Of course, the price of derivatives (including futures and options) has a major impact on the price of the underlying share (and vice versa). How can you as a trader benefit from this co-relation has been the subject of many books and much research work. While it is not important to trade on this basis, it is imperative to understand this relationship and how the price of futures and options affects the price of the underlying share.

Just to understand a basic cash-future spread in the simplest form, consider the example below:

Reliance Industries (RIL) share is trading at a price of Rs. 891 per share on 26 March 2014. At the same time, its one month future contract (expiring 24 April 2014) is trading at Rs. 900 (real prices taken as on 26 March 2014).

How you could make money on this trade – buy 250 shares (equivalent to 1 lot of RIL) at Rs. 891, and simultaneously sell the one month future contract (expiring 24 April 2014) at Rs. 900. Hold on to both positions until expiry (i.e. 24 April 2014) and you will make a risk free profit of Rs. 2,250/- irrespective of the future movement in Reliance’s share price.

How this works –

Purchase price of 250 shares – 250 * 891 = 2,22,750/-

Margin amount deposited to sell 1 lot @ Rs. 900 = 35,438/- (margin requirement being 15.75%)

Total capital deployed – 2,58,188/-

On the 24 April 2014, irrespective of where the price of Reliance Industries share settle, you will make a profit of Rs. 9 per share (i.e. Rs. 9*250=2,250/-).

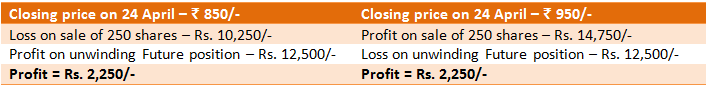

To understand this with 2 hypothetical prices look at the table below:

Irrespective of where the price settles on expiry, you will make this profit of Rs. 9 per share which you locked in on the day you entered into this trade.

See this page for a – list of option trading strategies.

It sure sounds tempting to get into this cash future arbitrage and it is indeed a rewarding area of work but keep in mind that while the rates above were true on the day (i.e. 26 March 2014), you do not often find such major spreads. I can tell you as a few of us at our office are constantly monitoring these spreads. Secondly, earning Rs. 2,250/- on an investment amount of Rs. 2,58,188/- in a month translates to approximately 1% return in the month (or 12% per annum). Given that some risk free bonds pay as high as 8-11%, I don’t think there is anything special in executing such complex orders with an aim to make a similar return.

__________________

So how exactly does the pricing of futures and options affect share prices?

Arbitrageurs are constantly looking for these spreads and every time they get an opportunity to make risk free profits, they place parallel orders in the two markets (like above). This brings the prices in the two segments (i.e. derivative and cash segment) closer to each other.

What if?

An investor (or institution) with a large fund at its disposal buys certain lots in the futures market and then starts buying shares in the cash market (i.e. taking delivery). Would then, the arbitrageurs jump in to take advantage of the large spread which get created due to random buying in the cash market?

. . . and when that happens, would it not drive the future prices higher? Think about it.

__________________