Goods and Service Tax (“GST”) is a comprehensive tax on manufacture, sale and consumption of goods and services, that will absorb most of the indirect taxes levied by Central and State Government. Currently the GST is adopted in over 150 countries. If passed, GST Bill would be THE biggest tax reform by the Indian government since inception of the Indian constitution.

How Will GST Work?

- In India, GST would work on dual model which will include – C-GST collected by Central Government + S-GST collected by State Government on intra-state sales. GST reform would also feature an Integrated GST (IGST) collected by Central government on inter-state sales, which is to-be divided between Central and States Government in a manner decided by the Parliament on recommendations by GST Council.

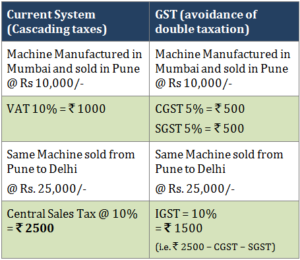

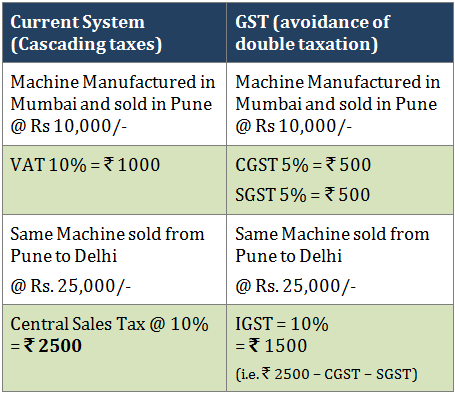

- By doing away with several Central and State Taxes, GST would diminish the cascading effect of tax (or double taxation, whereby the same product is taxed at the stage of manufacturing as excise, then as VAT/ sales tax on sale and so on..), which is prevalent in the current tax framework. Being a consumption-destination-based tax, GST would be levied and collected at each stage of sale or purchase of goods or services based on the existing input tax credit method. Current tax structure works on production-origin-based system i.e. goods and services are taxed differently on each stage of production.

Example:

- The various indirect taxes that would be subsumed in GST are:

| Central Taxes | State Taxes |

| Excise Duty | Value Added Tax (VAT) |

| Service Tax | Octroi and Entry Tax |

| Additional Customs Duty (CVD) | Purchase Tax |

| Special Additional Duty (SAD) | Luxury Tax |

| Central Sales Tax (Collected by States) | Entertainment Taxes |

| Central Surcharges and Cesses | State Surcharges and Cesses |

- Various sectors would be largely benefitted under this tax regimen and thus will drive market sentiment.

IMPACT OF GST AND ITS IMPLICATIONS

- Price reduction:

- Unification of different indirect taxes under GST will give boost to the existing tax-credit system, which will drive tax efficiency for manufacturers, wholesalers and also for consumers of goods. This will decrease the overall cost incurred by manufacturing sector which will reflect in various inflation indices in long-term.

- GST could have a negative impact on service sector, which contributes over 50% of Indian GDP. The existing Service Tax of 15% would surge to Goods and Service Tax rate which is anticipated at 18-20%. But at the same time, in current tax framework service sector is unable to enjoy tax-credit on VAT and Sales Tax, which is likely to change in favor of service providers after GST implementation. However, this might be lost if the GST rate is higher than anticipated.

- Less Compliance and Procedural Cost: The cost of collecting various taxes, maintaining big records and their respective reports by the government bodies would see a definite decrease as these taxes would come under one big umbrella of GST.

- Pricing and Profitability: The resultant tax expenditure after GST bill being passed would have a direct impact on pricing and profitability of different goods and services which will vary across different sectors. Given that Margin and Price Bands would also be reexamined, decline in prices is probable, which will have direct impact on consumer demand.

- Government Revenue: Despite the expected change in pricing, the government is expected to set GST @ revenue neutral rate, so there might be no significant change in Government Revenue.

- Cash Flow: Goods and Service Tax is set to boost cash flows through the removal of concept of excise duty. Being a consumption-based tax, GST would now be collected at the time of sale/supply over current tax predicament of tax being collected at the production/removal of goods.

- Redress Location Bias: This would enable uniformity through states and would not let investors discriminate states on basis of tax advantage. The only thing that would drive investor’s capital will be profitability, cash flows, and performances promoting smaller businesses and entrepreneurship without location bias.

- Uniform Per Capita Taxation: As mentioned above, Goods and Service Tax being destination-based consumption tax would allow poverty stricken states like Bihar to increase its tax revenue. As GST would be paid to states where the consumption of goods takes place, the states’ tax revenue would be driven by population (more the population, more the consumption) rather than number of businesses/industries. This would ultimately even out the tax per capita of each state.

- Fight Tax Evasion: Another perk of being destination based system, Goods and Service Tax Framework would ideally reduce tax evasion by large extent and promote use of bills and invoices.

It is a very usefullbut not updated site.