“One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute” – Peter Lynch

Share prices change because there is always someone willing to buy what you are selling at a certain price, if not, the trade would simply not happen. Of course, how share prices change in future is what will determine the merits of a trade and will reward the buyer / seller accordingly.

So remember, the next time you are planning to buy / sell a share, read this quote by Lynch, I bet you will think 100 times before placing that order.

The biggest reason why so much money gets lost in shares is because people jump into the share markets with little idea about how they really work. Those who are yet unclear on why Lynch would quote as above, often spend hours executing complex option strategies. On the other side of each trade is usually someone who has spent a lifetime sharpening his skills and training his psyche to undertake such activities. He is confident of what he is doing. Often intelligent, well connected, and conscious that he will be executing trades for a very long time in future.

As share prices change, money also (regularly) changes hands between market participants and it’s not hard to guess which way it flows in a scenario like the one above. The perception this causes is such that the average person starts viewing the stock market as a place for legalized gambling, where every morning people place bets and win or lose small or big amounts of money. The truth is that this is exactly what seems to be happening for many of them. At least until they get tired of betting.

Fortunately or unfortunately – once listed, how share prices change is BASED PURELY ON THE DEMAND AND SUPPLY OF SHARES. When more people demand a share, its price moves, when more people sell it, its price moves down. This demand and supply establishes an equilibrium price which is where the share trades. It is a rather simple mechanism, though one frequently overlooked:‘Price of a share changes because of the demand and supply pressure on the share and ‘FOR ABSOLUTELY NO OTHER REASON’.

If for absolutely no reason, a few of us got together and started buying a large number of shares in a loss making company, the share price of such company could indeed rise dramatically.

How share prices change – discovering the ‘Equilibrium Price’

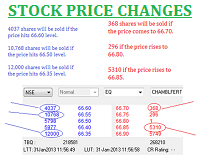

I don’t want to get into any technical aspects but it may be helpful to understand the concept of equilibrium price. In stock markets you can see this equilibrium price being created by the demand and supply pressure on shares. Look at the screenshot of this company’s shares trading on the exchange.

Buyers and sellers have entered their bids at prices at which they will be willing to buy and sell the disclosed quantity of shares. In addition to the pre-entered bids, you can also buy in the open market. So for example if you place an order for 10,000 shares at the market price of Rs. 66.65, instead of entering a price limit bid, the market will quickly buy 10,000 shares at whatever price they are available. In the above example, you will end up buying the lots of 368, 296, 1, 5310 (circled in red) and a part of the lot of 5,749 (i.e. until you get 10,000 shares). This will disturb the equilibrium because the price will suddenly shoot up to Rs. 66.90 levels. When it finds no buyers at those levels, it will come down gradually to wherever it finds buying and selling equilibrium.

It is important to keep in mind that while buying and selling (or demand and supply) of shares should be based on reasons such as growth prospects of the company, an estimation of corporate profits in future, success of company’s products and other such business reasons; even if buying and selling happens for no reason at all, it will still have the same effect on the share price. Stock market operators and manipulators regularly indulge in such aggressive buying and selling to give the impression that something big is afoot. The idea often is to bring in more investors to buy a sharply rising share. Once the price of the share rises substantially, the operators sell their entire holding and exit with a handsome profit.

There can be many reasons why some people lose money in the stock market. I too agree that the biggest reason is they buy high and sell low.

This post is good answer to Why do people lose money in stocks. Your tips to Avoid Losing, is helpful.

It will be worth adding some points:

Steps to Avoid Losing

*Take Emotions Out of the Equation

*Never Invest more than 4% of your capital in any one position

*Do not Be An Action Junkie

Thanks!

Yes Sumit. I agree with taking emotions out a 100 %. I did write a post on that aspect a few days back. Here is a link to that:

http://www.blog.sanasecurities.com/what-do-you-need-to-be-successful-stock-investor/

Hope you like it!

Very helpful. I always wanted to understand how this works.

Thanks.

VERY USEFULL THX FOR WRITING SUCH GOOD BLOGS

Dear Sir,

Request you to please explain, How circuit levels determined for intraday in stocks. what is the calculation for upper circuit levels and lower circuit levels.

Thanks

Pritesh

Sir,no company pay directly any money to shareholders then, why during trading people increase the demand of share to buy by seeing company’s performance or profit?

What is the benefit of company’s growth?why company’s growth affects demand and supply

Sometimes,they pay dividend but generally not.