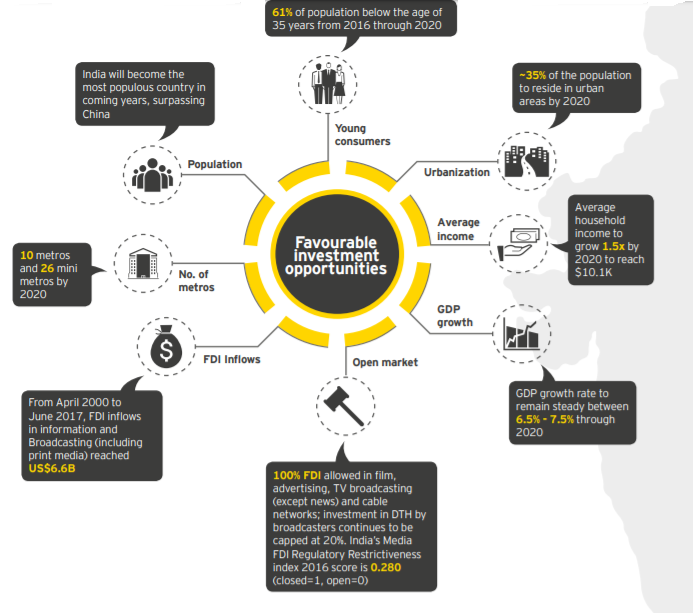

India is going to become third largest economy by 2030 backed by strong demographic, economic factors and conducive regulatory environment. With growing middle class, young demographic, uptake on digital and a rise in the consumer’s income, the propensity to spend on media and entertainment is growing faster.

Source: EY-Reimagining India’s M&E Sector| March 2018

Favourable Demographics –

- Young Population – India is expected to become one of the most populous nations by 2025, with a headcount of around 1.44 billion. India is poised to become the world’s youngest country by 2020, with an average age of 29 years.

- India’s Earning Population (over 25 years of age) is expected to grow from 40% to 55%-60% of the total population by FY 2020.

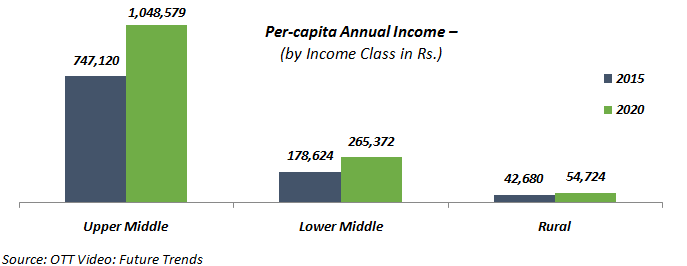

- Increasing Disposable Income

Digital Infrastructure –

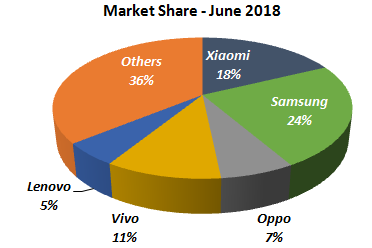

- India is the second largest smartphone market in the world after China.

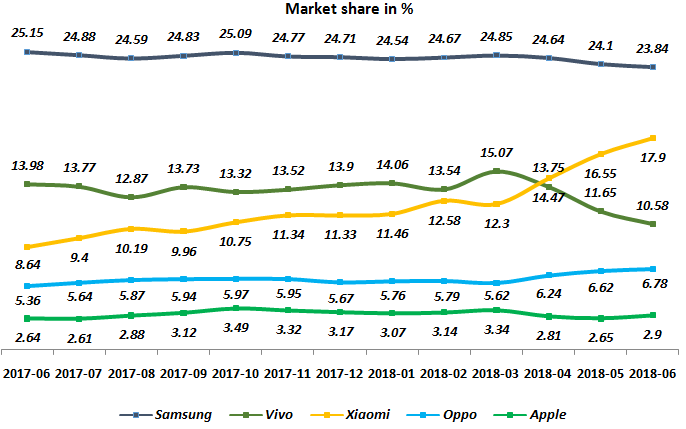

Source: http://gs.statcounter.com/vendor-market-share/mobile/india/#monthly-201706-201806

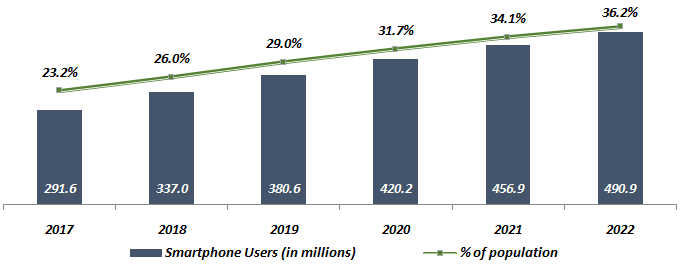

- India’s Smartphone Users and Penetration in India, 2017-2022

Source: EMarketer|May 2018| More than a Quarter of India’s Population Will Be Smartphone Users This Year

- In 2017, the daily smartphone usage reached to 2.2 hours in 13-30 years age group and 1.8 hours in the 31-50 years age group.

- Mobile Vendor Market Share – India

- CURRENTLY, IN INDIA, SAMSUNG AND APPLE HAS AROUND 120 MILLION AND 8.9 MILLION USERS BASE RESPECTIVELY.

- Increasing Trend in India’s Internet Users – India has 96 million internet users, as on March 31, 2018 with 65% urban penetration and 20% rural penetration. As growth in urban internet penetration moderates, rural India is set to drive the next phase of growth in India. Better digital infrastructure and entry of affordable smartphone segment is set to change the internet landscape in the years to come. By 2020, 50% of India’s internet users are estimated to be from rural India.

- Massive Increase In Data Consumption – The launch of Jio in September 2016 and subsequent reduction of data rates across operators has had a significant impact on data consumption. As per DOT, the average monthly data usage in India is expected to increase from 3.9 GB in 2017 to 18 GB by 2023.

- Mobile internet users spend 50% of the data usage in video services and are expected to reach 75% by FY2020 (Source – KPMG | the Digital First Journey).

- Total time spent on video apps has grown 85%, from 22078 million hours to 40471 million hours.

- Top 10 Video OTT Apps

| App Name | Rank | ||

| By Monthly Active Users | By Downloads | By Time Spent | |

| Youtube | 1 | 8 | 1 |

| Hotstar | 2 | 1 | 2 |

| JioTV | 3 | 2 | 3 |

| JioCinema | 4 | 4 | 6 |

| Voot | 5 | 3 | 4 |

| Amazon Prime | 6 | 5 | 5 |

| Sony LIV | 7 | 7 | 9 |

| Airtel TV | 8 | 6 | 8 |

| Netflix | 9 | 10 | 7 |

| Tata Sky Mobile | 10 | 9 | 10 |

Indian OTT (Over the Top) Market

By 2020, India is expected to become the second largest video viewing audience globally. At present, India has over 20 OTT players, including many global players.

Recent Trend | From Niche to Mass

Until recently, OTT video viewing was seen to be a niche play, targeting the youth, upwardly mobile, early adopter segment. However, 4G data wars have disrupted the consumption patterns across the demography and socio economic classes.

- To capture Indian audiences, global players like Amazon and Netflix are investing heavily in building local and original content.

- Introduction of Amazon Fire Stick and Smart TVs have further increased content consumption.

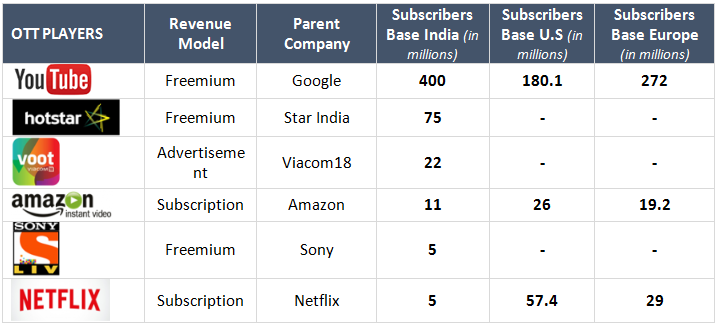

SUBSCRIBER BASE OF SOME OF THE OTT PLAYERS IN INDIA

* Freemium models are a mix of Advertisement based (AVOD), Subscription based (SVOD)

What Really is Slowing Down the Growth of Indian OTT Market?

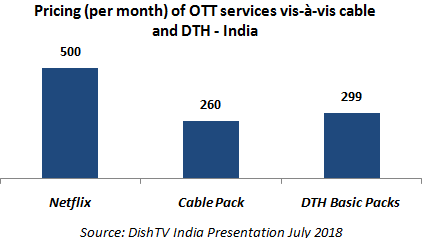

High Pricing Structure – OTT players will face challenge in capturing significant mindshare among Indian consumers.

High OTT streaming costs could be a major hindrance when it comes to Indian OTT proliferation.

SUBSCRIBER BASE OF THE DTH PLAYERS IN INDIA – DTH has attained net pay active subscriber base of around 67.53 million.

| NUMBER OF SUBSCRIBERS (In million) | |

| Dish TV | 29.04 |

| Tata Sky | 16.88 |

| Reliance | 0.68 |

| Sun Direct | 6.75 |

| Airtel | 14.18 |