Systematic Investment Plan (SIP) is a regular and disciplined way of investing money in mutual funds. SIP allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc). SIP helps the investor inculcate the habit of saving and building wealth for the future.

Read More – How to Start Systematic Investment Plan (Sip) In Mutual Funds

In this article, I will deal with questions relating to what will happen if you miss your mutual fund SIP installment. Whether your SIP investment still remains active? Do you need to pay double in next month?

Consider a situation; you have a SIP installment due for 21st of every month. Lets say, in the month of August, you incurred some unforeseen expenses, and in all you forgot to maintain the required balance for your mutual fund SIP, which was to hit your account on 21st of the month.

Due to shortage of fund available in your bank account, your SIP installment will not get deducted in that month. Many investors think that if they miss an SIP, then their account will get de-activated and the fear of missing out on the installment to save for future goals grips them.

Well, you need not worry as your SIP would remain active even if you missed 1 or 2 installments due to insufficient amount of balance in your bank account.

When you miss an SIP due to insufficient funds, all that happens is that you miss your SIP installment for that month. The fund house wouldn’t penalize you for missing the installment neither your SIP becomes inactive. But your bank may penalize you for not maintaining sufficient funds for auto-debit mandate through Electronic Clearing Service (ECS). Banks have their own set of charges for ECS rejection, which range from Rs. 150 to Rs 750.

Important – In case 3 consecutive SIP transactions fail, then it would be considered that you aren’t willing to invest further and the SIP would be liable for cancellation.

How to Avoid Bank Charges When You Miss Your Mutual Fund SIP installment?

If you are facing some financial crunch and are aware that you won’t be able to service your SIP installments for next 3 months then you can opt for Pause SIP Facility. Under which, investor can have an option to discontinue his SIP temporarily for specific number of installments (minimum 1 installment and maximum 6 installments). SIP would restart upon completion of the period specified by the investor. You must speak to your financial advisor to pause / restart your SIP.

Points to Note –

- Investors can opt for Pause facility only twice during the tenure of a particular SIP;

- Pause request should be submitted at least 30 days prior to the next SIP installment date;

- Not all AMCs offer the ‘pause’ facility. It is best to check whether the option is available when registering the SIP;

- The facility is not available to investors who have invested through the stock exchange channel or through an online distributor portal.

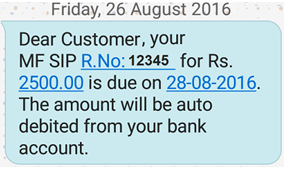

When you miss your SIP installment, you fail to accumulate the desired amount for your future goals. To avoid getting your SIPs rejected due to insufficient funds, register your active phone number and email and you would receive SMS from your fund house couple of days prior to the SIP date. The message will look something like this:

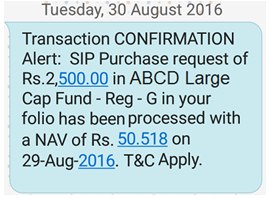

There are also facilities available wherein you even get an update once the SIP has hit to know whether the transaction has been successful. You will receive notification on your mobile number.

Tip: Updating your number and email address with your registered bank too helps you check the success of the SIP transaction. Selecting an SIP date closer to salary credit dates helps you minimize the risk of forgetting about the SIP installment.

When should we consider SIP and Lump sum investment options for MF? Should the fund be the same or different? Which fund do you like for long term (5-10 years) SIP?

Sir,

i am an civil engineer and i want to enter in share trading business,but i am new to this so i would like to know that, how do i start with it?

also what kind of share trading i should go for.

si, i want to know relaion of BSE, NIFTY,NSDL,CDSL with each other, what are the role of them

please can u guide me

#Nivezareview on -ABG Shipyard climbs over 3% on divestment plan:

Western India Shipyard was a loss making subsidiary of the parent company ABG Shipyard. Looking at the separate revenue of the companies losses were getting compensated by the parent. This is a better move by the management in order to survive in future. ABG Shipyard’s debt to equity conversion is looking like troubling the company in near term.

Actually yesterday I mean 20th of everymonth I ve deduction of my sip but yesterday I ran out of insufficient balance in my account n today I ve sufficient balance..n I got Your Purchase in Folio xxxxxxx in SBI Small Cap Fund Reg Growth for 39.446 units and value of Rs.2,000.00 at NAV of 50.7022 is processed subject to realization of funds-SBIMF