- E-commerce companies around the world are running in losses;

- By any measure, E-commerce industry commands the most extreme valuations;

- Having received million in private equity funding over the years, big E-commerce companies in India are planning their IPOs;

- Most big companies in India including Amazon, Flipkart, e-Bay and Snapdeal are focusing on developing high end logistics platforms.

The increasing popularity of online shopping portals has resulted in newer business verticals and a completely new way of doing things. So far online retail companies have survived purely on Private Equity (PE) funding and must now find an exit for these PE investors.

What Led to High Valuations of E-commerce in India?

To a large extent growth in online retail could be attributed to deep discounting of products on the back of PE money. This has helped big online players in two ways –

- Driving out the traditional brick and mortal model of shops thereby creating a monopoly;

- By getting people in the habit of shopping online, before discontinuing discounts.

Naturally such discounting of products cannot go on in perpetuity. Venture capitalist and private equity investors have borne losses in the hope that these firms will turn profitable as they expand their operations. Alternatively, these funds could find an exit by selling their equity at high valuations via an IPO.

Are These High Valuations Justified?

Absolutely not.

Once these online retailers attain scale, there will be pressure from the investors to cut down on their discounts and come up with a more sustainable and profitable business model. In such a scenario will India go back to the traditional brick and mortal model? Or could logistics players jump in and start working with the traditional shop owners to procure and supply their products to the end consumer.

Also Read: Can E-commerce Boost Stock Prices of Logistic Companies

How Do E-commerce Companies like Flipkart,

Amazon and Snapdeal Make Money?

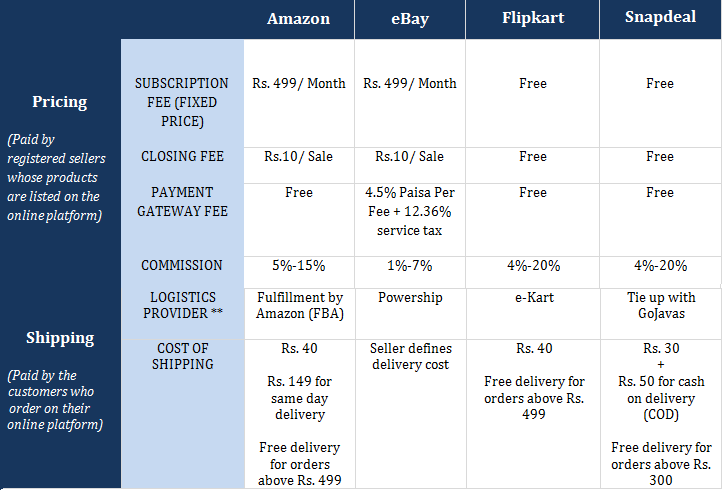

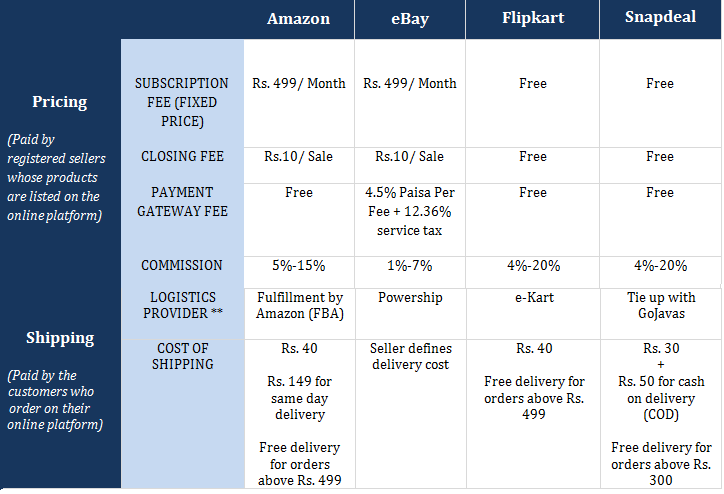

E-commerce companies make money in 2 main ways:

- Fixed Price – a fixed monthly subscription paid by the registered sellers to host their products on the platform (i.e. website) of the e-commerce company. In some cases the company also charges a fixed closing fee like 10 for every sale.

- Commission – Depending on product category, the company charges the registered seller a certain percentage commission on the value of the product sold. This commission could range between 5% – 20%.

- ** Why are E-commerce companies getting into Logistics?

The biggest advantage of getting into logistics for e-commerce players is not the back end integration as it may appear. In fact, logistics is a big source of additional revenue for these companies. They earn shipping / delivery charges directly from the customers as well as from the registered seller (for picking up and delivering the goods from the registered seller to the customer).

Deep Discounting: How Does Flipkart, Amazon and Snapdeal Manage to Sell Below The Market Price?

The justification for deep discounting of products by online retailers is often that these discounts are being offered directly by the registered seller. That the retailer just provides their website to the registered seller to offer their products.

What Really Happens:

Big online retailers like Flipkart, Amazon, SnapDeal and Junglee have cutting edge analytics capabilities and dedicated resources to compare prices of products on different websites and across stores. Based on these prices they suggest the price at which the registered seller should offer their product. This suggested price is where discounting happens.

The seller is not under any obligation to offer his products at these prices but since they get compensated for the discount element by the online retailer, there is hardly a reason for them to not offer their products at the suggested price.

How do Registered Sellers Get Compensated?

At the end of each month or quarter, the registered seller will send a debit note to the online retailer titled something like – “discounted funding bill”. This note mentions the amount of cumulative discounts at which the registered seller supplied the merchandise during the period. The online retailer can settle this balance in any way the parties decide.

In most cases this is done using the regular NEFT, RTGS or a simple cheque facility.

Nice article Rajat.

Correct me if I am wrong, but isnt this a weird kind of a pyramid scheme where the consumer actually benefits? The E-commerce people can survive only if fresh money keeps coming in since they have to reimburse the seller discounts. unless of course their logistics division makes enough money to cover this, which I doubt. In any case it is a double edged sword..

You are absolutely right when you say, new money is needed to fund discounts and to survive. Also you are right that consumers will keep benefiting (until the party lasts). Trouble is that the party will surely end somewhere.

Once the money invested in creating these online giants – the war chests given by the big PE funds run out, how exactly are discounts going to be funded? The hope is that by then, people will be shopping ‘only’ online and discounts will be discontinued. Profit making on sales can then start. Will that happen or not? I have my serious doubts, especially in a market like India.

Further, with all the buzz around online portals, everyone is likely to buy stocks in these companies once they list. More money for the company to fund more discounts….worst still….an exit option for those who provided the initial war chest.

The BIG question in everyone’s mind is What will happen when no deep discounts are offered and secondly till when will this party continue (for the consumer) at the price of brick and mortar stores (BMS).

Well, here’s my take:

In any given market, NOTHING absolutely NOTHING replaces another completely. More so in a country like India, nope…never. What I am trying to say is, IF any of these e-com players think they would be the ‘ONLY’ choice left for Indian masses and over the next few years they would replace BMS, ah…they seriously need to think again.

As of now the fight is to get eye-ball score, much like what happened in DOT COM boom/doom. The eye is on revenue without much concrete plan in place for generating profit or reach a break even atleast.

In current scenario, people think consumers are real winners, quite right, would like to add manufacturers also. Those manufacturers who earlier used to tap BMS now are selling their stuff online directly to the consumers and their revenue plus profit have shot up, but wait there’s a catch. We see X figures of sales and turnover every now and then but what about an ugly part which is nowhere shown, now what’s that?

Before I go any further, I do believe the majority of people in this world are good else we would have collapsed long back, but what about those creepy minds, people who are abusing the system, every system has loopholes and these very people use it for their advantage, how?

Mr. A buys a product online, be it clothes/white good. Uses it over the weekend or for a few days, raises a complaint (plays on customer is king), sends the item back in used/abused shape, gets his refund and does the same thing to other website and or makes a new ID and does it on same website again. There are reports already surfacing where suppliers are unhappy with these online portals.

I’ll give you a parallel example, every moth we read, the number of new subscribers are added by telecom players be is AirTel, Idea, Vodafone etc. They NEVER pulish how many left the system and got churned. The point is looking at ONLY the rising sales is a big flaw.

Coming back to where I started, once these deep discounts dry up, will masses buy online…NO. Only those who are impulsive/addictive buyers would be left and by percentage not many. In India, still people like to visit a store, touch and feel the product, bargain..can’t deny that, lots of customers service (read pampering), last but not the least lots of one to one personal attention, something which is missing in online format.

At that time, online store would be offering reward point, a few already have started that, but then is that a compelling reason to shop online, again…No. A lot many BMS been offering reward point since ages. Another example, Reliance offers loyalty card to its customers where point get added on every purchase which can be redeemed for anything across the store/different vertical. Say buy a white good at Reliance Digital and use the loyalty points at Reliance Trends.

Now when would these discounts dry up? Any time, once any of the BUBBLE market in the world collapses…do I hear China? The ride of finding a bigger fool stops after a time, always does. I fear, retail investors would get trapped for a long long time in that scenario, while PE investors would either go kaput because of bubble burst or make an exit through these upcoming IPO’s.

My 2 paisa.

🙂

All very good points Amit. I agree…

All the above comments are quite negative, very naive and absurd; not sure why people are so negative about the e-com model.

These are tech companies and can become profitable tomorrow, if they wish so. However they want to create a revolution and bring a change in customer buying patterns.

The example quoted above about Mr.A is the risk, and every business is associated with this kind of Risk and is less than 1% of their total volume.

Myself I bought more than 100,000 on these eCom websites Amazon.in, Flipkart and Snapdeal and I made a point to buy only online -forget about the brick and motor companies, they don’t offer me a choice, customer support and return policy (if I need).

One point the author is missing is these eCom tech companies are investing in many other profitable business such as finTech, logistics, etc etc; which in turn give the much required profit for long time survival.

Yeah I agree, if you take off the funding plug, these companies will collapse, but that is same for all other businesses in other areas, NBFC, Infrastucture, Pharma, Metals, Auto etc. Everyone needs funding for expansions, research etc.

Finally I suggest the author to not waste his time by writing stupid articles, instead go support these companies buy his groceries and gifts online.

🙂

Bees

I am convinced that you believe in everything you have written above. You surely sound like you do. That’s always a good thing in life…. to be convinced about what you believe. Its about your value system. I am happy for you.

I also congratulate you for buying new equipment for Rs 100,000, hope you like the stuff. I don’t think funding is going to stop for these companies. They always have a loyal base to bank on. Also, I agree with you on logistics being profitable. I did a post on that sometime back and have investments in that space. Going by your interest in this, I am sure you’d like to read – http://www.sanasecurities.com/can-e-commerce-really-boost-stocks-logistic-companies

I don’t think this article is stupid, you will learn as you grow older. I know its hard but we all went through this…. give yourself some time.

Yes I almost buy everything online, Why wouldn’t I? Its nicely discounted!

Hi Rajat,

Bud don’t take it personal, I don’t meant to put you down. Yeah I agree with you, I will learn as I grow.

Thanks

Bees

Be assured, I never take these things personally. Here is another stupid tweet on the subject:

I want to sell my Loss Making company (last 5 years losses to the tune of 24 Lacs)

Those seeking to take tax benefits in the future years may contact me for further information

E-com company has no base on which they can turn profitable in future . Sellers on Flipkart , Snapdeal or amazon are suffering loss . E-com companies itself are suffering loss . The high logistic cost , delay refund policy , high advertisement cost will always make them loss making company . Also many state government is suffering loss of VAT due to these E-com company and they are planning to impose huge entry tax on buy price .

These companies are surveying only till they are funded by private equity . They don’t have fundamental business model . They will bring down discount in future . They will bring down advertisement cost in future and their situation will be same as that of Quicker who made huge expenses on advertisement and once thy stopped advertisement , people forgot them .

Infact these companies are harming country and state economy . They are harming traditional retail business . By giving huge discount and selling product at loss , they are doing unethical trade practice and trying to shut down the small retailer shop . What will happen thereafter they never think . Remember that small retail shop is lifeline of country economy . It provides bread and butter to 30% population of India . If it is disturbed the whole country economy will be disturbed adversely . These e-com company cannot create even 2% job to India population . What will happen if e-com succeeded . New generation will forget entrepreneurship and opt for doing job only in these e-com companies .

The situation in future will be same as it is today for ‘Made in China’ product . Today China product has eaten up our manufacturing industries of India . Manufacturing industries growth is negative .Today we are requesting to stop using china product . In the same way in future these two or three giants will eat up Indian economy .

Any business model should be based on people welfare . They must be capable of loosing existing business creating new opportunity and employment , rather that doing cheap competition and behaving like big fish who is eating small fishes .

I am sure that these e-com is not going to survive in future ,but they must stop doing loss making business because they can survive even after huge loss (like 2000 crore by Flipkart ) but small retailer are not so capable . These e-com companies will end up by disturbing the whole economy . These E-com companies are suffering loss , financers to these E-com companies are also suffering loss , sellers through these e-com are also suffering loss , State Government is loosing vat revenue , local retainers business is also harmed and I am quite sure the day they bring public equities ,shareholders will also loose there capital because the valuation of these e-com companies are artificially high .

very nice and good helpful post i like your post thanks for sharing.