Note: The explanation below is based the basis of inclusion of stocks in the BSE Sensex and the Nifty 50.

Composition of a stock market index such as the S&P BSE Sensex (“Sensex”), S&P Nifty 50 (“Nifty”), the Bank Nifty etc is not constant. You must have come across a news item like – “NMDC and IndusInd Bank will replace Wipro and Siemens in the 50-share Nifty index”. Ever wonder the basis on which these stocks are selected – added or excluded from an index?

Stock Market Index – Meaning

A stock market index is a basket of stocks reflective of an industry, sector or the entire market itself. It is a selection of stocks put together in a basket with a weighted average of their aggregate prices being tracked as one. This cumulative price reflects the state of the underlying class of stocks. So for example the S&P BSE Sensex (or the 30 stock Sensex) is tracked widely by institutions and FIIs and is often called the true reflection of the Indian stock markets. It is the weighted average of 30 well established and financially sound stocks drawn from different industrial sectors of the Indian economy.

Basis of Inclusion in the Index

Every six months, the constituents of the Nifty and Sensex are reviewed, leading to replacement of some stocks.

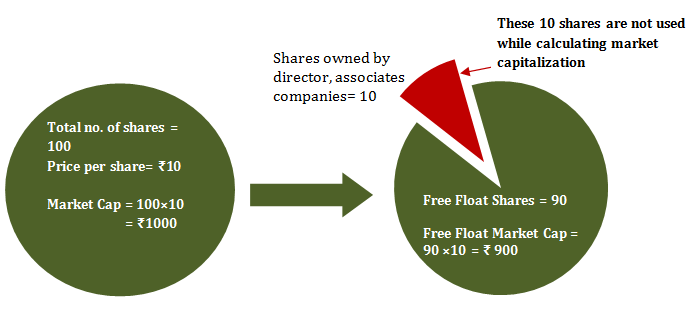

- Free float and the Investable Weight Factor (IWF): Free float is a measure based on the number shares that are readily available for trading. To explain in plain English – floating stock is a term used for stocks which are not held by company’s promoters or associated entities, and hence they are freely available for day-to-day trading. For a company to qualify for inclusion in the NSE/BSE index, it should have an investable weight factor (IWF) of at least 10 %.

IWF is a unit of floating stock expressed in terms of the number of shares available for trading and which is not held by the entities having strategic interest in a company. Let’s assume that Company ABC has total shares outstanding = 1,00,00,000. Higher IWF mean greater number of shares held by the public.

| Shares | % | |

| Shareholding of promoter and promoter group | 20,00,000 | 20.00 |

| Government holding in the capacity of strategic investor | 25,000 | 0.25 |

| Shares held by promoters through ADR/GDRs. | 2,75,000 | 2.75 |

| Equity held by associate/group companies (cross-holdings) | 37,575 | 0.38 |

| Employee Welfare Trusts | 1,20,987 | 1.21 |

| Shares under lock-in category | 14,53,500 | 14.54 |

IWF = [1,00,00,000 – (20,00,000+25,000+2,75,000+37,575+1,20,987+14,53,500)] / 1,00,00,000

= 0.608794 or 60.88%

- Market capitalization: A stock is eligible for inclusion in the index if its last six months average market capitalization has been Rs. 500 Cr. or more. The selected securities are given weights in proportion to their market capitalization.

- Trading Frequency: The stock should have been traded on each and every trading day in the last three months. Exceptions can be made for extreme reasons like suspension of the stock etc.

- Listing criterion: A company should have a minimum listing history of 6 months for inclusion. However, a company that is newly listed can be included in the index if it fulfills the first three criteria over a three-month period.

- Liquidity: Liquidity is defined as the cost of executing a transaction in a given stock which is measured by calculating the ‘market impact cost’ of a stock. The cost does not include fixed costs typically incurred like brokerage, transaction charges, depository charges etc.

Impact cost is based on the percentage mark-up (or down) that take place when buying / selling the desired quantity of a stock with reference to its ideal price (best buy + best sell) / 2.

Example:

| ORDER BOOK SNAPSHOT | |||

| Buy Quantity | Buy Price | Sell Quantity | Sell Price |

| 1000 | 98 | 1000 | 99 |

| 2000 | 97 | 1500 | 100 |

| 1000 | 96 | 1000 | 101 |

To Buy 1500 Shares =

Ideal Price = (99 + 98)/2 = 98.50

Actual Buy Price = [(1000×99) + (500×100)]/1500 = 99.33

Impact Cost = [(99.33-98.50)/98.50] × 100

= 0.84%

The higher the impact cost, the bigger the transaction cost. For a stock to qualify for possible inclusion into the index, it should have traded at an average impact cost of 0.50 % or less during the last six months.

The idea behind having liquidity as a factor for inclusion in the stock market index is to ensure that the stock does not spike up or down upon buying or selling of a small quantity.

Other Criteria

- Number of Trades: The script should be among the top 150 listed companies by the average number of trades per day for the last one year.

- Value of Shares Traded: The script should be among the top 150 listed companies by the average value of shares traded per day for the last one year.

- Industry Representation: Script selection would take into account a balanced representation of the listed companies from amongst various industry sectors. The index companies should be leaders in their industry.

- Track Record: To be eligible the companies must have reported positive revenues in the last four quarters from their core activities.

Final Selection and Inclusion in The Stock Market Index

A complete list of eligible companies meeting the above criteria is complied. Based on this list, the top ranking companies form a replacement pool. The top stocks are then identified for inclusion in the index from the replacement pool by assigning 75% weightage to the rank on the basis of:

a) Three-month average full market capitalization; and

b) 25% weightage to the liquidity rank; based on three-month average daily turnover & three-month average impact cost.