India Glycols Limited (“India Glycols” or the “Company”) is a leading company that manufactures specialty chemicals, natural gums, spirits, industrial gases, sugar and nutraceuticals.

What’s Positive for the Stock?

Well Diversified Business

The Company operates in 5 Business Divisions

[1] Chemicals – includes glycols, ethoxylates, performance chemicals, glycol ethers and acetates. The entire chemicals basket can be classified into two parts — Monoethylene Glycol (MEG) and Ethylene Oxide Derivative (EOD).

- MEG is used in the manufacture of polyester yarn, fibre, and as an automobile coolant.

- EOD meets the diversified needs of various end-use industries such as textile, pharmaceutical, personal care, emulsion polymerisation, paint, detergent, automotive, agrochemical and other industries.

| Sub division | Capacity |

| Ethylene glycols | 175,000 MTPA (million ton per annum) |

| Ethoxylates and polyethylene glycols | 70,000 MTPA |

| Glycol ethers and acetates | 70,000 MTPA |

| Performance chemicals | 35,000MTPA |

[2] Industrial Gases- manufactures 24,000 MTPA of liquid oxygen including medical oxygen, 1,600 MTPA of liquid nitrogen and 3,300 MTPA of liquid argon. These industrial gases are used in manufacturing/ servicing air conditioners, refrigerators, hospitals etc.

[3] Ennature Biopharma – specializes in the development and manufacture of natural active pharmaceutical ingredients (APIs), nutraceuticals, natural food colours, standardized herbal extracts and spice extracts for the beverage, dietary supplement, pharmaceutical and cosmeceutical industries. This division has an integrated, multi-process-centric manufacturing set-up of 100,000 square feet, which can process about 2,500MT of raw material per annum.

[4] Natural gums – guar based products are mainly produced for food, oil & gas and textile industries. The Company started operations in 2001 with a capacity to produce 7000 MT of guar gum powder per annum. Today the capacity has been scaled to 36000 MT.

[5] Spirits – The Company has a strong presence in the semi premium, regular and prestige segments within the whisky, rum, brandy, vodka and gin. The Company has 3 state-of-the-art distilleries in Kashipur (Uttarakhand), Gorakhpur (Uttar Pradesh) and Todarpur (Saharanpur, Uttar Pradesh) with a total distillery capacity of 280,000 KLPA.

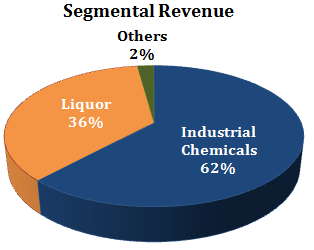

- Industrial Chemicals Segment comprises Glycols, Specialty Chemicals, Natural Gum and other related goods etc.

- Liquor Segment comprises manufacture and sale of Ethyl Alcohol

- Others primarily include Herbal Products and Rental.

Competitive Advantage

The Company is the largest manufacturer of Bio-Mono Ethylene Glycol (Bio-MEG) in the world made out of renewable feedstock i.e. Molasses and Ethanol. This helps the Company to generate better margins as compared to players producing MEG through petrochemicals route which is dependent on crude oil prices. MEG produced from molasses gives approximately 20% cost advantage to India Glycols. The Company’s division is capable of manufacturing 175,000 MTPA of finished products.

Bio-MEG has an application in making PET bottles, which is used for packaging of beverage products and polyester film.

Nationwide Distribution Network | Flourishing Export Market

India Glycols has nationwide distribution channel that comprises distribution in various industries such as agrochemicals, automotives, healthcare, food processing, mining, oil and gas, paper, personal care, pharmaceutical, paints, and textiles. The Company exports to over 65 countries, primarily in South East Asia, Middle East, Europe, and America’s. In FY 2016, exports contributed about 27%, i.e. Rs. 872.95 Cr. to the total revenue. The Company expects healthy growth in exports over the coming years, especially from Ennature bio-Pharma division.

Growing Presence in Ennature Bio-Pharma Division

India Glycols has become a qualified supplier to many large conglomerates worldwide for natural colors, nutraceuticals, health supplements and plant based Active Pharmaceuticals Ingredients (APIs). Over the years, the Company has established its name as a quality manufacturer and supplier with stringent quality control and quality assurance controls in place.

During FY 2016, as a result of taking several initiatives for improving functioning of the division, sales value of Ennature Bio-Pharma division increased to Rs. 79 Cr. as compared to Rs. 68 Cr. of last year registering a growth of over 16%. Both domestic & exports sales have increased. Also sale of existing products have increased with increase in the customer base and more usage from the old customers.

With growing awareness of beauty and health, the company’s presence in nutraceuticals and cosmeceutical sector, is likely to increase the revenue and profit margins in the coming year.

Strong Entry Barriers | Positive for Liquor Division

Obtaining a new license and setting up distilleries is time consuming and capital intensive. The production of liquor products in India requires manufacturers to obtain licenses from the respective state governments under the local state laws. These licenses determine the production capacity of each facility and are granted for a predefined price and time period.

Additionally, there is a ban on advertising of liquor products in India, other than on the points of sale, which makes it extremely difficult for a new entrant to create brand awareness. Such a regulatory and legal framework makes it extremely difficult for a new player to enter the Indian liquor industry and gives the existing liquor manufacturers huge competitive advantages.

India Glycols has a strong presence in the semi premium, regular and prestige segments within the whisky, rum, brandy, vodka and gin product categories. The Company’s product offering has created a niche market in Uttarakhand, Uttar Pradesh, Punjab, Chandigarh, Rajasthan, Haryana and Kerala. India Glycols’ has 3 manufacturing facility in Kashipur (Uttarakhand), Gorakhpur (Uttar Pradesh) and Todarpur (Saharanpur, Uttar Pradesh) with a total distillery capacity of 280,000 KLPA.

What’s Negative for the Stock?

LOSS MAKING FOR THE LAST 3 YEARS

India Glycols financial performance has not been so impressive. The Company has reported losses consecutively for 3 years. The performance of the Company is affected due to steep fall in prices of the chemical products (the Company derives 62 % of its revenue from its chemical businesses.).

| FY 2014 (In Rs.) | FY 2015 | FY 2016 |

| NET LOSSES | ||

| 161.36 Cr | 88.64 Cr | 49.12 Cr |

| EPS | ||

| (52.00) | (29.00) | (16.00) |

The Company has consolidated debt of Rs. 214.73 Cr. as of March 31, 2016; Net worth (Shareholder’s fund) stood at Rs. 254.41 Cr. as at March 31, 2016; Debt to Equity ratio stood at 0.84. The Company has not declared any dividends during the last five financial years and is most likely to use its future earnings for expansion and repayment of debts.

Liquor prices are controlled by state governments which revise them once every year.

Liquor companies cannot increase or revise the prices during the course of the year, irrespective of any rise in price of raw materials or under any other competitive pressures. The major raw materials for liquor companies is molasses and glass, the prices for both of which has been volatile. Additionally, Uttar Pradesh and Maharashtra are the source of a majority of the domestic molasses requirements. Most other states have imposed an import tax on molasses which puts further pressure on profitability margins of liquor companies, if there is a shortfall in a given year and the companies need to import from another state.

The Company may be too diversified for its size

For a Company with market cap of Rs. 350.02 Cr. (as of 17 November, 2016) and operating in so many verticals and product lines; hyper growth in profits may be difficult to achieve. Further, any deterioration in the demand for one product or segment could have a optimally negative impact on the overall performance of the Company.

Thanks for contributing your important time to post such an interesting & useful collection. It would be knowledgeable & resources are always of great need to everyone. Please keep continue sharing.