Caveat: Promoter Disclosure

While the yields look attractive for IndiGrid InvIT, its Promoters: Twin Star Overseas Limited (Mauritius) and Vedanta Limited together hold ~74% in Sterlite Power which in turn is the promoter of India Grid Investment Trust. Both these companies belong to the Vedanta Group which in past has displayed particularly bad corporate governance standards detrimental to the interest of shareholders (other than the promoter Group).

Also Read: Vedanta Cairn Merger: The Good, Bad and the Ugly.

View: AVOID

| What are InvITs? | How InvITs Work? | Structure of an InvIT |

| Infrastructure investment trusts, or InvITs, are similar to mutual funds. While mutual funds provide an opportunity to invest in equity stocks, an InvIT allows investors to invest in infrastructure projects such as road and power. | InvITs are designed to raise money from a large number of investors to invest in infrastructure projects and complete the projects that sometimes get stalled midway due to lack of funding. | There are four important parties to an InvIT — sponsors, investment managers, project managers and the trustee. InvITs are formed under the SEBI Infrastructure Investment Trust Regulation, 2014. |

IndiGrid InvIT (IndiGrid) – India’s First Power Sector InvIT

IndiGrid InvIT was created in 2017 to acquire operating power transmission assets. IndiGrid owns operational, revenue generating inter-state power transmission assets

IndiGrid provides investors an opportunity to invest directly in operating power transmission assets and provides infrastructure developers a robust platform to monetize their operating projects.

Structure of IndiGrid InvIT

| Role | Entity | Duties |

| Sponsor | Sterlite Power Grid Ventures Ltd. | |

| Project Manager | Sterlite Power Grid Ventures Ltd. | Operate maintain and manage Indigrid’s assets |

| Investment Manager | Sterlite Investment Managers Ltd. | Administration & management of IndiGrid’s assets |

| Trustee | Axis Trustee Services Ltd. | Ensure interests of unit holders |

IndiGrid’s Initial Portfolio Assets (At the time of IPO in May 2017) included two power transmission projects (Bhopal Dhule Transmission Company Limited (“BDTCL”) and Jabalpur Transmission Company Limited (“JTCL”)) located across 4 states of India. These projects comprise 8 Power transmission lines and two sub-stations with 6,000 MVA (Mega Volt Amp) of transformation capacity.

IndiGrid InvIT Strategy includes acquiring assets from both the sponsor and third-parties to reach assets under management (AUM) of Rs 30,000 Cr. In line with this vision, IndiGrid has completed its first set of acquisitions. In Feb 2018, IndiGrid acquired three transmission assets from its sponsor Sterlite Power Grid Ventures for a consideration of Rs 1,410 Cr. The acquisition was funded through a debt of Rs. 1,000 Cr. borrowed by IndiGrid and Rs. 423 Cr. borrowed by JTCL.

Recent Acquisitions include RAPP Transmission Company (RTCL), Purulia and Kharagpur Transmission Company (PKTCL), and Maheshwaram Transmission (MTL), all from Sterlite Power Grid Ventures, which has helped increase its AUM to Rs. 5,300 Cr. from Rs. 3,742 Cr. (at the time of IPO).

Portfolio Assets after Acquisition – the total portfolio has increased to 13 transmission lines and two substations across 8 states. IndiGrid has also agreed to acquire 46% stake in a third-party assets owned by Techno Electric & Engineering in Patran Transmission Company for Rs. 230 Cr.

Financial Performance

| Consolidated Financials

(In Rs. Cr.) |

Q1 FY18

One month of operations |

Q2 FY18

Full Quarter of operations |

Q3 FY18

Full Quarter of operations |

YTD FY18

Seven months of operations |

| Revenue | 40.60 | 132.30 | 126.70 | 299.60 |

| EBITDA | 36.90 | 122.30 | 117.30 | 276.50 |

| EBITDA Margin | 91% | 92% | 93% | 92% |

| NDCF | 25.80 | 101.40 | 101.30 | 228.50 |

| PAT | 11.40 | 60.70 | 68.80 | 140.90 |

| DPU* (Rs./unit) | 0.92 | 2.75 | 2,89 | 6.56 |

*Distribution Per Unit: Cash paid to the Unit holders in the form of interest/ capital repayment / dividend

WHAT’S DRIVING INDIGRID INVIT?

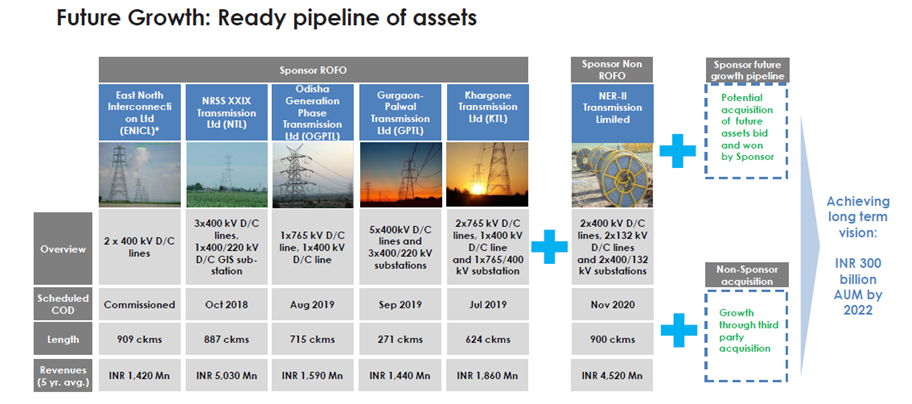

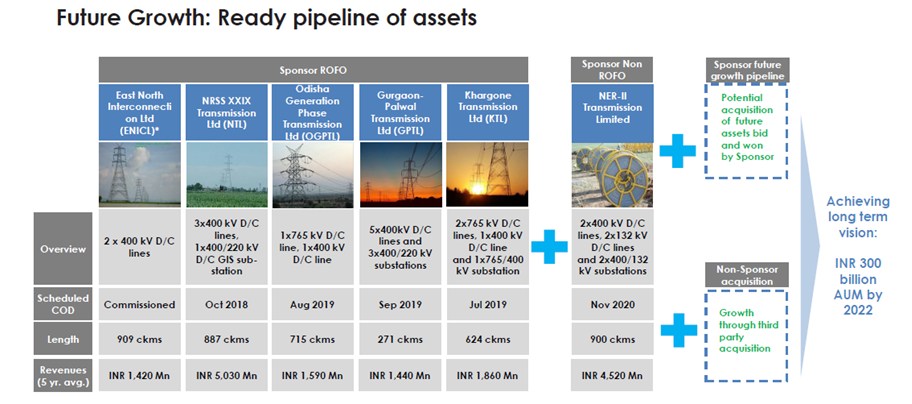

Robust Pipeline of Sponsor’s Assets

The Sponsor has a strong pipeline of 9 inter-state transmission assets. Pursuant to the Right of First Offer (ROFO) Deed, IndiGrid has a right to acquire first, 8 of these assets.

Of the 8 ROFO assets, 3 have been fully commissioned, 2 are partially operational and revenue generating and other 3 are under various stages of development. The non-ROFO assets are under development stage.

In February 2018, IndiGrid acquired 3 projects, which are already commissioned and have more than 33 years in residual contractual life, offering long term cash flow visibility to IndiGrid.

Focused Business Model

IndiGrid is focusing on owning power transmission assets with long term contracts, low operating risks and stable cash flows. These assets under TBCB (Tariff Based Competitive Bidding*) regime are offered on pre contracted availability based tariffs with perpetual ownership rights.

* Tariff based competitive bidding is price discovery mechanism in which various developers (generator) bids and one with the lowest bid gets the contract.

The Company’s recent acquisition is also in line with its strategy.

- Long term contract – Approx. 33-35 years residual life of acquisition assets.

- RTCL – 34 years

- PKTCL – 34 years

- MTL – 35 years

- Low operating risks – High historical availability of assets.

- RTCL – 99.79% (average line availability)

- PKTCL – 99.92%

“Availability” is defined as the time in hours during a given period for which the transmission system is capable of transmitting electricity at its rated voltage, expressed as a percentage of total hours in the period.

For each asset, IndiGrid is required to maintain system availability of 98% in order to receive 100% of the transmission charge. Incentive payments are received if the availability exceeds 98%. If the average availability rate for a power transmission asset falls below 95%, penalties might be imposed under the Transmission Service Agreement.

-

Key Revenue Model: Stable cash flows under the Point–of–Connection (PoC) mechanism – Under the POC mechanism, power Grid as the central transmission utility, collects monthly transmission charges on behalf of all interstate transmission system (ISTS) licensees, from all the designated ISTS customers. All ISTS licensees are then paid their share of transmission charges from the centrally collected pool.This method diversifies counter party risks, as the risk of default or delay by a particular customer is distributed among all ISTS licensees, in proportion to their share in the centrally collected pool.

- Despite weak counterparties, Power Grid has demonstrated strong collection efficiency over the last 4 years, signifying its high bargaining power.

Focus on Increasing DPU by 3%-5% on an Annual Basis

The Company is on track to deliver FY 2018 DPU guidance of Rs 11 per unit. The acquisition done so far will result in 4% increase in distribution, so Rs. 11 per unit this year would be at least Rs. 11.44 per unit next year FY 2019. IndiGrid intends to increase DPU by 3%-5% on an annual basis by following a value accretive acquisition strategy.

Not a Classic Equity Investment | Hybrid Investment Product

Share price of India Grid Trust is trading 4% below its issue price of Rs 100. But for InvIT investors, it’s not appropriate to look merely at the share price performance because; returns would also be in the form of dividends and interest. While analyzing such stocks, distribution per unit is the key parameter one should look at to determine if these companies are delivering what they promised, over and above the share price returns.

Note – Minimum Quantity That an Investor Can Buy – 5103 units = 1 lot.

WHAT’S DRAGGING INDIGRID INVIT?

Unforeseen Changes in Regulatory Environment – Any adverse regulatory development can impact the cash flows to unit-holders.

Moderate O&M Risks – Maintenance of high line availability is critical to ensure stability in revenue in the power transmission sector. Although the O&M expense form a small portion of the revenue, improper line maintenance may lead to revenue losses and weaken debt repayment capabilities.

Delays in collection under the PoC mechanism

request your suggestion for investment on Indigrid Invit on its current market price. also request if you could explain as how quarterly interest is calculate and paid?