Every quarter, there is a buzz around whether the RBI will cut or increase the interest rate. The RBI decides interest rate periodically and takes decisions whether to hike/slash the rate or leave it unchanged. The central bank’s monetary policy committee’s decision could impact liquidity and inflation in the Indian economy.

RBI Decides Interest Rate – Deciding Interest Rate Trajectory

There are three defined approaches to interest rate policy: (1) accommodative, which means the RBI has a preference for lower interest rates to help the growth of the economy; (2) hawkish, which means the preference is to have relatively higher interest rates to slow down growth and contain inflation; and (c) the one in between, i.e., neutral.

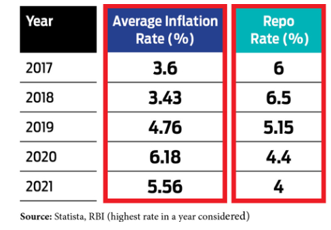

The most important factor that helps RBI in deciding interest rate is inflation. The rate and inflation have an inverse relationship. If the rate is increased, it will bring down inflation and if the rate is lowered, inflation will go up. Thus, the repo rate becomes very important tool for the RBI to control inflation trends.

“Interest rate is basically a percentage of the principal that the lender charges from the borrower for the money lent. From savings bank interest to interest on loans, these rates are very crucial for the economy. Interest rates play a vital role in the economic development of a country, they significantly influence the stock prices and other investment decisions.”

Relationship between Inflation and Interest Rates – When the inflation rate fluctuates, the RBI enters into action and makes changes in the interest rates to control the inflation. Inflation affects price of goods and services and price stability is very much needed for a healthy economy. Considering this interest rate is decided. As to control inflation interest rate needed to change after a regular interval to maintain a healthy economy.

Effect of Increase

| Inflation | Interest Rate |

| If Inflation increase, interest rate decrease | If the interest rate increase, inflation decrease |

| Money Circulation in the market increase | Money Circulation in the market decrease |

| Borrowing became cheap | Borrowing became expensive |

| Demand for goods & service increase | Demand for goods & service decrease |

| Inflation leads to rise in the price of services and goods | Interest rate increase leads to a fall in the price of services and goods |

Effect of Decrease

| Inflation | Interest Rate |

| If Inflation decreases, interest rate increase | If the interest rate decrease, inflation increase |

| Money Circulation in the market decrease | Money Circulation in the market increase |

| Borrowing became expensive | Borrowing became cheap |

| Demand for goods & service decrease | Demand for goods & service increase |

| Inflation decrease leads to fall in the price of services and goods | Interest rate decrease leads to a rise in the price of services and goods |

How Do Repo Rates Affect Inflation? – RBI last changed the rates in December 2020. Since then, the repo rate has been kept unchanged at 4% and reverse repo at 3.35%, but the inflation rate has changed drastically over the past one year.

How Lower Rate Benefits the Individuals – It reduces your interest rates which means you pay a lesser amount of interest. This brings down the overall cost of your loan. In Dec 2021, RBI Governor Shaktikanta Das kept repo rate unchanged at 4%. This is the ninth consecutive time that the RBI maintained status quo amid current uncertainties. The unchanged repo rates will help maintain status quo on the prevailing low interest rate regime for some more time. This works well for all loan borrowers as the environment of affordability will continue.

To conclude:

Interest rates drive inflation in the opposite direction. Higher interest rates reduce inflation whereas lower interest rates lead to a rise in inflation. The right amount of inflation is good for the economy. RBI controls the interest rates via monetary policy using various measures such as reducing or increasing policy rates, conducting open market operations, etc.