Since the day Interglobe Aviation (“Indigo“) got listed in 2015, I have consistently maintained that it is an overvalued stock. At 900, it was overvalued at 1300, it defies all common sense.

Disclosure: I (and my clients) have sold future lots of Indigo shares. Be aware that unless you are willing to rollover your positions for many months, which may requires substantial margin, this may be a risk strategy.

Why do I find Indigo Overvalued?

First is just basic math where things don’t seem to add up. They never did.

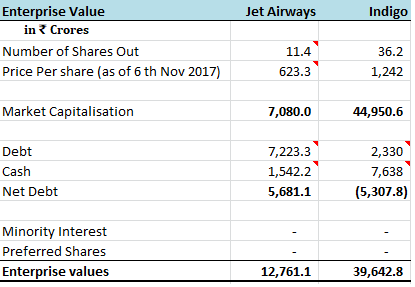

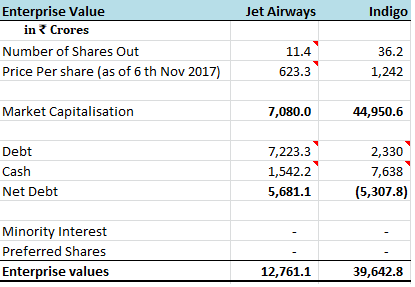

With 11.4 Crores shares (of Rs. 10 each) in circulation for Jet Airways as against 36.2 Crore shares of Indigo, the low equity base at Jet gives it more room to expand by dilution.

Now wait, I am not being silly to not realize that Indigo promoters hold a much higher share in the company compared to their peer over at Jet Airways.

- Jet Airways Promoter Holding: 51.00%

- Indigo Promoter Holding: 77.91%

(More on this in financial aspects)

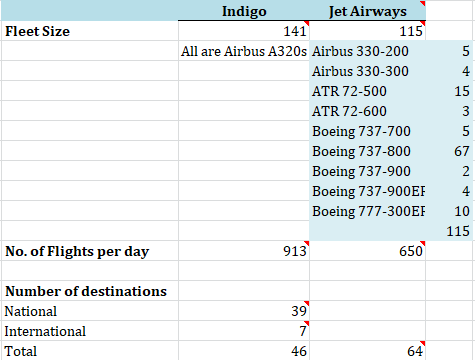

Be that as it may, it doesn’t change the fact that the two companies operate in the same industry in the same geography, infact Jet Airways has a slight advantage in this area. Not only do they have a strategic alliance with Etihad Airways, an airline operating from a region with lower fuel costs (the largest material cost for airlines), Jet also flies to more international destinations.

Financial Aspects

The difference between the market capitalization of the 2 companies is over 1:6. If you take into account the debt and cash on the books of each company; it gives Indigo an enterprise value of close to Rs 40,000 Crores. This is still 3 times over than the enterprise value of Jet Airways.

Note: Jet airways net debt includes company’s negative reserves accumulated post the acquisition of Jet lite in prior years.

Even if someone can put forward a good or a great argument suggesting that Indigo has achieved operational efficiency, is managed better, has deeper pockets to buy more aircraft, it still doesn’t explain why it should be so much more overvalued while it flies the same passengers in the same geography, most of whom will choose a small pricing benefit over any differentiated service (really…..I am in retail and I can guarantee this last statement).

Impact of Rising Crude Oil Prices

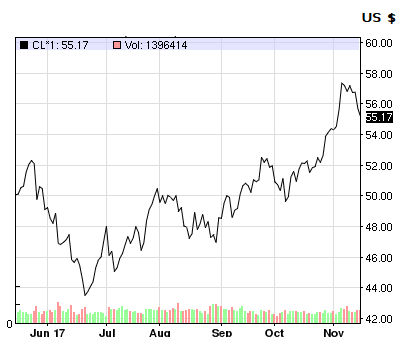

Naturally, an increase in the price of crude oil puts significant margin pressure on the airline industry. Fuel prices are the largest input cost for airlines. This is how crude prices have moved over the last 6 months:

Fun fact: Interestingly, cheap crude prices were hurting airlines in India and now certainly expensive prices are helpful? I am not sure why this is but this is what the stock price trend seems to suggest. Of course the impact of crude price movement is actually felt about a quarter later but again, if I know this, I am sure you do too.

Management Not Forthcoming

I am not aware of how deep pocketed the management or the founders are, but they have missed delivery commitments on their aircrafts in past, and they may miss them again. This has been a problem in prior management calls. Not as much as some of the recent incidents around ground staff manhandling passengers and accidents on the tarmac. In all of these instances, one thing that was common was that the management spent more time defending these events after they came to light instead of disclosing them in time.

I had had side bets in past that one of these days the stock price of Jet Airways will overtake Indigo, everything else remaining the same. Of course this is not based on any financial analysis but the difference keeps closing!