If you compare Indian stock markets to global markets both developed and developing, Indian stocks are trading at a much higher valuation.

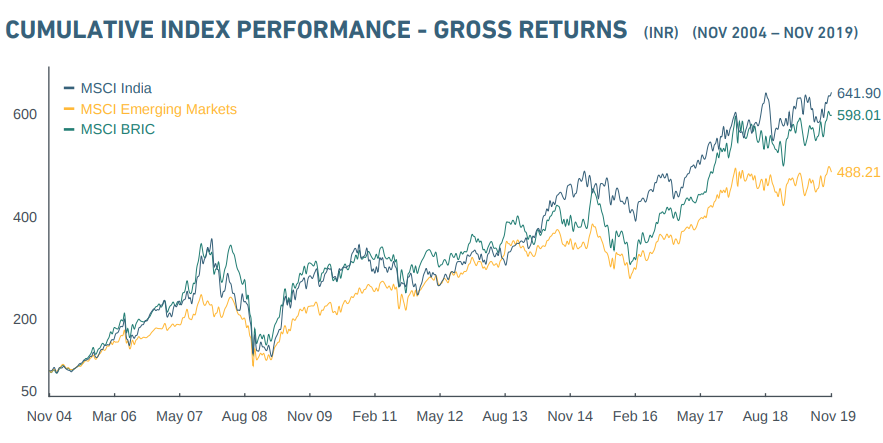

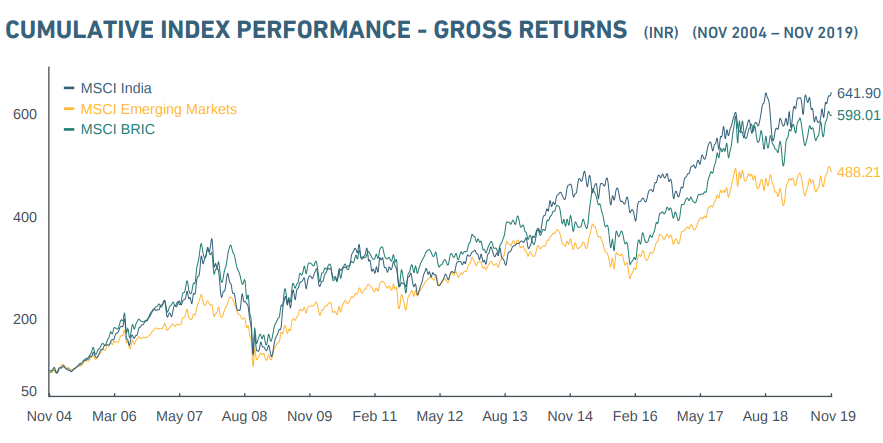

Consider this, the ‘MSCI India Index’ which had grown at par with the ‘MSCI emerging Markets Index’ from 2004 to 2014, is today trading at a 42% premium to the latter. Further, MSCI Index itself is trading at a 23% discount to the Nifty 50, while it covers 85% of the entire Indian equity market by market capitalization. That is how expensive the benchmark Indian Index is at the current stage.

Those in the business of selling stocks are coming up with all sorts of rationalizing theories about mid and small cap stocks being cheap and select sectors offering amazing value; the truth is that stocks as an asset class are extremely expensive.

It is not like value does not exist. The worry is that from value to deep value takes very little time. When selling happens, it does not discriminate between classes of stocks. When buying, investors look for all sorts of metrics from value, to growth to momentum. In selling on the other hand, there is only one underlying sentiment – Fear. If at all there is another, it is the need to deleverage which is painfully practical.

The reason why I am writing this article today is not to justify buying mid or small cap stocks; nor to criminate the idea of buying or selling large caps. The idea was to think about why are the Indian stock markets so expensive? That’s all.

The twin effect of Demonetization and a series of rate cuts by the RBI are to blame for this.

First, Demonetization brought all the money into the banking system. Even if it was temporary as many would argue, it surely made people accept financial assets as a sustainable and better investment avenue. Fall in price of other traditional asset classes mainly real estate and the advent of financial advisory as a more organised business also had its part to play.

A lot of the money deposited in banks was parked into buying stock and mutual funds. This led to a rise in stock prices and every time there was a little correction, advisors provided the much needed cushion to calm the nerves of investors. Assets under Management swelled more in percentage terms than they ever had in past.

To add to this, RBI continued its aggressive policy stance of cutting interest rates. The benchmark rate has fallen consistently from 8% in 2014, to its current rate of 5.15%. That sure does ease up liquidity. I wonder why consumption has not picked up. I guess the fear is making people save more than invest which seems counterproductive given what people are buying.

Be that as it may, liquidity rush may keep pushing stock prices higher and higher at least in the short term, I am confident that whenever there is an event which leads to a correction of 10-15%, reality will dawn and the correction will go much deeper. Until that happens, let’s enjoy this party.

As a precaution, pay a little premium to keep your portfolios hedged. To me, 10% assured return in this market is far more desirable than going for 18% which may or may not happen.

Thanks for this beneficial information. every trader and investor wants to read these types of blogs.