Recently I met a client whose portfolio consisted of 34 mutual funds. That was my inspiration for an earlier post, here – Top 6 Investing Mistakes of All Times

Since the time I’ve started helping people with mutual fund investments, a few of the questions that have been asked of me again (and again), relate to:

- – Best Mutual Fund to do an SIP in?

- – How many Mutual Funds Should I buy?

- – The difference between debt / equity / hybrid etc type of mutual funds.

I have written much about the 1st and 3rd. In this post, I will address the 2nd type of questions.

Short Answer – 4 if you are not happy with 2 or 3.

Long Answer

There can never be one size fit all approach for this aspect.

How many mutual funds you own should depends on many factors including your

(i) Age;

(ii) Goals, i.e. how long will you stay invested to achieve your goal of investing in the fund; and most importantly on;

(iii) The Type Of Investor You Are

TYPE OF INVESTOR

What percentages of your savings / investments are deployed in mutual funds?

The answer to the above question is critical. Think about a 35 year old businessman who actively invests in stocks, PPF and real estate Vs. A 35 year old employee who does a majority of his investments in mutual funds.

Being goal specific is a good way to get around this problem.

Being Goal Specific

No matter what category / type of investor you are, you should plan your portfolio allocation with a set goal in mind.

Step 1: GOAL– I will need Rs. 20 lacs by the year 2020.

Step 2: – Define how much you can invest today or systematically over the next 4 years.

Step 3: – Fund Selection

Your fund selection could be aggressive (high risk – high reward funds) moderate (combination of various funds) or conservative (low risk funds) based on the type of investor you are. In other words, how much money will you be able to pull from other sources in case your portfolio of funds fails to deliver the desired return over the next 4 years. A good investment advisor will focus on all these aspects before coming up with an ideal portfolio.

In most cases 3 funds is good enough (if you can’t get it right with 3, you are most likely to get it wrong with 30!). The only time I would recommend buying 4 (or more) funds would be if an investor for some reason wants to invest in a gold or real estate fund.

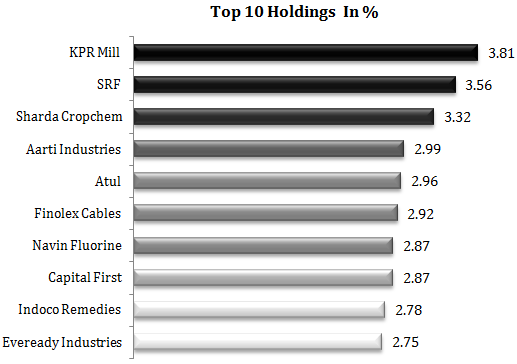

IDEAL PORTFOLIO ALLOCATION – FOR MODERATE INVESTOR (AS ON 6TH April 2016)

The portfolio allocation below was done for a 36 year old professional whose goal was to earn at 15 -18% p.a. over the next 4 years. He invested a lumpsum amount of Rs. 2,00,000 in each of the funds below and started 3 SIPs of Rs. 10,000 in each. In addition, the client invests Rs. 1,50,000 each year in his PPF account and owns a house.

Given the age and risk profile of the client, I would have liked to replace ICICI Regular Savings Fund with another equity fund from the large cap space for the next 2 years.

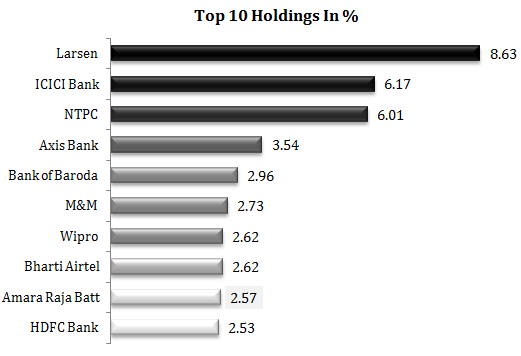

ICICI Prudential Value Discovery Fund

For latest allocation and holding visit here

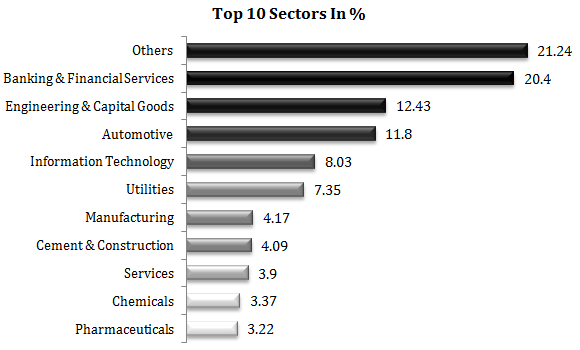

ICICI Prudential Value Discovery Fund Performance v/s S&P BSE 500 Index (Returns In %)

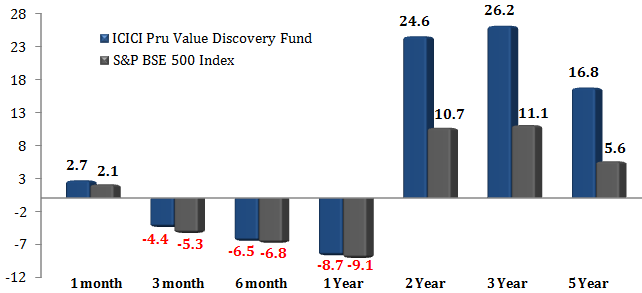

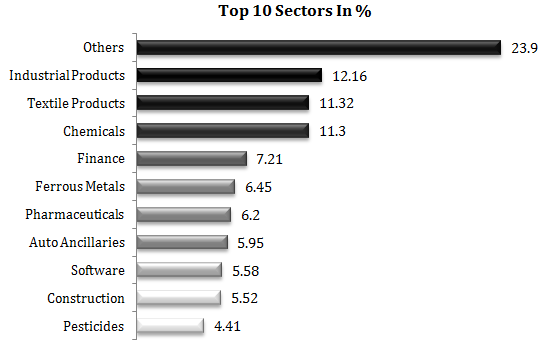

DSP Blackrock Micro Cap Fund

For latest allocation and holding visit here

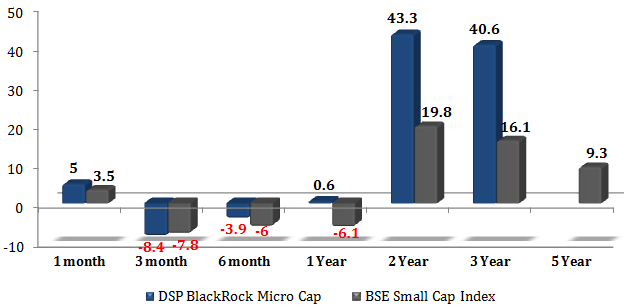

DSP BlackRock Micro Fund Performance v/s BSE Small Cap Index (Returns In %)

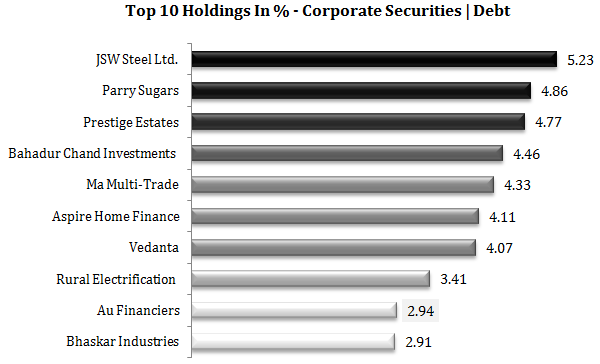

ICICI Prudential Regular Savings Fund

For latest allocation and holding visit here

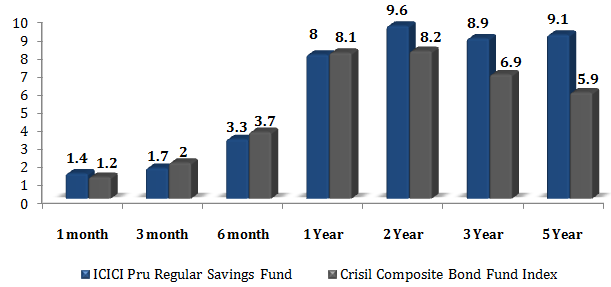

ICICI Prudential Regular Savings Fund Performance v/s Crisil Composite Bond Fund Index (Returns In %)

*Note – Portfolio holdings in this article is as of 29th February 2016

Since Pharma is a beaten down sector now a days. Can you also advise if you have looked into any Pharma MF which is good to enter now.

Subscribe and post your question.