Indian Energy Exchange Limited (“IEX” or the “Company”) provides the power trading platform in India. The exchange primarily brings together sellers of power like independent power producers, captive power plants, distribution companies, government-owned power generation companies and buyers of power like distribution companies and industrial, commercial and institutional power consumers. IEX provides trading of several electricity products designed for short-term markets over the firm’s electronic trading platform providing physical delivery of electricity.

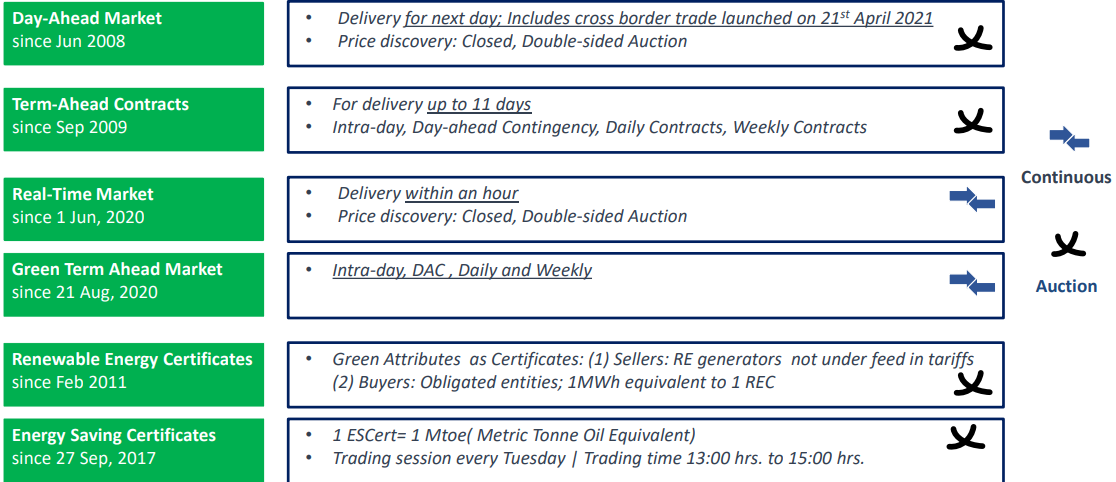

Diversified Market Segments –

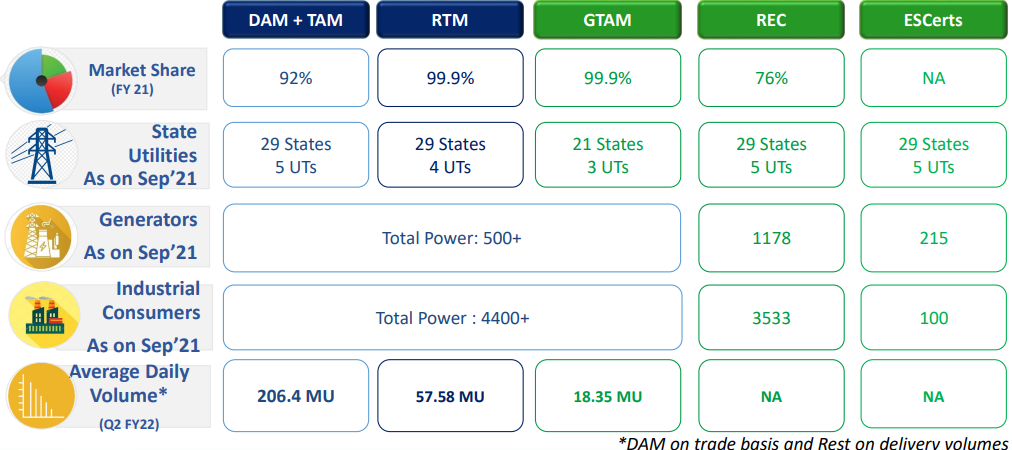

IEX has a robust ecosystem of 6,800+ participants located across 29 States and 5 Union Territories comprising of 55+ distribution utilities and 500+ conventional generators. It also has a strong base of 4400+ commercial and industrial consumers representing industries such as such as metal, food processing, textile, cement, ceramic, chemicals, automobiles, information technology industries, institutional, housing, and real estate, and commercial entities.

Financial Performance

| Particulars | FY17 | FY18 | FY19 | FY20 | FY21 |

| Revenue (In Rs. Cr.) | 198.65 | 230.45 | 254.08 | 257.13 | 317.85 |

| Growth | – | 16.01% | 10.25% | 1.20% | 23.61% |

| EBITDA (In Rs. Cr.) | 143.47 | 184.87 | 202.82 | 202.16 | 250.63 |

| EBITDA Margin | 72.22% | 80.22% | 79.83% | 78.62% | 78.85% |

| EBIT (In Rs. Cr.) | 140.05 | 174.60 | 192.40 | 186.92 | 234.12 |

| EBIT Margin | 70.50% | 75.76% | 75.72% | 72.69% | 73.66% |

| PBT (In Rs. Cr.) | 173.85 | 200.00 | 231.75 | 225.62 | 270.45 |

| PAT (In Rs. Cr.) | 113.58 | 131.69 | 165.04 | 175.72 | 206.09 |

| PAT Margin | 57.18% | 57.14% | 64.96% | 68.34% | 64.84% |

| EPS (In Rs.) | 3.79 | 4.40 | 5.51 | 5.87 | 6.88 |

| EPS Growth Rate | – | 15.94% | 25.32% | 6.47% | 17.28% |

| Historic P/E (Closing Price of 31st March) | 43.06 | 35.78 | 27.32 | 22.59 | 40.87 |

| CURRENT P/E | 87.41 | ||||

| CURRENT PE/ROE | 1.70 | ||||

| EV/Sales | 23.71 | 17.99 | 19.60 | 22.80 | 71.52 |

| PE/ROE | 0.69 | 0.51 | 0.44 | 0.39 | 0.79 |

| D/E | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Coverage | NA | ||||

| ROCE | 50.34% | 61.54% | 51.96% | 48.18% | 42.12% |

| ROE | 62.49% | 70.49% | 62.59% | 58.16% | 51.41% |

Quarterly Performance

| Q2 FY 2021 | Q3 FY 2021 | Q4 FY 2021 | Q1 FY 2022 | Q2 FY 2022 | TTM | Q-o-Q % | Y-o-Y % | |

| Revenue | 70.92 | 85.23 | 93.82 | 91.03 | 110.38 | 380.46 | 21.26% | 55.64% |

| EBITDA | 55.45 | 69.59 | 77.45 | 74.86 | 95.04 | 316.94 | 26.96% | 71.40% |

| EBITDA Margin | 78.19% | 81.65% | 82.55% | 82.24% | 86.10% | |||

| PAT | 44.33 | 58.14 | 61.52 | 62.82 | 77.73 | 260.21 | 23.73% | 75.34% |

| PAT Margin | 62.51% | 68.22% | 65.57% | 69.01% | 70.42% | |||

| EPS | 1.49 | 1.95 | 2.06 | 2.10 | 2.60 | 8.71 | 23.81% | 74.50% |

Q2 FY 2022 Highlights:

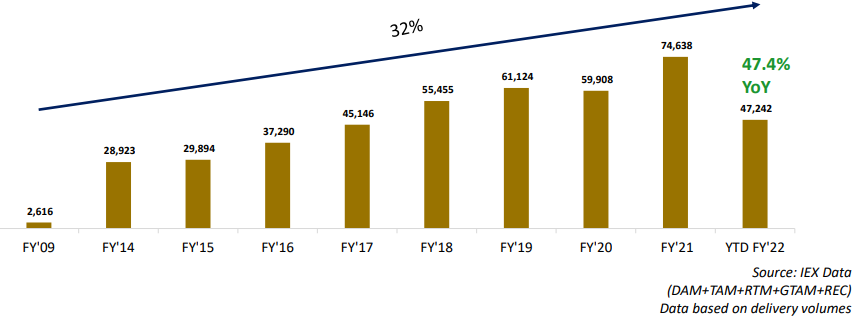

- During the quarter, electricity volumes on the Exchange grew by 58% YoY with 25.9 BU volumes traded versus 16.5BU in Q2 FY’21.

- During the first half of FY’22, IEX traded a total of 47.2BU of electricity as against 31.4BU in 1H FY’21, implying a robust growth of 50.6% YoY.

- The growth in volumes was driven by substantial increase in electricity consumption as well as the preference by the distribution utilities to meet their short-term supply requirements in a competitive and flexible manner through IEX

- The Real-Time Market remained one of the fastest-growing electricity market segments on the Exchange, achieving a growth of 125% YoY with 5.3 BU of volumes traded during the quarter. Continuing its outstanding performance, RTM contributed 20% to the overall volumes during the quarter.

- On the gas market front, the Indian Gas Exchange witnessed an increase in both volume and participation. During the quarter, IGX traded approximately 10 lakh MMBTU in terms of cumulative volume

INVESTMENT RATIONALE

Leadership Position | Market Share of Indian Energy Exchange (product category wise):

The Company reported a strong quarter with revenue growing by c.21% sequentially and c.56% over same period previous year. Margin expanded both sequentially by 387 bps and YOY by 790 bps to 86.1% led by lower other expenses and strong operating leverage. Volumes traded on platform continued their growth momentum with volumes growing by almost c.21% sequentially and c.57% YOY led by robust growth in new products. Contribution from the new products increased to 27% in this quarter from c.14% in Q2FY21.

Bonus Declared

2:1 IEX declared Bonus Issue of Equity Shares in the proportion of Two Equity Share of ₹1/- each for every One existing Equity Shares of ₹1/-

Growing @32% CAGR Since Inception

Market-Based Economic Despatch Phase-I to begin from April 1, 2022

Recently the Ministry of Power has announced a framework for implementation of Market Based Economic Despatch (MBED) – Phase1 for lowering the cost of power purchase to consumers. Around 5% reduction in the cost of power to the consumers from MBED is expected. The move is to create a “One Nation, One Grid, One Frequency, One Price” in reforming electricity market operations. The implementation of the MBED will be done in a phased manner to help the participants, power exchanges and load despatch centres to adapt gradually to the new regime. With the implementation of the MBED, volumes on the IEX platform is expected to increase significantly over the coming years.

Globally Proven Business

Globally, as high as 50% of the total power consumed in many of the Western and European countries is traded through exchanges. In India, IEX is the first such exchange that commenced operation in 2008. Just like any other exchange, the seller, which is mostly a power producer and a buyer (distribution companies like state utilities and others) come on the IEX platform and bid according to their requirements. Once the deal is done, Indian Energy Exchange makes its commission or brokerage which is about 2 paisa per unit (both from the buy and sell-side). This accounts for 87% of revenue.

In India, around 6% of total energy generated in FY 2021 was traded on the power exchange as compared to 30-35% in developed countries and IEX claims to control 98.6% of this market. An exchange operates on the premise of providing a platform in order to drive market efficiency for both buyers and sellers. Government Initiatives like rural electrification, Power for All, UDAY are likely to drive short-term power market volumes, which could result in an expected share of 21.1% by FY 2022.

Professionally Managed Company with a highly qualified and experienced management team.

Expand into New Geographic Markets

Indian Energy Exchange plans to offer its products in neighboring countries such as Bhutan, Bangladesh, and Nepal, all of which are connected at one or more points with the Indian power grid. Expanding into such new geographic markets would allow the Company to increase its customer base and also enhance the liquidity of electricity products available on its Exchange.

INVESTMENT CONCERN

- The launch of MBED will result in multifold increase in the volumes on the exchange platform resulting in increasing competition from the new and existing players, thus resulting in the loss of monopoly for the Company.

- Major risk for the Company is the launch of market coupling where all the bids across the power exchanges will be clubbed together to determine a uniform power price. This will directly impact the dominance of IEX established over the years.

- With increase in the power volumes through the exchange, there is a possibility of reduction in the revenue per trade from current 4 paisa per trade by the authority. This will result in significant reduction in the Company’s revenue in turn impacting the bottom-line.