The Indian Government has identified infrastructure as one of the key drivers of economic development in the country. The infra sector continues to suffer with the high concentration of poorly performing assets and lower-than-expected returns. Infrastructure sector Breakup (for the purpose of this article)

- Roads & Highways

- Power

- Railways

- Ports

- Water & Solid Waste Management

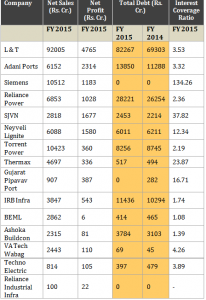

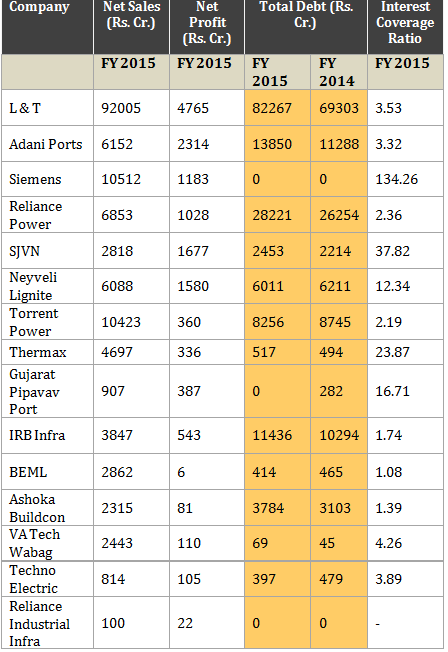

Major Problem – Debt Burden

Infrastructure companies are operating with high level of debt on their balance sheets and have limited options for further fund-raising. Banks who funded infra projects are now trying to clean up their own books due to near bankruptcy of many infrastructure companies.

INFRASTRUCTURE COMPANIES WITH POOR INTEREST COVERAGE RATIO HAVE BEEN IGNORED FOR THE PURPOSE OF THIS STUDY

ROADS AND HIGHWAYS

| Market Cap | Debt/Equity | Current Price | |

| Larsen & Toubro | 1,15,228 | 1.60 | 1236 |

| IRB Infra | 8,165 | 2.48 | 232 |

| Ashoka Buildcon | 3,396 | 0.22 | 181 |

Larsen & Toubro – Larsen & Toubro Limited (“L&T” or the “Company”) has business interests in sectors ranging from engineering, construction, manufacturing, information technology and financial services. It has a dominant presence in India’s infrastructure, power, hydrocarbon, machinery and railway-related projects. The Company continues to be the best play in the Indian infrastructure space, given its strong business model (diversified with a presence across all segments of infrastructure i.e. power, roads, hydrocarbons & process industries), strong execution capabilities and relatively healthy balance sheet.

IRB Infra – IRB Infrastructure Developers (“IRB” or the “Company”) is one of the leading infrastructure development companies in India in road and highway sector. The Company’s portfolio of 21 BOT projects (14 operational, six in construction phase and one won recently) is among the largest in the country. IRB has recently won a big Rs.10,000 Cr. plus Zozila pass project in Jammu and Kashmir. With this, IRB’s order book stands at Rs.17,320 Cr. – 4.5 times FY 2015 revenue — that provides good earnings visibility.

Ashoka Buildcon – Ashoka Buildcon Ltd. is one of the largest highway developers in the country with an impressive portfolio of over 28 PPP (Public Private Partnership) projects.

POWER

| Market Cap | Debt/Equity | Current Price | |

| Reliance Power | 13,366 | 0.20 | 47.45 |

| SJVN | 12,265 | 0.24 | 29.65 |

| Neyveli Lignite | 11,223 | 0.40 | 66.80 |

| Torrent Power | 10,885 | 0.73 | 227.00 |

| Techno Electric | 2,883 | 0.43 | 505.00 |

Reliance Power – Reliance Power Limited (“Reliance Power” or the “Company”) is engaged in the development, construction and operation of power generation projects both in India as well as internationally. The Company on its own and through its subsidiaries has a portfolio of over 35,000 MW of power generation capacity, both in operation as well as capacity under development.

The Company has 1,540 MW of operational power generation assets. The projects under development include seven coal-fired projects to be fueled by reserves from captive mines and supplies from India and elsewhere; two gas-fired projects; and twelve hydroelectric projects, six of them in Arunachal Pradesh, five in Himachal Pradesh and one in Uttarakhand.

Reliance Power has won three of the four Ultra Mega Power Projects(UMPPs) awarded by the Indian Government so far. These include UMPPs in Sasan( Madhya Pradesh),Krishnapatnam( Andhra Pradesh) & Tilaiya(Jharkhand).UMPPs are a significant part of the Indian government’s initiative to collaborate with power generation companies to set up 4,000 MW projects to ease the country’s power deficit situation.

SJVN – SJVN operates the country’s largest Nathpa Jhakri Hydropower plant with 1,500 MW of operational capacity (Source: Company). Beginning from a single hydropower project company, SJVN has diversified its presence in different set of power projects, which includes hydropower projects, thermal power projects, power transmission projects, wind power projects and solar power projects. SJVN has the healthiest capital structure in the listed (power) space. The Company has reserve of Rs. 6,066.41 Cr. and outstanding long term borrowings of Rs. 2,435.42 Cr. Current debt to equity ratio stands at a healthy 0.24:1.

Read More – Power Stocks : Deep Value or Junk Buying?

Neyveli Lignite – Neyveli Lignite Corporation Limited (“Neyveli Lignite” or the “Company”) operates in the energy sector and is engaged in lignite excavation and power generation. On the power generation side, Neyveli Lignite has four power generation facilities including — Three Thermal Power Stations with a total installed capacity of 2490 Mega Watt at Neyveli and one Thermal Power Station at Barsingsar, Rajasthan with an installed capacity of 250 Mega Watt.

Torrent Power – Torrent Power Limited (“Torrent Power” or the “Company”) is engaged in the business of power generation, transmission and distribution of electricity with operations in the states of Gujarat, Maharashtra and Uttar Pradesh. The Company’s power plants are located at SUGEN, Taluka Kamrej, District Surat; Sabarmati, Ahmedabad, and Vatva, Ahmedabad.

Currently, the Company has a generation capacity of 2,102 megawatt and distributes 14 billion units to over 2.76 million customers in the cities of Ahmedabad, Gandhinagar and Surat, besides operating as the distribution franchisee in Bhiwandi in Maharashtra and Agra in Uttar Pradesh. Its subsidiaries include Torrent Power Grid Limited, Torrent Pipavav Generation Limited and Torrent Energy Limited.

Torrent Power is currently implementing a 1200 MW gas based power project at Dahej in South Gujarat, through its subsidiary Torrent Energy Limited. The project is called the DGEN Mega Power Project. It is being implemented in a phased manner starting with a 400 MW first phase. It is also in the process of expanding the capacity of its SUGEN plant near Surat.

Techno Electric & Engineering Company – Techno Electric & Engineering Company (“Techno Electric” or the “Company”) provides c omplete solutions for captive power plants including Engineering Procurement Commissioning (EPC) of power plants and substations*, Balance of Plants (BOP) **, transmission and distribution of power, and industrial installations.

PORTS

| Market Cap | Debt/Equity | Current Price | |

| Adani Ports | 49,464 | 1.29 | 239.20 |

| Gujarat Pipavav Port | 8,438 | – | 174.55 |

Adani Ports – Adani Ports and Special Economic Zone Ltd (“Adani Ports” or the “Company”) cover wide-ranging activities in coal Mining, power generation, oil and gas exploration, logistics, and realty development.The Company is India’s largest private multi-port operator, with presence across six ports in India. The Company is a subsidiary of Adani Enterprises, India’s leading infrastructure conglomerate.

The Company wants to increase annual cargo handling capacity from 91 million MT in 2015 to 200 million MT by 2020. Adani Petronet Port Pvt. Ltd. (Dahej) is a joint venture between Adani and Petronet Liquefied Natural Gas Ltd. at Dahej, South Gujarat.

Gujarat Pipavav Port – Gujarat Pipavav Port (“Gujarat Pipavav” or the “Company”) is engaged in the construction, operation and maintenance of ports at Pipavav, District Amreli, in the state of Gujarat, India. Gujarat Pipavav has the exclusive right to develop and operate APM Terminals Pipavav and related facilities until September 2028. The Company is promoted by APM Terminals, one of the largest container terminal operators in the world with a global network of 49 terminals in 32 countries and five continents.

RAILWAYS

| Market Cap | Debt/Equity | Current Price | |

| Larsen & Toubro | 1,15,228 | 1.60 | 1236 |

| Siemens | 37,987 | 0.005 | 1066 |

| BEML | 4,518 | 0.20 | 1085 |

| Reliance Industrial Infrastructure | 645 | – | 427 |

Larsen & Toubro – See above

Siemens – Siemens (“Siemens” or the “Company”) rail division comprise the entire Siemens rail vehicle business – railways, metros and locomotives and even trams and light rail and related services. The Company’s division has recently won hree orders worth approximately Rs 450 Cr. from Varanasi-based Diesel Locomotive Works of Indian Railways for locomotive equipment.

BEML – BEML (“BEML” or the “Company”) operates in three distinct business segments namely, Mining & Construction Equipment, Defence, and Rail & Metro. The Company has diversified into manufacturing various types of mining and construction equipments, Metro coaches and specialised defence vehicles/ products. BEML is the single supplier of Tatra trucks to Indian defense. BEML’s order book as of 3Q FY2016 stands at ~ Rs. 6,376 Cr.

Reliance Industrial Infrastructure – Reliance Industrial Infrastructure (“Reliance Industrial” or the “Company”) is mainly engaged in the business of setting up/operating industrial infrastructure. Its main activities are providing (i) services of transportation of petroleum products and raw water through its pipelines, (ii) construction machinery on hire and (iii) other infrastructure support services. The Company has its operations mainly in the Mumbai and the Rasayani regions of Maharashtra, Surat, and Jamnagar belts of Gujarat.

WATER AND SOLID WASTE MANAGEMENT

| Market Cap | Debt/Equity | Current Price | |

| Siemens | 35,327 | 0.005 | 1066.30 |

| Thermax India | 9,269 | 0.23 | 777.95 |

| VA Tech Wabag | 2,942 | 0.08 | 543.00 |

Siemens – See above

VA Tech Wabag – VA Tech Wabag (VA Tech” or the “Company”) is the leader in the water management sector. The Company has a strong order book and has bagged Rs 5,000 Cr. worth of orders in FY 2015.

Major Orders in FY 2016

- In September 2015, the Company secured Rs 1,500 Cr. Effluent Treatment plant from PETRONAS, Malaysia.

- Also, the Company has bagged sewage treatment plant from Al Madina Al Shamaliya, Bahrain, valued at Rs 580 Cr.

- Rs 594 Cr. worth major order from Chennai Metropolitan Water Supply and Sewerage Board for construction, operation and maintenance of 45 MLD (million litres per day) water reclamation plant in Chennai.