companies are today burdened in debt for exactly this reason. In India, they primarily belong to the real estate, infrastructure and power sector.

[II] Demand Slowdown

Demand slowdown, or slowdown in growth is part of a natural economic cycle even though from time to time economists ascribe this slowdown to various factors. Continuing with the above theme of China and steel, the slowdown in China is attributed to a gazillion factors with one central theme – the fact that China took on too much debt to power its economy.

During the years of economic recovery post the 2008 crisis, the Federal Bank of the United States continued its quantitative easing and the regime of printing easy money to revive consumption and growth. China on the other hand was setting up massive manufacturing facilities to become the manufacturing hub of the world. It borrowed heavily to create these facilities, make new homes and add to its infrastructure. China’s debt today is 250% of its GDP. The trouble is only this – there is a massive overcapacity build up. Demand is not the only worry, China must also find ways to service the massive debt used to build excess capacities. If you visit Shanghai, you can not miss the inventory of unsold homes all around the city.

Is it a Good Time to Buy Metal Stocks in India?

Let me present the argument from both sides before I try to give a ‘Yes’ or ‘No’ answer.

Cynics would believe that equities in general will not perform well over the next few years. Falling metal prices is an indication that Industrial Production (IP) will also fall; and as IP falls, corporate earnings will also follow sometime after IP starts showing a declining trend. There is enough indication of slowdown in metal prices for the above theory to play out.

Those more positive (generally – the equity analysts) will argue that the slowdown in commodity prices including base metals is a fallout of slowdown in China. This in turn is good news for countries like India.

How is China Slowdown good for India?

Recently I read a report which suggested that the current slowdown in China is a once in a lifetime opportunity for India. 2 things will happen as China slows down:

First, with fall in prices of base metals, corporate earnings will improve for companies which use base metals as raw materials. This includes – infrastructure, automobile, housing and a host of other sectors. On that logic – this may be a great time to buy stocks in these sectors and not necessarily, metal stocks.

Second, it gives India the opportunity to do what the United States did almost 6-8 decades back and what China did 2-3 decades back – build up infrastructure – highways, railways, ports and commercial spaces. At a time when commodity price are low and the world is looking for a new growth engine, India can potentially attract global investments and emerge as a growth engine for the world.

If you believe in the second and the more positive of the two views then the only thing you must be sure of is this – have metal stocks in India hit a bottom? Is India ready for beyond 8-10% Growth (on GDP projections)? If Yes – then metals will do well, Indian metals will do particularly well.

So what you are saying is slowdown in global economy will further hurt metal stocks or improvement in Indian econoy will help metal stocks ? I am confused …….

What I am saying is this – slowdown in global economy is and will continue to hurt metal stocks. Can India absorb the oversupply and help in reviving metal prices and production and consequently emerge as a growth engine to the world – I think the country has the potential. I have updated a video on this on the page above.

I’m delighted to read your articles. It is crisp & clear for the layman like me.

Since the metal stocks have hit the bottom, is it right time to buy these stocks now for a long time investment horizon – may be 3 or 5 yrs.

In my view – Yes, but very selectively.