In the stock markets, participants can trade in 2 segments:

(i) Cash segment; and

(ii) Futures and Options (Derivative) segment.

Participants in the cash market can buy/sell any number of shares of a company (i.e. they can buy anything from a single share to thousands of shares). On the other hand, in the futures and options segment, participants buy contracts which have a pre-determined lot size depending upon the underlying stock.

To explain with Example:

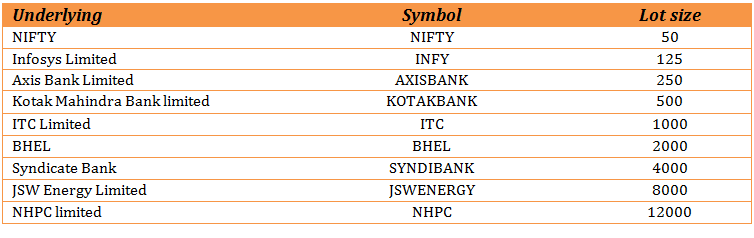

- You want to buy Infosys futures contract which has a lot size of 125 shares – this is the same as buying 125 shares of Infosys.

- You want to buy an IDBI futures contract – IDBI has a lot of 4,000 shares – this is the same as buying 4000 shares of IDBI.

The lot size is set for each contract and it differs from stock to stock.

Further, in the cash segment you must pay the full price to buy a share (other than in case of intra-day margin trading#); In the futures and options segment you pay:

- For buying option lots – a fee called the “premium“.

- For buying future lots – an “Initial Margin” amount which is a fraction of the total price of the underlying share.

What does this lot size mean?

Lot size refers to the number of underlying shares in one contract. In other words, it refers to the quantity in which an investor in the market can trade in the Derivative of particular scripts / stocks. The table below shows the lot sizes of some of some frequently traded stocks:

How many shares are there in 1 futures and options lot?

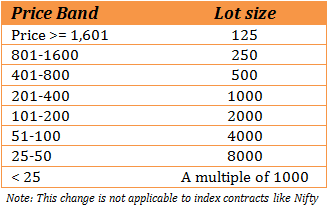

As per a standing committee recommendation to amend the Securities Contract (Regulation) Act, 1956 the minimum contract size of derivative contracts traded in the Indian stock markets should be pegged not below Rs. 2,00,000*. Based on this recommendation SEBI had specified that the value of a derivative contract should not be less than Rs. 2, 00,000 for a futures and options contract.

Accordingly, the lot size is determined keeping in mind this minimum contract size requirement. For example: if one share of XYZ Limited trades at Rs. 500, then the futures and options lot size of XYZ’s contracts should be at least 400 shares (calculated on the basis of minimum contract value — Rs. 2,00,000/500 = 400 shares).

Value of one futures or options contract is calculated by multiplying the lot size with the share price.

For example – the lot size of Asian Paints futures is 500 shares. So, buying 1 lot of Asian Paints futures (or 1 option lot – lot size is the same for both futures and options) would involve buying 500 shares, of course by paying only a fraction of the amount (i.e. the margin amount). So if the Company’s share is trading at Rs. 470, then the value of 1 lot will be Rs. 2,35,000 (Rs. 470 x 500)**.

Note: This change is not applicable to index contracts like Nifty

The idea is to maintain the contract size of derivatives between Rs. 2, 00,000 and Rs. 4, 00,000. Since stock prices are constantly changing, the exchange review the lot size once in every six months and revise the lot size by giving an advance notice of at least two weeks to the market.

_____________________________________________

# Margin trading is a leveraging mechanism, which enables investors to take exposure in the market over and above what is possible with their own resources. It allows an investor to put as security (i.e. margin), their shares or a fractional amount of cash and get 3-4 times more exposure than the value of the shares put up as margin. The risk here is that if the investments made on this leverage decline more than the amount of security (i.e. margin), then the investor must either deposit more money or more security to top up their margin account. If this is not done, the financiers will sell the security in the market.

* The Standing Committee on Finance, a Parliamentary Committee, at the time of recommending amendment to Securities Contract (Regulation) Act, 1956 had recommended that the minimum contract size of derivative contracts traded in the Indian Markets should be pegged not below Rs. 2,00,000.

** Accordingly you will have to put a margin amount of Rs. 29,375 to buy a single lot (i.e. the current margin requirement for Asian Paints being – 12.5%)

pharmacy 365 cialis https://krocialis.com/ – free cialis offer order cialis online no prescription reviews

WHAT IS 1 LOT RENUKA SUGARS

2500

First of all I appreciate you and thank you to write this post … It is so informative…. !!

U have explained nicely about the stock future’s lots size … My question is index future’s lot size ..!!

How do they determine the lot size for index future?

what is margin amount of Andhra Bank, J P Associates and R.com

How much maximum lot can i purchase in futures segment…? Is there any limitations on maximum buying?

No.

want to know how stamp duty is calculated for options

1. Stamp Duty is charged based on option turnover where turnover is Price * Lot size.

or

2. Stamp Duty is charged based on option turnover where turnover is Strike Price + Premium * Lot size.

Hello, my question here is, I have a lot of a particular script in Call Option. so when I want to execute that call option, I’m supposed to have amount required to Buy that complete lot??? and then I can sell it immediately or not?? Please suggest me sir.

Not sure what you mean.

Eqity Lot Size and Money required for each eqity Lot

pl give me list of of all future shares with lot size

Pl give me list of shares with lot size and margin amount per lot….

Search the internet or go to NSE’s website. This is available all over 🙂

i sis possible to trade 100,000 lots of nifty options in one go, because buying in intervals of 200 lots will take a lot of time.