Hester Biosciences Limited (“Hester” or the “Company”) is one of India’s leading animal healthcare companies and second largest poultry vaccine manufacturer with a market share of nearly 35% in India. Hester has a state-of-the-art manufacturing facility for products ranging from vaccines, health products to diagnostics.

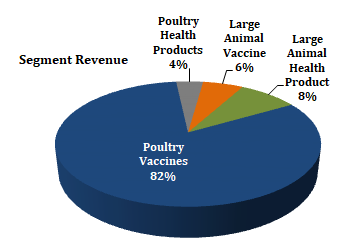

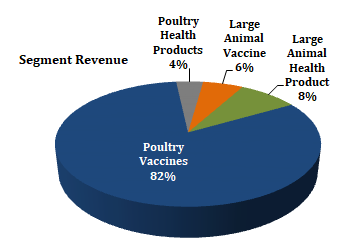

The Company has four verticals: Poultry Vaccines, Large Animal* Vaccines, Poultry Health Products and Large Animal Health Products.

*Large Animal – Buffalo, Sheep, Goat, Cattle, Swine

Hester’s product portfolio includes over 50 vaccines and 35 health products, which are distributed through Hester’s pan-India distribution network. Exports are currently to 9 countries with registration process on in over 20 countries.

Financial Position

| Particulars | FY14 | FY15 | FY16 | FY17 |

| Revenue | 69.05 | 90.04 | 100.89 | 123.04 |

| Growth | – | 30.40% | 12.05% | 21.95% |

| EBITDA | 24.45 | 25.18 | 32.59 | 40.86 |

| EBITDA Margin | 35.41% | 27.97% | 32.30% | 33.21% |

| PAT | 9.45 | 13.60 | 18.88 | 23.45 |

| PAT Margin | 13.69% | 15.10% | 18.71% | 19.06% |

| EPS | 11.11 | 15.99 | 22.20 | 27.56 |

| EPS Growth Rate | – | 44% | 39% | 24% |

| Historic P/E (Closing Price of 31stMar) | 7.99 | 29.29 | 22.50 | 27.69 |

| P/E Ratio (TTM) | 45.80 | |||

| Shareholder funds | 75.01 | 84.92 | 100.71 | 119.61 |

| Minority Interest | 1.28 | 2.87 | 4.10 | 4.58 |

| Debt | 45.26 | 51.87 | 53.95 | 62.94 |

| Cash | 4.85 | 6.58 | 5.28 | 11.96 |

| Ratios | ||||

| D/E | 0.60 | 0.61 | 0.54 | 0.53 |

| ROCE | 20.12% | 18.03% | 20.53% | 21.84% |

| ROE | 12.60% | 16.02% | 18.75% | 19.61% |

| Interest Coverage | 3.78 | 5.56 | 8.76 | 11.67 |

| Quarterly Results | Q3 FY 2017 | Q4 FY 2017 | Q1 FY 2018 | Q2 FY 2018 | Q3 FY 2018 | TTM |

| Revenue | 28.52 | 34.93 | 29.04 | 38.48 | 31.93 | 134.38 |

| Growth | – | 22.48% | -16.86% | 32.51% | -17.02% | |

| EBITDA | 9.39 | 11.64 | 10.76 | 15.07 | 12.61 | 50.08 |

| EBITDA Margin | 32.92% | 33.32% | 37.05% | 39.16% | 39.49% | |

| PAT | 5.80 | 7.08 | 6.18 | 8.86 | 6.50 | 28.62 |

| PAT Margin | 20.34% | 20.27% | 21.28% | 23.02% | 20.36% | |

| EPS | 6.82 | 8.32 | 7.26 | 10.42 | 7.64 | 33.64 |

WHAT’S DRIVING THE STOCK

Early Mover With Established Track Record of Operations

The Company has long and established manufacturing track record of almost two decades in manufacturing of poultry vaccine. Hester Biosciences primarily operates into two segments, i.e. vaccine and animal healthcare products each for poultry as well as large animals.

The Company manufactures vaccine and health products mainly for poultry apart from sheep, goats, cattle and pigs. Over the year, the Company has regularly launched new products and has expanded its geographical presence in various countries including Africa through its subsidiary Hester Biosciences Nepal Private Limited (HBNPL) which is engaged in the manufacturing of large animal vaccines complementing the Indian operations.

Large Opportunity In Animal Healthcare Market

Food and Agriculture Organization (FAO) of the United Nation (UN), and OIE (World Organization for Animal Health) have embarked on a worldwide PPR (Peste Des Petits Ruminants) disease eradication program over a period of 15 years, starting in 2015. This PPR eradication project will induce a high demand for the PPR vaccine thereby growing the PPR vaccine market by leaps and bounds. Hester Biosciences through its manufacturing set-up in Nepal is engaged in manufacturing of PPR and Goat pox vaccines of Nigerian strain which are not allowed in India, thereby provides opportunity to grow.

Wide product portfolio

The Company’s product portfolio comprises of 49 vaccines (including both poultry and large animal vaccines) and 35 animal health products (medicines, feed supplements and disinfectants). Further, during FY 2017, the Company submitted 60 dossiers in 12 countries through Hester Biosciences and 3 dossiers in 3 countries through HBNPL for approval. The Company received registration approval for 22 poultry vaccines in 3 countries during the year, thus making it eligible for exports business.

Low Equity Base

The Company has only 8 million (i.e. 80 lacs) shares in circulation. Typically if these kind of stocks do well, initial investors benefit the most from an expanding equity base as the promoter raises more capital.

Strong Balance Sheet Position

The capital structure marked by overall gearing at a consolidated level stood comfortable at 0.53 times as on March 31, 2017.

Extensive Distribution Network

The Company operates through six own warehouses, five C&F agents and nearly ten authorized distributors which have pan India presence. The Company has also started distribution network in Tanzania and Kenya. In July 2017, Hester Biosciences developed a diagnostic laboratory division for animals to diagnose the diseases at an early stage thereby representing a backward integration of its business model of vaccines development.

WHAT’S DRAGGING THE STOCK

Regulated Industry and Risk Related To Poultry Industry

The vaccine industry has very high entry barriers and is a highly regulated market in terms of intellectual property rights (IPR) and other regulatory requirements. Further, the poultry industry is exposed to the risks of outbreaks of diseases, which in turn, could affect the poultry vaccine industry. Such instances cause a severe reduction in the consumption of poultry products besides causing a cascading effect on the profitability of poultry companies.

Competition from Venkys which holds 40% market share in the poultry vaccine.

Working Capital Intensive Nature of Operations

The operations of Hester Biosciences remained working capital intensive with high inventory requirements considering the nature of its products.

- Inventory level stood at 105 days for the nine months ended FY 2018.

- Total receivables are for 87 days for the nine months ended FY 2018.

- The working capital cycle was for 72 days for the nine months ended FY 2018.

with the increasing cost of poultry feeding cost will the margins will not be effected.