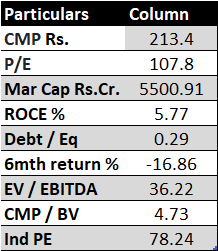

Valuations- The company has guided for 1200 cr revenue and 16-17% margins in FY 24, at current valuations available at 4.73X Book and 36X EBDITA for FY 23.

If the management fulfills its guidance, they are expected to generate around 192Cr EBITDA. Based on the company’s consistent track record of generating returns with a median ROCE of 12% over the past 11 years, the valuation multiple can be determined after considering future growth from Smart meters, AMISP, and Gas meters. This valuation multiple is estimated to be around 25x EVEBITDA after discounting for future growth. The company is right now trading at 36x EV/ EBITDA. The net debt of the company is around 155Cr.

Estimated Market Capitalization:

192 * 25 = 4800

4800 + 155 = 4955

Currently Market Cap: 5500 cr

VIEW: SELL

Company Background

Genus Power is a leading player in the domestic electric metering market. It was incorporated in 1992 for manufacturing Thick Film Hybrid Microcircuits & SMT PCB Assemblies.

Production of tamper-proof meters started in 1996 and since then, Genus Power has installed >70 million meters. In 20 years, the company has expanded its range of metering products to include Pre-payment meters, smart meters, Smart Street Light Management Systems, Smart Distribution Transformer Meters, etc.

Genus Power also provides comprehensive end-to-end service solutions, including meter installation, meter maintenance, data analytics, and MDM solutions. This gives them a noteworthy edge over their competitors.

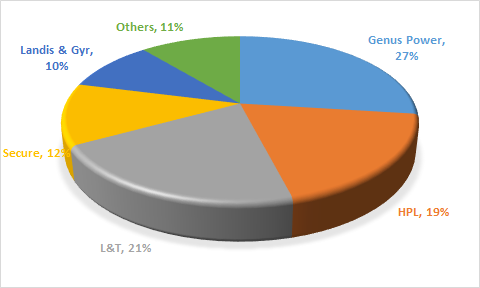

- Genus Power has a 27% market share in the Meter Industry and a 70% market share in Smart Meters.

- Genus Power has till date installed 70 mn+ Meters and has annual production capacity of 10 mn+ meters

Market shares of companies in manufacturing Smart meters in India.

- Unit realizations considered :

Non-smart meter – INR 800

Smart meter – INR 2500

Smart meter with full service Stack (AMISP) – INR 6000 : This is the model where Genus not only supplies the smart meter but also manages the solution (Meter + software stack) end-to-end. As per management, incremental INR 3500/meter flows to the P&L as revenue in 5 years i.e. INR 700 per year

WHAT HAS WORKED WELL FOR GENUS POWER?

- Reforms-Based, Result-Linked Power Distribution Sector Scheme – A win-win scheme for Discoms, end consumers, and power generators.

- Focus on corporate governance with business restructuring and strengthening the Board of directors: Genus Power has restructured itself and demerged its non-core businesses to focus solely on providing metering products and solutions. Further, it has onboarded eminent personnel on its Board, including Subhash Garg (former finance secretary and power secretary of India) and Keith Torpy, a veteran in smart metering technology and product development.

Reforms-Based, Result-Linked Power Distribution Sector Scheme – Government Of India approved Rs. 3.03 trillion power distribution company (DISCOM) reform scheme. Approximately half of the scheme’s total funds, totaling around Rs. 1.5 trillion, are designated for the deployment of smart meters, with Genus Power emerging as a primary beneficiary – The scheme targets installation of 10cr prepaid smart meters by Dec’23 and 25cr by Mar’25, replacing conventional meters. – This shows the substantial market opportunity available for Genus Power to tap into.

The scheme aims to meet the following objectives:

- Bring down AT&C(Aggregate Technical & Commercial) losses from the present level of 21.4% to 12-15% by 2024-25 -At present, India loses around 30% of its power generated due to transmission, distribution, billing generation

and collection inefficiencies.

Theft is one of the main causes of the high losses. Theft occurs in several ways, viz: by tapping power lines

and tempering / by-passing meter etc. - Narrow the deficit between the cost of electricity and the price at which it is supplied to ‘zero’ by 2024-25

India can save Rs. 9.5 lakh crore by investing Rs 1.25 lakh crore for replacing 25 crore conventional meters with

smart meters

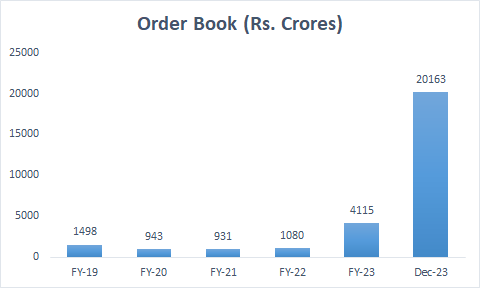

Total order book stands in excess of Rs. 20,000 Crore (net of taxes).

“Key guidance from management”

- Management plans to maintain a stable EBITDA of 16-17% beyond FY23.

- Company will restrict itself to only 30% of AMISP (Explained below) contracts among the total smart-meter contracts it wins under the scheme. This is a management threshold set to ensure capex costs don’t become unmanageable

- Company has a present manufacturing capacity of 1 Cr meters (Fungible between smart meters and non-smart meters) can double in 6 months with brownfield approach,

- Company is venturing into Gas meters which is a good growth area as well, recently won order by company has Gas meters as well)

Advanced Metering Infrastructure Service Provider (“AMISP”) – Bidding as System Integrator – Genus is planning 30% of revenues in med term from this model where they own end-to-end solution ( hardware + software + FMS( facility mgmt) – this will require higher WC but is a long term annuity contract and relatively better margins – will reduce overall performance volatility

Orderbook Position

- Current order book ~20163 Cr, Execution period – 27 months; The order book can be further broken into – Production, Installation, and Maintenance (6-7 yrs.)

Revenue Guidance

- 1,200 Cr. confident guidance for FY24, Assam and Bihar orders to contribute for FY24 revenue;

- For H1, it has been Rs. 520 Cr. The remaining revenue of 680 Cr. is expected in H2’24. That will be more than 50% growth in revenue against H2’23.

- Revenue for FY25 & FY26 will be multi-fold

Margins

- Current subdued margins are due to increased expenses for the preparation of delivering the huge order book e.g. employee cost, finance cost, etc.

- Once the revenue from newer orders comes in the management expects 15-16% margins

Future Outlook

- Ability to take order book to about 30,000 Cr. That was a target for 3 years order book. 2/3rd of that has already been achieved.

- Current capacity 10 Million orders. Can increase capacity if the order book continues to scale up