From early 2016, investors will be able to buy mutual funds online via e-commerce websites (such as Flipkart, Snapdeal, Amazon etc). Securities & Exchange Board in India (SEBI) is considering introducing a third category of mutual funds called online mutual fund plans, which can be sold through e-commerce websites. This is likely to help both, Asset Management Companies (AMCs) and investors as it will not only simplify the process but will also bring down selling expenses.

Currently, mutual fund schemes are sold under 2 plans – DIRECT and REGULAR.

Difference between Direct and Regular Plan

Regular Plan: Until January 2013, mutual funds were sold mainly by third party distributors who charged very high commission rates, often as high as 5%.

Direct plan was introduced by SEBI in January 2013 to help investors earn higher returns by doing away all distribution commissions. Investors under this plan can invest directly with AMCs.

Regular plan is suitable for investors who may not be sophisticated enough to invest in mutual funds on their own and may need the help of an educated distributor to explain key features of various funds. These days however, with so much knowledge available on the internet, for tech savvy investors, the regular plan makes little sense.

Also see: Various types of mutual funds.

Expense Ratio

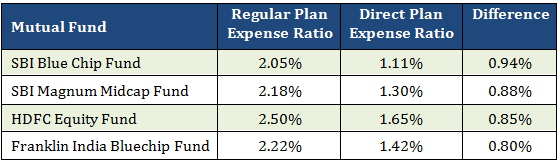

The direct plan has a lower expense ratio (by 0.70%-1.00%) as compared to regular plans in the same schemes since there is no commission to be paid to the distributor under the direct plan.

Note: According to regulation 52 of SEBI Mutual Fund Regulations, there are limits on the total expense ratio (which includes investment management and advisory fees) charged by mutual fund schemes. Accordingly, equity mutual funds can charge maximum of 2.50% every year to its unit holders while debt funds can charge 2.25 %.

Before, SEBI (Mutual Funds) (Second Amendment) Regulations, 2012, there was also an internal limits on these expenses. Mutual funds had to allocate a maximum of 1.25 % as management fee and 1.25 % as other expenses incurred by the AMC for marketing, distribution etc.

But after the regulation, SEBI has removed the sub-limits on expenses, giving AMCs the freedom to allocate the 2.50 % expense ratio the way they want to. What this means is that mutual fund companies are now incentivized to cut all middlemen (i.e. distributors) to try and earn the maximum of the 2.5% they are allowed to charge.

Following table from HDFC Equity Fund (Regular) explains the charges included in expense ratio of a fund on an annual basis.

| Expense Head | HDFC Equity Fund |

| Recurring expenses permissible under Regulation 52(6)(c)(i) | |

| (a) Investment Management and Advisory Fees | 1.25% |

| (b) Expenses | |

| – Trustee Fees | 0.10% |

| – Audit Fees | 0.01% |

| – Custodian Fees | 0.01% |

| – Registrar & Transfer Agent Fees | 0.15% |

| Marketing and selling Expenses including Agents Commission and statutory Advertisement and Brokerage & Transaction Cost pertaining to the distribution of units | 0.75% |

| Cost related to investor communications and Cost of fund Transfer from location to location | 0.15% |

| – Other expenses | 0.08% |

| Total recurring expenses | 2.50% |

Source: http://www.hdfcfund.com/

- Different NAVs

Different expense structure for direct and regular plans result in different NAVs for both plans.

Though the portfolio for the regular and direct plans is same, the NAV for the direct plan is higher than regular plan due to lower expense ratio. For example, NAV for HDFC Equity Fund – (Dividend), DIRECT PLAN is Rs. 53.03 and NAV for HDFC Equity Fund – (Dividend), REGULAR PLAN Rs. 51.79. **As of 1 December 2015

- Investors Suitability

Direct plans are best suited for investors who have good knowledge on mutual funds and can research on their own and then save costs by investing in direct plans of mutual fund schemes.

But, investors who require assistance in selecting funds may be better off going through the regular channel of distributors. Distributors get commissions on every purchase you make through them.

Third Category of Mutual Funds – Online Mutual Fund Plans

SEBI will soon be introducing another plan – online plan to automate the whole process of mutual fund sales including e-KYC (Know Your Customer) with the intention to reduce the cost of buying mutual fund schemes.

Going forward, we will have 3 kinds of plans and 3 kinds of NAV.

Types of Mutual Funds That Can Be Sold Online

It is widely believed that in the initial stage, SEBI is likely to allow sale of simple mutual fund products like the balanced (hybrid) funds to be sold through e-commerce sites.

Process of Selling Online Mutual Fund

E-commerce sites will dedicate a page where various funds will be hosted. Investors can go to the e-commerce website or the app and can buy mutual funds just like they buy other goods on the site.

The purchase amount will get debited immediately from investor’s bank account through net banking or via debit card and the investor will be allotted the appropriate number of units.

No Need for In Person Verification

Fund houses and other intermediaries already sell mutual funds online, but the documentation process is done physically, which adds to their cost. Under the new plan, there will be no need for in-person verification. Everything will be done online – Aadhaar linked KYC (eKYC).

Note – None of the above has been finalized as yet and SEBI is yet to issue proper guidelines with regard to online mutual fund distribution. We will update this post, as soon as more updates become available.

Effect on Mutual Fund Distribution Commission and Expenses

2 types of Commissions

- Upfront Fees – This is what the mutual funds pay directly to the distributors at the time that they get fresh investments,

- Trail Fees – This is what the mutual funds pay to distributors for as long as the investor stay invested.

Selling mutual funds on e-commerce websites will help the investor by reducing the distribution commission associated which has now been set at 1% by SEBI. UNDER THE NEW PLAN, DISTRIBUTION COMMISSION (including trail) IS EXPECTED TO BE AROUND 0.5 % TO BE PAID BY THE FUND HOUSE/ INVESTOR DIRECTLY TO THE E-COMMERCE PLATFORM VIA WHICH THE SALE TAKES PLACE.

The BIG Problem Related to Buying Online Mutual Fund

Absence of Help in Selecting Right Mutual Funds – If Investors were to buy mutual funds from e-commerce website, they will still need guidance from someone who understands the product. This will be a challenge for most big e-commerce players, who may have to set up dedicated units of financial advisers to deal with client queries.

Why would investors use big e-commerce players like Flipkart, Amazon etc to purchase mutual funds when so many investment advisers are available online to advice them in this regard. Not only are these advisers more educated about the nuances of mutual fund products but may also be relatively inexpensive. Financial advisory and consulting firms are likely to continue having an edge over these e-commerce websites.

It is true that Direct plans have lesser expense ratio. But some fund houses just reduces a marginal % only for direct plans (example PPFAS Long term Value Fund). Requested the reason but no reply.

Hi

That was an excellent article. It gave a clear picture about the categories of mutual fund investment. I just wanted to know which is the best way to invest mutual funds?

Thanks for that. Please Write in to me at rajat@sanasecurities.com

Nice blog for online mutual fund investment.