Incorporated in 2008, Indian Energy Exchange Limited (“IEX” or the “Company”) provides a platform for trading in a range of electricity products in India. The exchange primarily brings together sellers of power like independent power producers, captive power plants, distribution companies, government owned power generation companies and buyers of power like industrial, commercial and institutional power consumers in addition to distribution companies.

IEX provides trading of several electricity products designed for short-term markets over the firm’s electronic trading platform providing physical delivery of electricity.

- Electricity contracts in blocks of 15 minutes in the day-ahead-market (the “DAM”),

- Electricity contracts for fixed terms in the future, including intra-day contracts, day ahead contingency contracts and contracts of up to 11 days ahead, known as term-ahead-market (the “TAM”)

- Renewable energy certificates (“RECs”): solar and non solar

In September 2017, the Company commenced trading of energy saving certificates.

Short term Power Trade Market

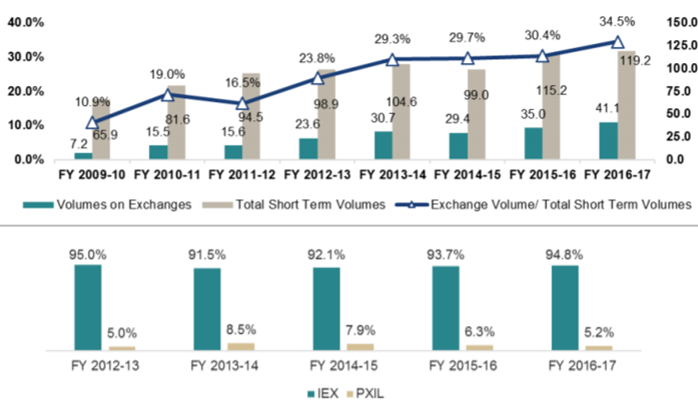

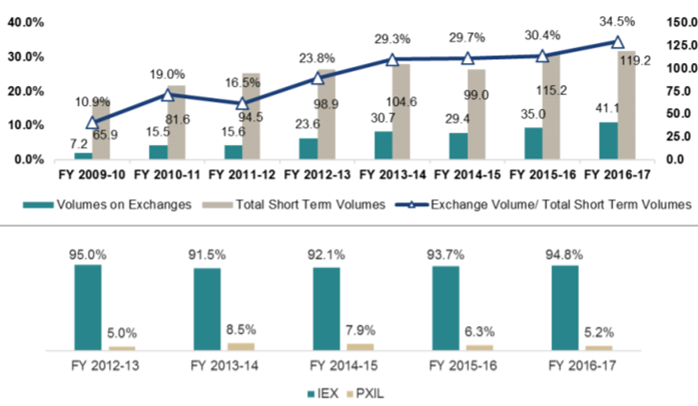

In India, between 2010-17, the overall size of short-term power market almost doubled from 66 billion units to about 119 billion units. In the same period, exchange business volumes have moved up 6 times to 41 billion units or 34.5% of the total short-term power volumes traded.

Share of exchanges in short-term market (in billion units)

IEX and Power Exchange India Limited (PXIL) are the two power exchanges facilitating short-term trade of power in India. IEX dominates the space, with its share in total volume traded through exchanges at an average of over 93.5%

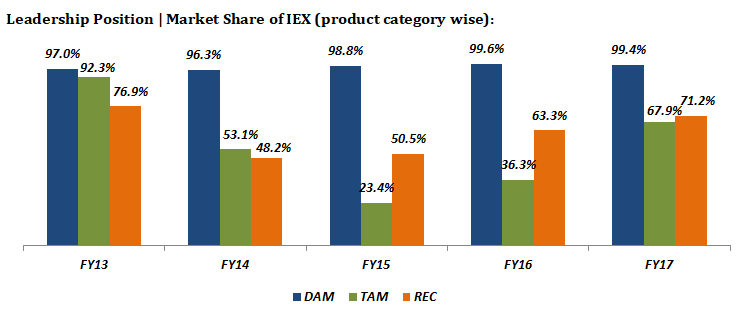

Market share of IEX and PXIL by DAM, TAM and REC

Financial Position

| Particulars (IEX) | FY14 | FY15 | FY16 | FY17 |

| Revenue (In Rs. Cr.) | 152.57 | 144.78 | 175.03 | 203.91 |

| Growth | – | -5% | 21% | 17% |

| EBITDA (In Rs. Cr.) | 114.12 | 104.09 | 125.18 | 143.29 |

| EBITDA Margin | 75% | 72% | 72% | 70% |

| PAT (In Rs. Cr.) | 91.95 | 90.02 | 100.34 | 113.57 |

| PAT Margin | 60% | 62% | 57% | 56% |

| EPS (In Rs.) | 30.61 | 29.43 | 33.3 | 37.66 |

| EPS Growth Rate | – | -4% | 13% | 13% |

| D/E | 0.01 | 0.00 | 0.00 | 0.00 |

| Interest Coverage | 5187.32 | 437.36 | 467.08 | 1093.81 |

| ROCE | 44.63% | 43.38% | 46.20% | 52.11% |

| ROE | 36.36% | 37.52% | 37.03% | 41.30% |

WHAT’S DRIVING THE STOCK?

Globally Proven Business

Globally, as high as 50% of total power consumed in many of the western and European countries is traded through exchanges. In India, IEX is the first such exchange which commenced operation in 2008. Just like any other exchange, the seller(s), which are mostly a power producers and buyer(s) (distribution companies like state utilities and others) come on the IEX platform and bid according to their requirements. Once the deal is done, IEX makes its commission or brokerage which is about 2 paisa per unit (both from buy and sell side). This accounts for 87% of revenue for IEX.

Breakup of Total Revenue

| Particulars (In Rs. Cr.) | FY14 | FY15 | FY16 | FY17 |

| Transaction fees | 122.30 | 118.59 | 149.45 | 177.76 |

| Annual subscription fees | 27.36 | 25.27 | 24.76 | 25.20 |

| Admission, processing and transfer fees | 2.91 | 0.92 | 0.82 | 0.95 |

| Total | 152.57 | 144.78 | 175.03 | 203.91 |

In India, around 3.5% of total energy generated in FY 2017 was traded on power exchanges as compared to 30-35% in developed countries and IEX claims to control 98.6% of this market. An exchange operates on the premise of providing a platform in order to drive market efficiency for both buyers and sellers.

Government Initiatives like rural electrification, power for all, UDAY are likely to drive short-term power market volumes, which could result in an expected power exchange share of 21.1% by FY 2022 (from current 3.5% as stated above).

Increasing Registered Participant

As of August 2017, IEX had over 5,900 participants registered on the exchange as compared to 2839 participants in FY 2013. Participants registered to trade electricity contracts are located across 29 states and five union territories in India. Participants include 50 distribution companies, over 400 electricity generators and over 3,900 open access consumers.

Professionally Managed Company

IEX has a highly qualified and experienced management team.

Expansion into New Geographic Markets

IEX plans to offer its products in neighbouring countries such as Bhutan, Bangladesh and Nepal, all of which are connected at one or more points with the Indian power grid. Expanding into such new geographic markets would allow the Company to increase its customer base and also enhance the liquidity of electricity products available on its Exchange.

WHAT’S DRAGGING THE STOOCK

Revenue Concentration

IEX has small number of participants. The Company’s top 10 clients constitute almost 35% of its total revenue from DAM operations.

IEX operational success depends substantially on its ability to maintain and increase the number of participants.

Small Share of Short Term Electricity Market

In India, short term electricity comprises 10.3% of electricity generated. Of which ~3.5% of short term electricity contracts are traded on the exchange. Over the past 5 years. The share of short term electricity market share has remained in range of 9-11%. Anticipated growth not playing out or remaining muted would result in a lower-than expected performance for the Company.

Thanks for detail analysis. Could you please elaborate regarding the valuation including margin of safety.