IIFL Wealth Management Limited (“IIFL Wealth” or the “Company”) is one of the fastest-growing private wealth management firms in India with an AUM greater than USD 33 billion. The Company serves the highly specialized and sophisticated needs of high net worth and ultra-high net worth individuals, affluent families, family offices and institutional clients through a comprehensive range of tailored wealth management solutions.

[1] IIFL-ONE – IIFL-ONE institutionalizes a range of investment options for clients under a transparent “All-in-fee” structure. Under IIFL-ONE, HNI clients will be offered institutional-grade portfolio management processes and portfolio discipline for their personal portfolios at very competitive and transparent all-in-fee, coupled with host of privileges like access to preferred lending terms, wealth structuring and estate planning services.

[2] Lending Solutions – IIFL Wealth Prime Limited is an NBFC registered with the RBI, and a 100% subsidiary of IIFL Wealth Management Limited. The Company offers a range of lending solutions to its clients across the spectrum of structured leverage. Its loan book (₹3,620 Cr.) as on 31st March 2021 makes it the leading NBFC in India by asset size in the wealth management industry.

[3] Investment Products – The Company offers cutting-edge innovation-led product offerings.

[4] Estate Planning – IIFL Investment Adviser and Trustee Services Ltd (IIFL IATSL) has been assisting families in planning succession of their financial assets, immovable assets, jewelry, art and artefacts. IIFL IATSL has wide range of experience in giving solutions to families with various objectives:

- Promoter Business Ownership

- Joint family businesses with three generations actively involved

- Ring fencing of personal assets against business risks

- Global family requirements

- Family having children with special needs

Financial Performance

| Particulars | FY18 | FY19 | FY20 | FY21 |

| Revenue (In Rs. Cr.) | 1,714.81 | 1,577.19 | 1,527.48 | 1,659.02 |

| Growth | – | -8.03% | -3.15% | 8.61% |

| EBITDA (In Rs. Cr.) | 1,062.45 | 986.50 | 829.02 | 941.44 |

| EBITDA Margin | 61.96% | 62.55% | 54.27% | 56.75% |

| EBIT (In Rs. Cr.) | 1,048.84 | 964.99 | 788.00 | 898.47 |

| EBIT Margin | 61.16% | 61.18% | 51.59% | 54.16% |

| PBT (In Rs. Cr.) | 490.08 | 537.93 | 286.42 | 484.92 |

| PAT (In Rs. Cr.) | 380.17 | 374.55 | 201.16 | 369.19 |

| PAT Margin | 22.17% | 23.75% | 13.17% | 22.25% |

| EPS (In Rs.) | 43.23 | 42.59 | 22.87 | 41.98 |

| EPS Growth Rate | – | -1.48% | -46.29% | 83.53% |

| Historic P/E (Closing Price of 31st March) | – | – | 44.95 | 26.98 |

| CURRENT P/E | 35.91 | |||

| CURRENT PE/ROE | 2.75 | |||

| CURRENT P/B | 5.09 | |||

| D/E | 3.74 | 2.10 | 2.95 | 1.60 |

| PE/ROE | – | – | 6.69 | 2.07 |

| P/B | – | 4.09 | 3.14 | 5.09 |

| EV/Sales | 3.63 | 11.24 | 11.16 | 10.92 |

| EV/EBITDA | 5.86 | 17.97 | 20.56 | 19.24 |

| Interest Coverage | 1.90 | 2.31 | 1.65 | 2.28 |

| ROCE | 11.88% | 10.69% | 6.66% | 12.24% |

| ROE | 20.41% | 12.87% | 6.72% | 13.06% |

Quarterly Performance

| Quarterly Results | Q1 FY 2021 | Q2 FY 2021 | Q3 FY 2021 | Q4 FY 2021 | Q1 FY 2022 | TTM | Q-o-Q % | Y-o-Y % |

| Revenue

(In Rs. Cr.) |

349.46 | 387.43 | 454.73 | 420.00 | 382.55 | 1,644.71 | -8.92% | 9.47% |

| EBITDA

(In Rs. Cr.) |

214.49 | 223.32 | 232.31 | 223.94 | 209.77 | 889.34 | -6.33% | -2.20% |

| EBITDA Margin | 61.38% | 57.64% | 51.09% | 53.32% | 54.83% | |||

| PAT

(In Rs. Cr.) |

82.27 | 87.13 | 96.48 | 103.30 | 116.85 | 403.76 | 13.12% | 42.03% |

| PAT Margin | 23.54% | 22.49% | 21.22% | 24.60% | 30.55% | |||

| EPS (In Rs.) | 9.34 | 9.87 | 10.93 | 11.64 | 13.12 | 45.56 | 12.71% | 40.47% |

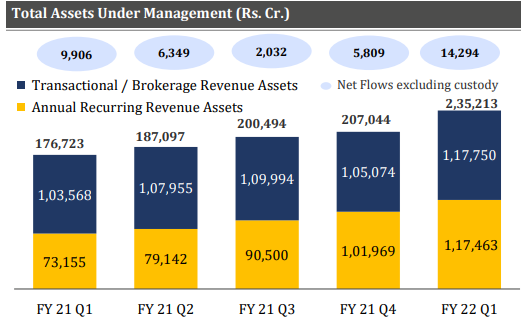

- Total AUM is up 33.1% YoY for Q1 FY22 and up 13.6% QoQ

- Continued focus on Annual Recurring Revenue assets – Increase of 15.2 % QoQ

- Net flows remained strong for Q1 FY22, up 146.1% QoQ

- Annual Recurring Revenues increased 19% QoQ

INVESTMENT RATIONALE

Strong Track Record

IIFL Wealth is one of the leaders in private wealth management firms in India with consolidated AUM of Rs. 2,07,044 Cr. having presence in 7 countries with 29 offices across the globe with employee strength of 900+ employees as on March 31, 2021. As on June 30, 2021, the AUM (gross) increased to Rs. 2,35,213 Cr. The Company serves highly specialized and sophisticated needs of high net worth and ultrahigh net worth individuals, affluent families, family offices and institutional clients through a comprehensive range of tailored wealth and asset management solutions.

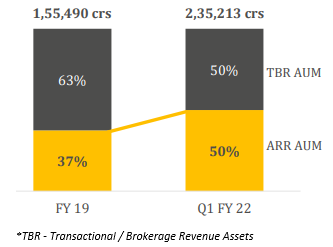

Sustained Progress on Business Model Change

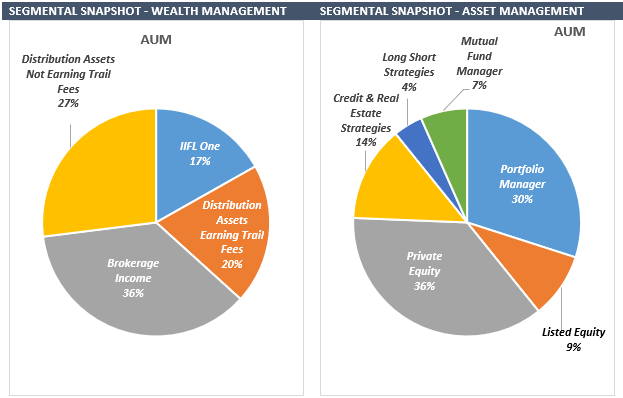

In 2019, the Company initiated the change in its business model, moving towards recurring revenues across all its business lines. The plan was to move towards 70-75% of revenues from ARR over 3 years – the Company is well headed towards the same. At 27 months, it has achieved a key milestone – ARR assets account for 50% of its total AUM and recurring revenues share is 67% for Q1 FY 2022 (of revenue from operations).

Strong Institutional Shareholding

The Company is backed by strong institutional shareholders with ability to raise capital from time to time. As on June 30, 2021, 21.17% of the shareholding was held by General Atlantic, 13.75% was held by Fairfax, promoters held 22.9%, public shareholding was 15.8% whereas other institutions held 21.6%. The Company is backed by these marquee investors which further gives it an advantage to raise debt in the capital market.

Comfortable Asset Quality

IWPL, a 100% subsidiary of IIFL Wealth, provides loans against securities and had a loan book of Rs. 2,836 Cr. These loans are largely to the clients of the wealth management business and are sourced by the wealth relationship managers. The loan book accounted for ~2% of the wealth management AUM and is expected to remain within ~3-4% of the AUM. The reported asset quality indicators remain comfortable with gross and net NPAs of 0% and zero credit losses since inception.

The Company has strong market position and established business franchise in the wealth management, distribution and advisory business in India along with a long-standing track record. The Company demonstrated ability to raise capital from marquee investors, comfortable liquidity profile, and healthy capitalization with comfortable gearing ratios. With IIFL ONE, the Company is looking to change the way wealth management is offered in India. Traction in ARR assets and IIFL ONE, in particular, remains healthy. Over the last two quarters, net flows have been encouraging.