A few days back I received this Question –

“Is it better to choose low priced stocks over high priced ones?”

To elaborate on the question – do low priced stocks have a better chance of multiplying faster than shares that are already priced very high?

Think of a share trading at Rs. 10 vs. a share priced at Rs. 1678.

Which one should you buy?

The simple answer – THE RETAIL PRICE OF A STOCK TELLS YOU NOTHING.

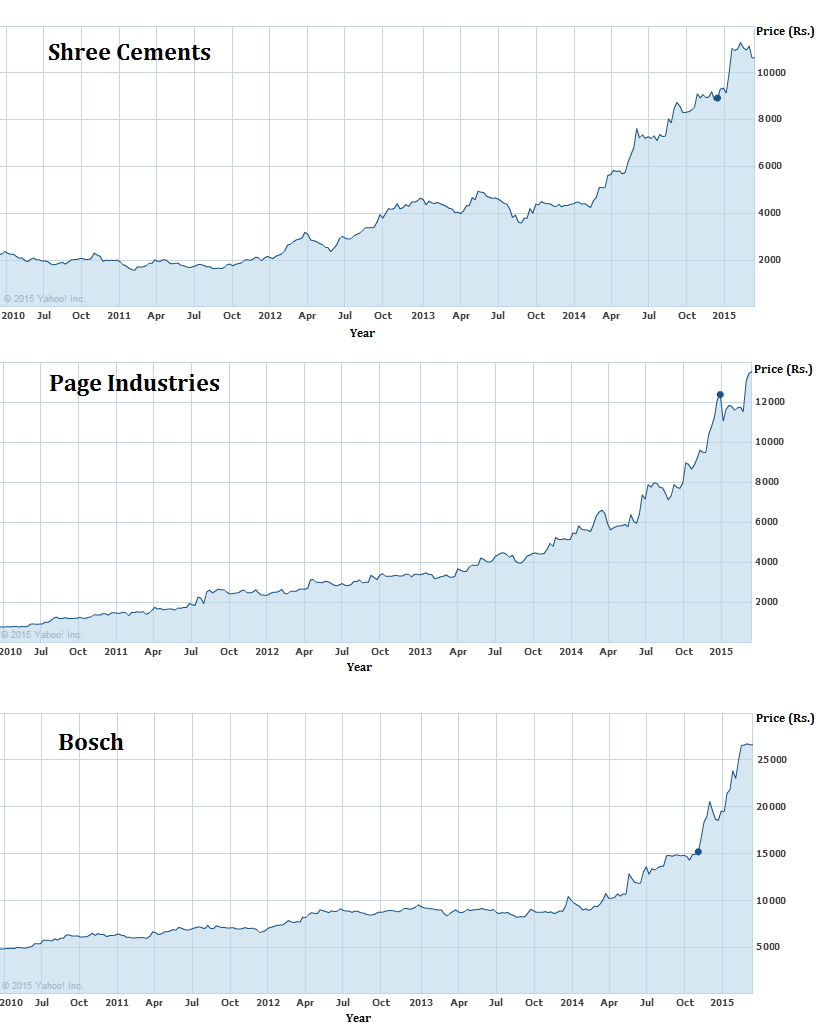

To take an example, look at the 2 stocks below. Compare the returns which each stock generated over a 5 year period.

Click on Images to enlarge

Firstsource Solutions

Price on 31 March 2010 – Rs. 29/-

Price on 16 March 2015 – Rs. 29/-

MRF

Price on 31 March 2010 – Rs. 6,848/-

Price on 16 March 2015 – Rs. 40,400/-

MRF which was trading at over Rs. 6,800 in the year 2010 generated six times. That’s more than doubling your money each year – for 6 straight years!

And this is not the most extreme example. In fact if you ask me, purely on the basis of statistics – stocks priced higher than Rs. 500 deliver higher returns both over short & long term in comparison to stocks priced below Rs. 500.

Though there is no rule on this and no scientific study may have been done on this but higher priced shares have a much better rate of success both in probability and in percentage returns. Yet I have seen an almost childlike fascination amongst retail investors to buy shares priced at Rs. 4 – 6 – 10 – or below Rs. 20.

What Drives Investors Towards Buying Low Priced Stocks?

I can only guess that the belief may well be that low priced stocks are likely to grow much faster since they start from a low base. The other reason why a lot of investors get tempted to buy low priced stocks is their affordability and the fact that a lot of shares could be bought with a small amount of money.

Each reason is worse than the other.

What People Do Not Realize About High Priced Stocks

Besides the stocks mentioned above, there are many other companies the shares of which are currently trading at a high price but from time to time those companies give bonuses, split their shares and issue rights shares. This reduces the price of the share based on the number of new shares issued.

MUST READ – IT’S SHOCK TREATMENT!

Take the example of ITC. These days, with all the excise duty hikes and with the anti tobacco lobby in an overdrive mode, it’s hard to take notice of the kind of returns it has delivered continuously for many over 2 decades.

In the year 2003, ITC was trading in the range of Rs. 770. Its current trading range is Rs. 350.

Now for some FACTS about how rich ITC has made its investors.

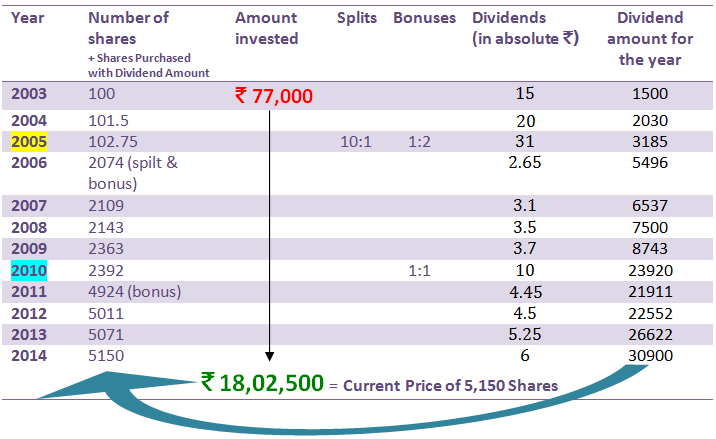

If you bought 100 shares of ITC for Rs. 77,000 in the year 2003, how much will your Rs. 77,000 be worth today?

Answer – Rs. 14,00,000.

Yes, your money would have grown 1,718% in 12 years.

Here is the kicker – This is without counting the dividends which ITC paid along the way. So that you get a complete picture, Let’s calculate how much dividend would you have received over these 12 years on your investment of Rs. 77,000.

ITC Dividend over the years – calculated on 100 shares purchased in 2003.

| Amounts in Indian Rupees | |||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| 1,500 | 2,030 | 3,185 | 5,496 | 6,537 | 7,500 |

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| 8,743 | 23,920 | 21,911 | 22,552 | 26,622 | 30,900 |

Total Dividend on Rs. 77,000 = Rs. 1,60,896/- (Rupees one lakh sixty thousand eight hundred ninty six = total dividend for all years from 2003 to 2014).

Finally, let me do some math based on dividend reinvesting plan. Meaning – if you kept investing all the dividend back into buying ITC shares – the way “mutual funds – growth (G)” plans invest, this amount would be even higher. Look at the image below. If you kept purchasing more shares from the dividend you received, your principal would be Rs. 18,02,500/-.

ITC is just one example. There are Blue Chips like HUL, L&T, Infosys, TCS and many others which have delivered exceptional returns.

Change Your Thinking

You are not the only one who buys low priced stocks hoping that they have a better chance at multiplying your money faster. For every 1 fundamentally sound company there are at least 5 low to super low priced stocks in the market. Do not buy them for the reason that they are cheap and hence have a better chance at becoming

Every time I choose stocks which priced at Rs. 250+ and say that they belong to a multibagger portfolio, invariably someone tells me this –

How much more can they rise, even if they rise 4 times they will reach only 100? – I hope reading this article makes one realize that these shares could multiply 20 times and still be trading at Rs. 200.

Great analysis..

I remember reading somewhere about a person buying HUL shares worth a couple of lakhs or even lesser (?) a couple of decades ago and is now sitting on a hundred crores or so.. (dont remember the exact numbers)

Your Blog is really very informative. There are many new things which i got to know from your blog… So keep going…!!!