CMP: Rs. 2425

View: Buy

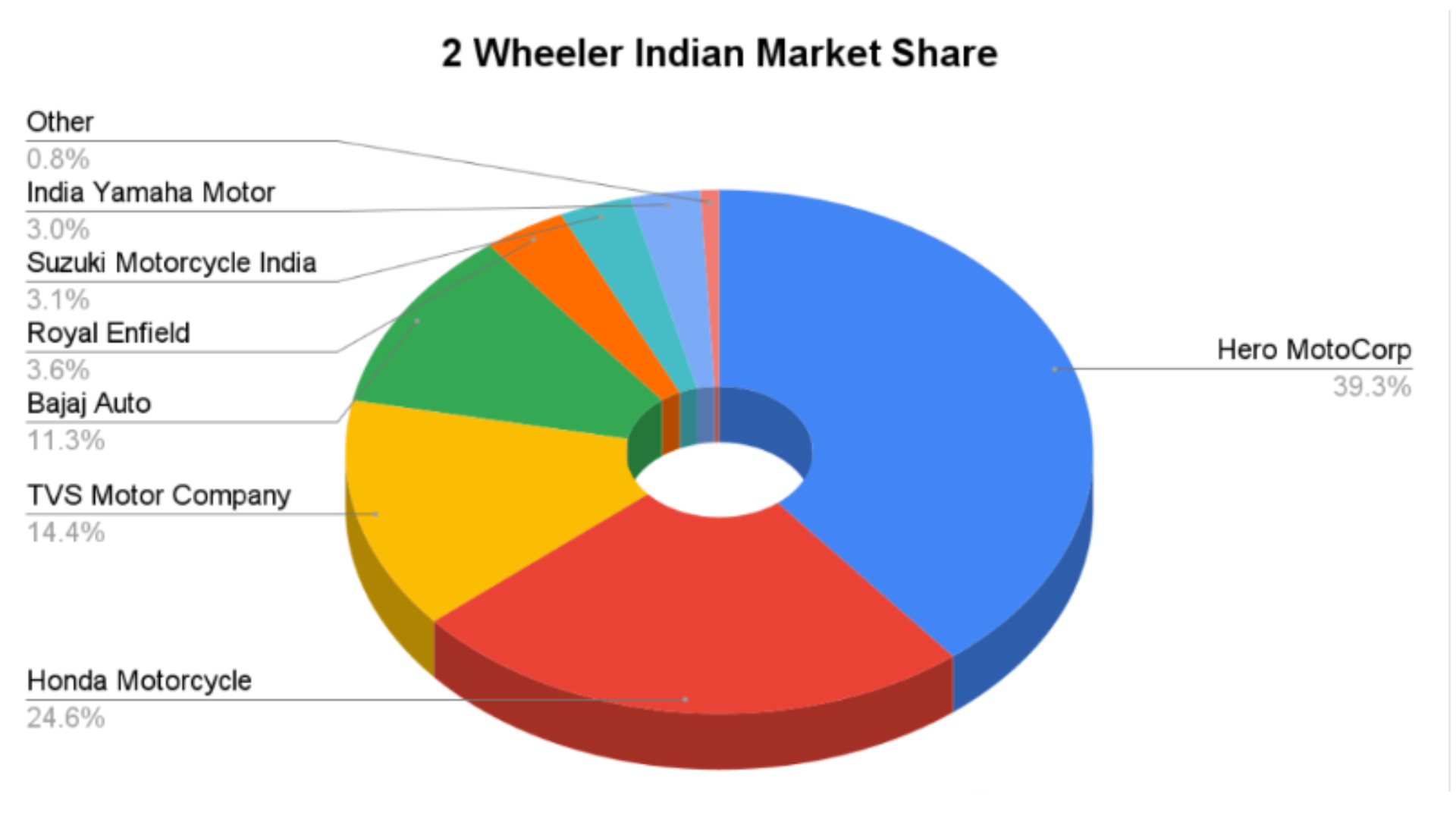

Hero MotoCorp (Hero) has been the largest manufacturer of motorcycles and scooters globally, with a 48.3% Indian Motorcycle Market Share and around 34.6% of market share in the Indian two-wheeler industry. Over the past 10 years, the company has rapidly expanded our capacity, geographic footprint, customer touchpoints, and R&D capabilities to emerge as a truly global brand. The Splendor model has 82% market share in Mar-22 and had an impressive performance.

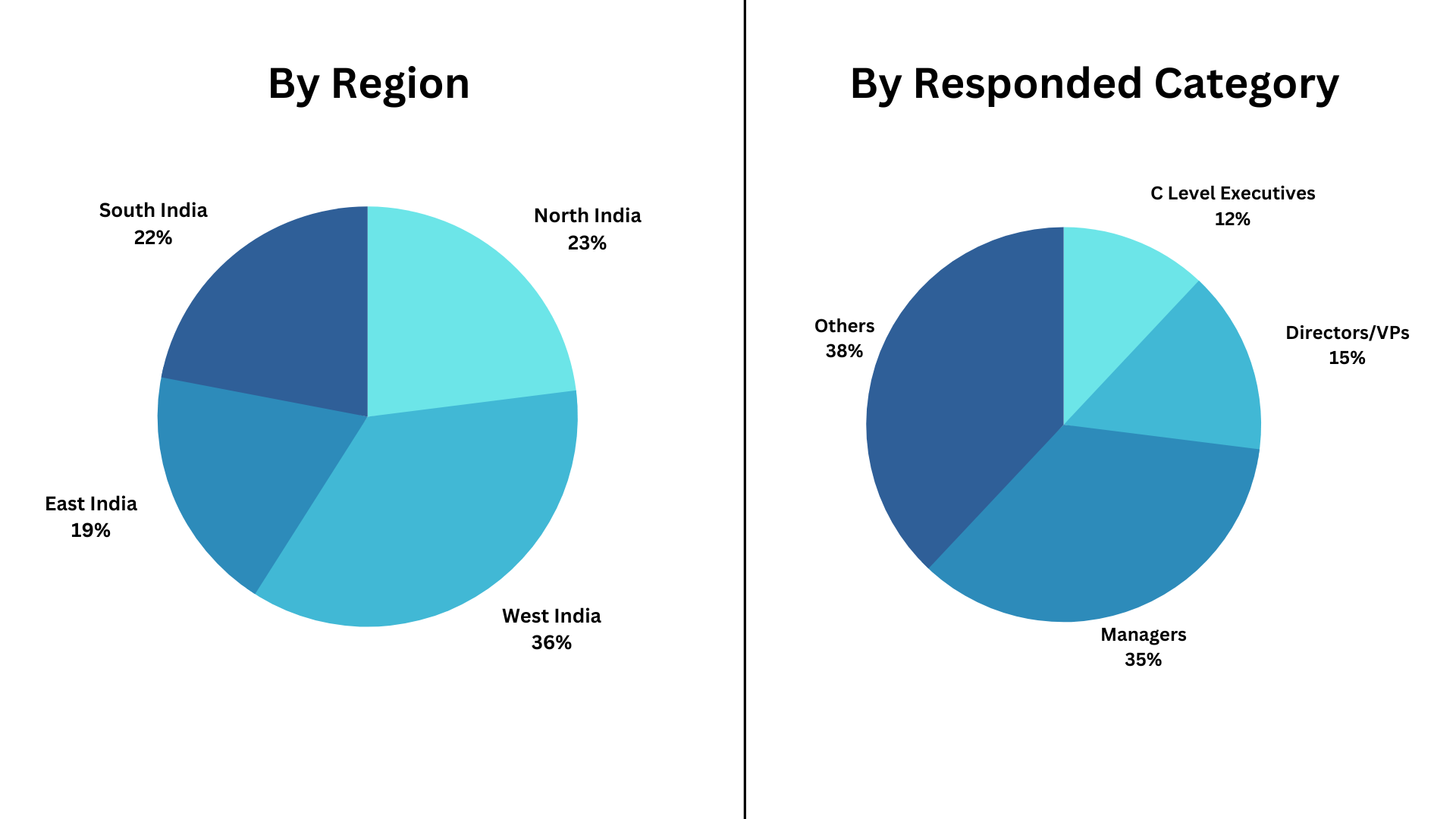

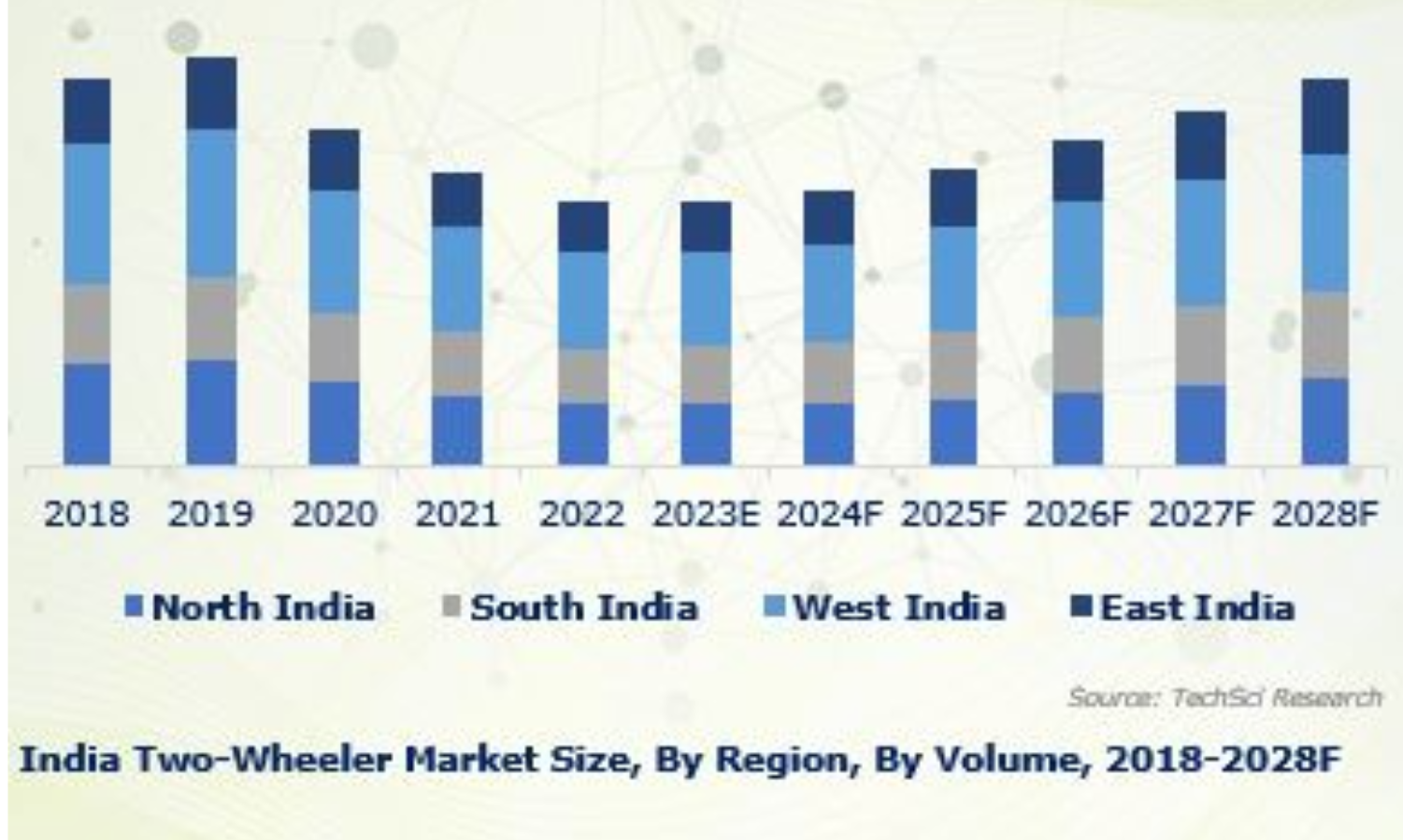

The India two-wheeler market size reached a volume of 18 Million Units in 2022. Looking forward, it is expected that the market will reach a volume of 48.1 Million Units by 2028, exhibiting a growth rate (CAGR) of 17.80% during 2023-2028. The rising trend of personal vehicle ownership, the escalating consumer concerns regarding high vehicular pollution levels, and the expanding travel and tourism sector represent some of the key factors driving the market. Let’s understand how Hero Motocorp can benefit significantly from this.

INDIAN TWO WHEELER AUTO INDUSTRY OVERVIEW

The Indian two-wheeler market size reached a volume of 18 Million Units in 2022. Looking forward, it is expected that the market will reach a volume of 48.1 Million Units by 2028, exhibiting a growth rate (CAGR) of 17.80% during 2023-2028.

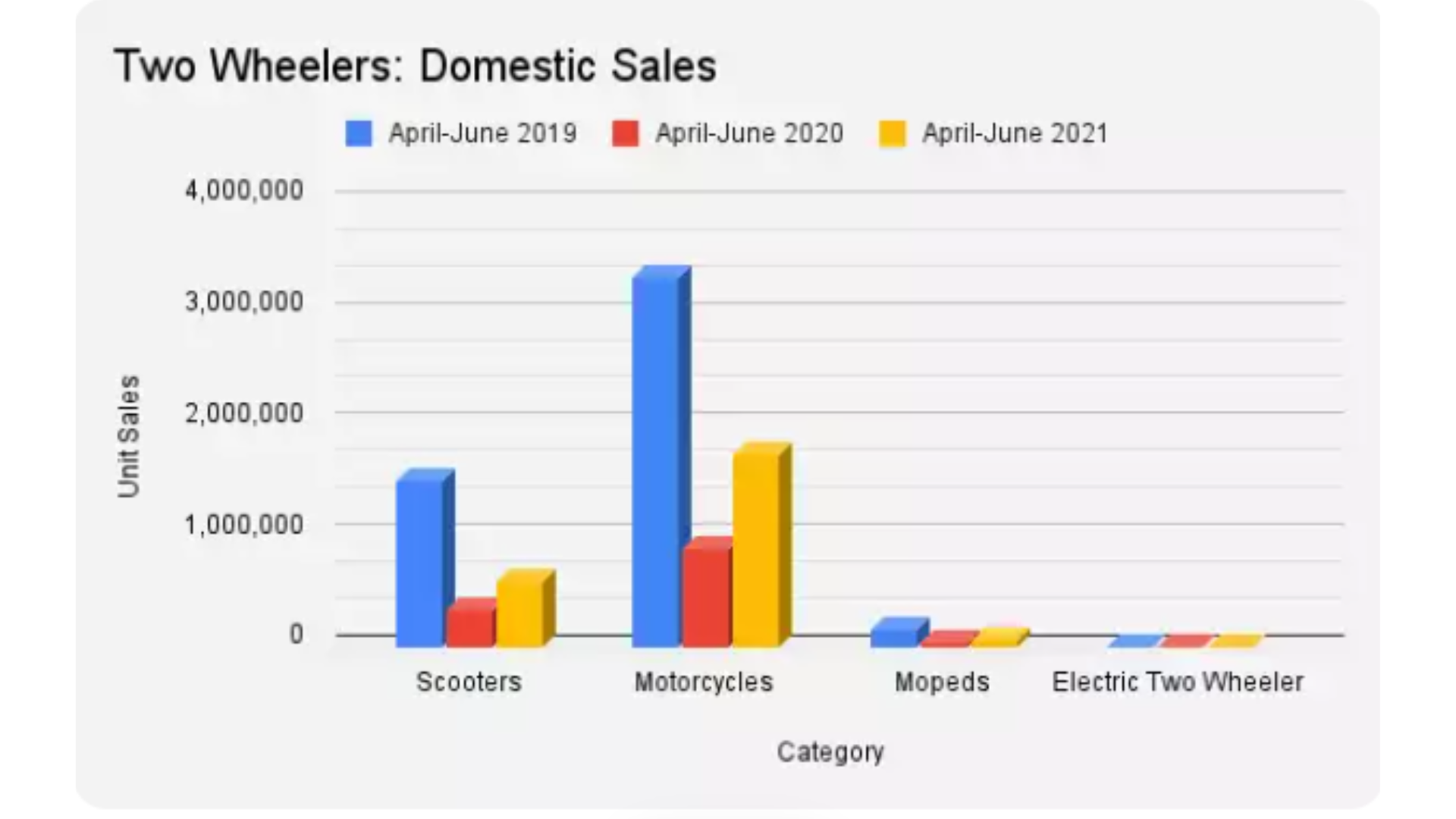

Based on vehicle type, India’s 2-wheeler market has been segmented into Motorcycle, Scooter, and Moped. The motorcycle was the largest segment in 2021, with almost 16.2 million units sold while performance bike sales merely reached 10 million units for the same year. India is the second-largest two-wheeler market in the world. It stands next only to China and Japan in terms of the number of two-wheelers produced and the sales of two-wheelers respectively. The average number of two-wheelers per 1000 people in India is 31. The urban market for two-wheelers is largely penetrated with nearly 57 of every 100 youths that earn an income to support the ownership of a two-wheeler.

The market is finally evolving rapidly pulled up by the success of several new OEMs specialized in the electric scooter which braked up the dominion of Top 5 traditional manufacturers, forcing them to invest in EVs and in new and more modern models. Data regarding the first two months of the year confirm the expectations, with January up 4.8% and February 10.2% with Year to Date figures at 2.4 million (+7.4%).

The electric segment performance was astonishing with the Electric L1 segment (equivalent to below 50cc ICE models) up 113.7% and the Electric L3 segment up 104.9%.

Looking at top manufacturers performance, Hero Motocorp is still on top, having recovered in February (+15.4%) the January lost (-2.6%) with 731.743 year to date sales (+6.0%).

CURRENT INDIAN TWO-WHEELER MARKET

In the first quarter of the current year, SIAM reported 1,740,198 motorcycle sales and 592,445 scooter sales in the domestic market as against April-June 2020 when sales nosedived to 901,743 units of motorcycles and 339,008 units of scooter. In April-June 2019, the industry recorded 3,330,868 motorcycles and 1,514,202 scooter sales.

During the first quarter of FY21 (April-June 2020), the country’s largest two-wheeler maker Hero MotoCorp gained a market share of about 5% to cross the 40% mark for the first time in almost five years (past 19 quarters). However, the automaker ended the first quarter of the current financial year (April-June 2021) just below the mark at 39.2%.

PRODUCT PORTFOLIO OF HERO MOTOCORP

- The company continues to focus on expanding our portfolio across all segments to cater to the continuously evolving and competitive market dynamics.

- While it maintains our leadership in the mass market or commuter segment, it is gaining share in the other segments.

- The company is continuously launching premium variants with enhanced features of our

existing products in addition to launching newer models, thus providing consumers with wider choices. - The two-wheeler EV market is evolving in India, growing at a fast pace driven by favourable government policies, such as lower goods and services tax (GST) and permit exemptions, developing charging infrastructure and lower running cost per km. To capitalize on this opportunity Hero Motocorp’s R&D team has developed state-of-the-art technology, and we will soon be launching our first electric scooter under our new EV brand ‘Vida’-Powered by Hero.

GLOBAL PRESENCE

- Hero Motocorp remained well-positioned to capitalize on the growing preference for Indian brands in international markets through their R4 strategy.

- The global expansion and substantial presence of the company is projected to contribute around 15% to the revenue by FY 2024-25.

- The Xpulse 200 and Xtreme 160R motorcycles appealed the most to customers across our key geographies. Hero Motocorp’s market-specific approach focused on Hunter 100 motorcycles in Nigeria, Hunk 200 in Latin America, and the Hunk 150 in the Middle East, which enabled the company to fast-track growth.

KEY FINANCIALS OF HERO MOTOCORP

Key Financial Highlights:

- Sales volume declined by 14.8% during FY 2021-22, on account of disruption in business activity due to the spread of the pandemic and consequent lockdowns in different parts of the country. Domestic demand also declined due to the slow recovery of the Indian economy and lower demand from a rural part of India.

- Global business registered a healthy growth of 57% as against Industry Growth of 36% in the year. While there has been a volume drop of 14.8%, the decrease in Revenue from Operations was lower at 5%.

- The Revenues were supported by healthy Spare Parts business growth of 24% and price increases during the year. The increased revenue thereby helped in an offsetting volume drop y-o-y to a great extent.

- The Material Cost as a percentage of Revenue increased to 71.2% (vs 70.7% FY 2020-21), largely attributable to a surge in commodity prices, partly offset by aggressive leap savings and judicious price increases.

- The employee cost has grown nominally by 1.9%, due to an increase in counts and the impact of annual increments.

- Depreciation and Amortisation costs decreased by `27 crore. Lower depreciation is mainly attributable to the discontinuation of old assets and amortization of ROU.

- Finance Cost increased by `4 crores on account of change in lease liability and financial liabilities. Other expenses came down marginally by 0.2% during FY 2021-22 to `3,115 crores. The effective tax rate has marginally decreased by 0.1 (23.91% vs 24.0% in FY 2020-21) in the current year.

- The debtor turnover ratio decreased from 15.04 times in FY 2020-21 to 12.13 times in FY 2021-22 predominantly on account of the decrease in revenues.

- The operating profit margin for the year has declined from 10.85% to 9.30% on account of negative operating leverage and higher commodity inflation.

- Net profit margin decreased from 9.45% to 8.30% mainly attributable to negative operating leverage and higher commodity inflation.

LATEST QUARTERLY RESULTS OF HERO MOTOCORP

Q3 FY2022 Highlights:

- During the quarter, the Company achieved Net Sales of INR 81,183 Cr., a decrease of 11% over the corresponding

quarter of the previous year. A total of 12.40 lakh units of motorcycles and scooters sold in Q3 FY’23. - EBITDA during the quarter was INR 9,417 Cr. corresponding to an EBITDA margin of 11.60% as compared to a

margin of 11.86% in Q2FY22. - The Company reported a Profit before tax (PBT) of Rs. 940 Crore in Q3 FY’23 (vs Rs. 911 Crore in Q3 FY’21) and the Profit after tax (PAT) of Rs. 6,832 Crore (vs Rs. 6,845 Crore in Q3 FY’21). The nine months revenue grew by 1.31%, while PAT registered fall of 6.76%

- During the quarter, VIDA, Powered by Hero, the emerging mobility brand of Hero MotoCorp, commenced customer deliveries of its electric vehicle – the VIDA V1 scooter. The highly customizable, Built-to-Last VIDA V1, with convenient removable batteries and three-way charging options, is available in two variants – VIDA V1 Plus at Rs. 135,705/- and VIDA V1 Pro at Rs. 146,880/-, price includes all connected features, portable charger and charging service.

INVESTMENT RATIONALE

Market Positioning and Market Leader:

- Hero Motocorp (HMC) is the leader in the Indian 2-wheelers market with a dominating presence in the entry level segment. It has been gaining back its lost market share in this segment with Mar-22 & FY22 share at 74% and 62% respectively.

- The Splendor model has 82% market share in Mar-22 and had impressive performance. Management expects the 2W industry to post double-digit growth in FY23 on the back of favourable indicators that include marriage season demand, good festive demand in key regions in April, and positive rural sentiment on the back of expected healthy crop output.

- The company took price hike of Rs 1,000 (ex. showroom) in first week of April. The current inventory levels have come down to 6-7 weeks compared to 7-8 weeks at end of Mar-22.

Dominant Global Presence:

- The company made significant progress in terms of our global expansion strategy. During FY 2021-22: It commenced retail sales in Mexico and introduced an extensive portfolio of products; relaunched products in Argentina and Nicaragua.

- Strengthened our presence in the strategically important Gulf region, expanding our network of touchpoints, including

dealerships, service centres and spare parts outlets; entered into another exclusive dealership in Dubai. - Reinvigorated our strategy for the Nigerian market, leading to a 978% dispatch growth. We also launched a new motorcycle – ‘Hunter,’ developed especially for the market. The model, extensively tested in native conditions, comes with an industry-first 12-month or 75,000 km engine warranty. Additionally, we are establishing outlets across the country through dealers and parts distributors and an extensive network of 5,000+ trained technicians to ensure easy access to services and parts for all customers.

- The Xpulse 200 and Xtreme 160R motorcycles appealed the most to customers across our key geographies. Hero Motocorp’s market-specific approach focused on Hunter 100 motorcycles in Nigeria, Hunk 200 in Latin America, and the Hunk 150 in the Middle East, which enabled the company to fast-track growth.

- The global expansion and substantial presence of the company is projected to contribute around 15% to the revenue by FY 2024-25.

Booming Industry prospects:

- The Indian two-wheeler market size reached a volume of 18 Million Units in 2022. Looking forward, it is expected that the market will reach a volume of 48.1 Million Units by 2028, exhibiting a growth rate (CAGR) of 17.80% during 2023-2028.

- The two-wheeler industry has strong medium- to long-term potential owing to resilient fundamentals globally and in India. In addition to being a means of transport for short to medium distances and providing end to end connectivity, even amid less than adequate public infrastructure, two-wheelers have also become an income enabler for many, especially in developing and emerging markets.

- The two-wheeler industry has strong medium- to long-term potential owing to resilient fundamentals globally and in India. In addition to being a means of transport for short to medium distances and providing end to end connectivity, even amid less than adequate public infrastructure, two-wheelers have also become an income enabler for many, especially in the developing and emerging markets.

Government incentives for boosting growth:

- The two-wheeler EV market is evolving in India, growing at a fast pace driven by favourable government policies, such as lower goods and services tax (GST) and permit exemptions, developing charging infrastructure and lower running cost per km. The electric two-wheeler penetration stood at 1.9% during FY 2021-22 vs 1.0% in FY 2020-21.

- EV sales are expected to gain momentum going forward. Favourable Government policies driving EV adoption:

- 10,000 crore rupees subsidy under FAME-II for one million two-wheeler EVs.

- Production-linked incentive (PLI) schemes in the auto segment focus on EVs and other

alternative energy technologies with an outlay of 25,938 crore to promote the manufacturing of battery and hydrogen fuel cell vehicles. - PLI schemes for advanced chemistry cells with an outlay of J18,100 crore to boost local battery cell production and to reduce the cost of batteries.

- The proposed formulation of a battery-swapping policy along with the formalization of interoperability standards for public charging.

- The plan to create special mobility zones for EVs, which are already in place in other regions like China and Europe.