I am sure you have thought about investing in Google, Apple, Microsoft, Wal-Mart etc. Despite the fact that these companies are not listed on Indian stock exchange(s), Indian investors can still invest in them either directly or as part of mutual funds/ Exchange Traded Funds (ETFs).

How Much Can Indian Investors Buy Foreign Stocks?

The Reserve Bank of India (RBI) allows an individual to remit U.S. $250,000 per financial year (April-March) under the Liberalized Remittance Scheme (LRS), which can be used for investing abroad.

Liberalized Remittance Scheme – Under LRS, domestic investors are allowed to remit a certain amount of money during a financial year to another country. This money can be used to buy foreign stocks and debt instruments in overseas market. Apart from this, the remitted amount can also be used to pay expenses related to travelling, medical treatment or studying.

Process of Investing in Foreign Stocks – Call Your Broker!

- Open a trading account with a brokerage house (ICICI Direct, Kotak Securities etc.) that offer overseas trading facility. Domestic brokers have tied up with international partners to allow this.

- Submit duly filled separate account opening form along with know-your-customer (KYC) documents.

- For investing/trading in foreign stock markets, you are required to transfer money to the international partner of the domestic equity broker through whom the service is provided.

- Funds are transferred to the international partner as below:

- Submit application-cum-declaration form under LRS,

- Form A2 (this will be available with your brokerage house),

- Sign a form for Foreign Exchange Management Act (FEMA) declaration (this will be available with your brokerage house),

- Form authorizing the designated bank branch as authorized dealer (this will be available with your brokerage house),.

Once the funds are transferred, you can start buying and selling foreign stocks on the online platform.

Another Way to Buy Foreign Stocks

Global Mutual Funds/ Exchange Traded Funds

You can also buy international mutual funds. These funds are denominated in local currency and there is no limit to investing in these funds unlike direct investments which are capped at U.S. $2, 50,000. This is because payment for such funds is made in local currency and hence no foreign exchange flows out of the country.

International mutual fund – Schemes which invest a major portion of their assets in overseas markets including in stocks, commodities etc.

Exchange Traded Funds (ETFs) are investment products which allow domestic investors to take exposure to international indices. ETFs are passive investment instruments based on indices and invest in securities in the same proportion as the underlying index.

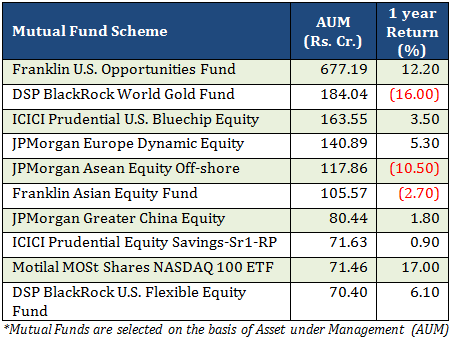

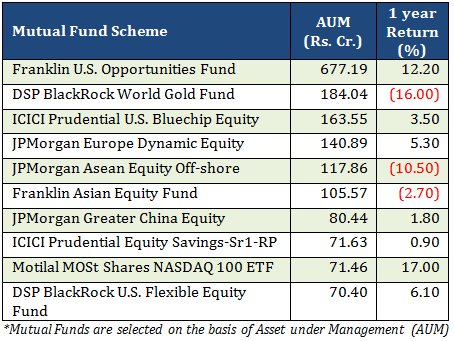

Top 10 Global ETFs and Mutual Funds Available in India

Tax Considerations

TAX ON CAPITAL GAINS

If an investor holds domestic equities for over a year, there is no tax on capital gains. However, there is no exemption on profits from foreign stocks. The investor will have to pay 20.60% tax on such gains.

For tax treatment of long-term capital gains from stocks and equity funds READ HERE: Capital Gains Tax | Dividend Income Tax in India

Not sure if you’re updated. ICICI and loyal no more provide this service.

However there are alternate brokers and international platform for this.

Incorrect – ICICI very much Provides this, I know this personally. Call them!

Yes- there are many brokers who do this.

Pls give the list of the brokers who provide this service. Is Geojit BNP provide this? I think yes as the BNP is international company

Simple – Just call them and find out.

Can i take direct trading account from USA based broker and invest/trade in NASDAQ or any other foreign stock exchanges by transferring money through LRS?

Not if you are a citizen of India – while LRS will work, you may not be able to open a bank/ brokerage account in the U.S. If you manage to open one via business or any other route – it should work.

what is LRS?

Liberalised Remittance Scheme of the RBI – Read up.

Yes, from india we can invest to many International Stock Exchanges.

I was in US for 3 years on deployment and have a bank account and also a trading account. Now, i am back in India but i still hold some shares which i couldn’t dispose off due to the huge losses.

So, my question is , can i continue to invest using the same broker and how do i pay income tax in India for the capital gains in US.

Appreciate if you can provide details on the above subject.

Yes you can but remember – you will have to pay taxes for that in the U.S. and not in India.

Can I work in F&O in US stock exchange being an Indian ?

Not unless you get an account opened with a stock broker in the U.S. Which you will not be able to do it from India, at least as per conventional laws.

If i get an overseas trading account for buying stocks in USA; Through LRS, buying stock options and index options is legal?

Buying stock and index options comes under trading or investment ( as they are also holdable for some time)

Thanks in advance.

Yes it is totally legal. The challenge will be to open an overseas trading account. If you can submit documentary requirement which satisfies a U.S. Broker, then you are all set (you will need a bank account in the U.S. for a start).

Buying stock and index options comes under trading or investment – trading . But this should not matter.

If you are looking to open an account in the U.S. Email – rajat@sanasecurities.com

Can NRI open international trading account from India. Tax treatment on capital gains in India is much better than country I currently live. I have NRI trading account in India but not sure if I can trade in US market.

No.

i am indian citizen & resident . i want to invest in the us stock market. The taxation of 20.60% you mentioned is payable in US or india ? this is short term taxation or Long term ? If payable in india what do v pay in terms of taxes in usa or vice versa. Does it make sense to open a account where there is minimum tax like Singapore , dubai then trade?

Hi,

I am an Indian resident, working in an IT company which si owned by a Swedish company listed in Swedish Stock market. I am getting stock option for the shares in Swedish company. How can i get these shares on my name

I think the best way to get this answered is to consult a lawyer. And while I am a lawyer, I dont think the comments section of a blog is the best place for such questions.

Hi,

As a resident Indian, I hold ESPP (employee stock purchase plan) stocks listed on an exchange in the US. Once I sell these shares ( and declare the same in my tax returns in India) can I retain the sale proceeds in dollars in the US and use the money to trade in other shares listed on NASDAQ or NYSE or do I have to remit the money back to India. My foreign brokerage allows me to retain the amount abroad but what about India laws?

You can surely retain it in the U.S. and trade or invest in markets there. Write in to me at rajat@sanasecurities.com for a detailed explanation, if you so wish (that will be chargeable). But in short … you can retain the proceeds in dollars in U.S. What’s your visa status in India?

Hi Rajat,

International stocks can be traded through Etoro. Do you have any idea about it ? Also what I came to know that there are high brokerage charges through broker houses in India & also long term capital gain tax can;t be avoided in international stocks.

can we short sell the u.s stocks from india??

Not unless you have a trading/ demat accouNt in the U.S.

can us commodity futures be trader by remitting money from india under LRS?

Absolutely. The bigger challenge (if at all) is to open a trading account in the U.S.

I verified with both ICICI Direct and Kotak Securities, but they do not provide this kind of services. This they confirmed through E-mail. The I approached to bank, but certain bank also clearly stated that I cannot make any Foreign Investment directly. Now I am in confusion, whether this is at all possible or not! Kindly guide me in a right way.

Send me a mail on rajat@sanasecurities.com

I am a resident Indian and applied for Resident Overseas Trading Account.

I am targeting to do Individual Stock and Option Trading ( not Future, Future Option or FOREX)at NYSE , CBOE.

I would like to know whether I am permitted to do Stock Option Trading at a Foreign Stock Exchange or not under Indian Law.

I have asked this to a number of my CA and Taxation friend, but they are not aware of this specific.

If you can guie me on this that will be of great help for me.

I have

Please ignore my question. This is mentioned above in response to Mr. Ramesh’s question.

My Apologies for not chekcing the trail properly

Hope this is answered now 🙂

I am in Kerala and there the leading Stock broking firm is *************, will they provide these services? And what’s your advice.

No.

Dear Rajat Sharma,

I would like to know whether under LRS scheme is it allowed to invest and trade in US Equity Indices. Ex.NASDQ 100,DowJones 30 etc. I’m more interested in index trading rather than investing in stocks/mutual funds. But the RBI circular mentions in capital account transaction for only equity investment so it is not clear whether it allowed or restricted.

Short answer – yes

Investing through Interactive brokers for overseas stock trading. Are they safe ?

I am not sure. But they are popular for sure.

I used to live in US where I have bank account and trading account in TDAmeritrade. Can I still continue the trade from India? Is that Legal in India?

I give tax in US and file it there as well for the income. They said I can trade from anywhere according to US policy. But not sure how Indian policy is

Can I still hold that account and trade in US?

Please write in to me at rajat@sanasecurities.com so I can let you know the right way of doing it.

Hi,

I want to invest in a foreign start-up, is it possible to do so from India? Does NEFT remittance to foreign account allow this?

I am a US resident.Can I buy US stocks on behalf of my friend in India? What legal procedures should I follow? Is it risky?

He should open his account on his own. Whatsapp me on 9833905054, ill tell you the procedure

Hi Rajatji,

I want to start investing in US market coz March to June is very slow in US market to I can generate my wealth by investing in Dow. Kindly pls suggest how can open such trading account and with which securities. Currently have account with Axis Direct and Ventura.

I checked with KOTAK securities.

They do not provide this facility.

yes i want to open an account in u.s. how can i open

Hi want invest in mutual fund based on chinese equity market ….

Is there any way i can invest that kind of mutual fund…

Yes. Call us on 011 – 41517078

Another method is to use Hox. A global stock trading platform based on Cryptocurrency. It works in India and other regions also. The major downside is to understand the legal grounds before investing in stocks via cryptocurrency. It supports payments via Indian platforms like WazirX.

Interactive brokers provide cash account for investing overseas, but they dont provide margin account for indians so we cant trade in leveraged products (futures and options) as per the rbi rule.

Is their any way i can trade in futures overseas from india.

hi thanks for the information and posts

I am not actually here for stock market insights but I wanted to learn from you,sir about what book(s) to refer for a beginner who is new in the field of corporate laws?

I will be very delighted to receive a reply from you.

Hello rajat ji

can I apply in ipo outside India under LRS scheme

Yes

How can I obtain list of RBI approved US and other country brokers. I wish to set up brokeragae a/c. diarectly with them instead of going through Indian brokers.

I understand that some private banks are asking for Rs. one cr. portfolio with them to provide foreign stock purchase service. This is disadvantage to small investors.

Please reply. Thanks.

Naturally, there is no such list, nor need for one.

Can I open a foreign account from India and trade in US options market under LRS?

yes

How can I invest in US stock market from India with more than 250,000$ in one financial year without using ETFs or mutual funds?

I have sent you an email on this.

Thanks for the informative post, Rajat sir. I found two-three direct investing platforms that can be used to invest in USA markets.

Does the LTCG tax change which happened in 2018?

Thank you.

CAN WE WORK AS BROKER FOR FOREIGN STOCK EXCHANGES? I want to trade in Foreign Exchanges can I possible and how I remit payment. if yes, pls share me FEMA or RBI provisions if any. further, can I use a wallet payment system?

Great Blog.