Info Edge India Limited (“Info Edge India” or the “Company”) is India’s premier online classifieds company in recruitment, matrimony, real estate, education and related services.

Its business portfolio comprises:

[1] Recruitment – Online recruitment classified, www.naukri.com – market leader in the Indian e-recruitment space.

[2] Matrimony – Online matrimony classified, www.jeevansathi.com – among the top 3 in India’s online matrimonial space.

[3] Real Estate – Online real estate classified, www.99acres.com – India’s largest property marketplace.

[4] Education – Online education classified, www.shiksha.com

INTERNAL BUSINESSES

To tap the opportunity in the growing and vibrant Indian internet market, the Company has made investments in early stage companies/start-up ventures.

STRATEGIC INVESTMENTS

Other Strategic Investments Include:

- Vacation Labs (SAAS solution for tour operators)

- Unnati Helpers (Tech enabled employment software)

- Rare Media Company (Field sales force management)

- Diro Labs (Phonebook app)

- Wishbook (Catalog sharing app)

- NoPaperForms (Advanced enrolments management platform)

- Univariety (Guidance on careers, admissions and tests)

- Zippserv (Online real estate intelligence platform)

- Gramophone (Agri-Inputs e-commerce)

- Shoekonnect (B2B footwear marketplace)

- Printo (Retail chain providing print and document services)

The Company operates through a network of 62 offices located in 43 cities throughout India. Info edge has also made forays abroad into the Gulf market with the website www.naukrigulf.com and currently has offices Dubai, Bahrain, Riyadh and Abu Dhabi.

Financial Position

| Particulars | FY14 | FY15 | FY16 | FY17 | FY18 |

| Revenue (In Rs. Cr.) | 617.41 | 827.37 | 1,188.17 | 970.48 | 1,077.02 |

| Growth | – | 34.01% | 43.61% | -18.32% | 10.98% |

| EBITDA (In Rs. Cr.) | 146.83 | 115.80 | 532.85 | 260.04 | 346.97 |

| EBITDA Margin | 23.78% | 14.00% | 44.85% | 26.79% | 32.22% |

| EBIT (In Rs. Cr.) | 125.67 | 68.86 | 509.03 | 227.28 | 317.34 |

| EBIT Margin | 20.35% | 8.32% | 42.84% | 23.42% | 29.46% |

| PBT (In Rs. Cr.) | 122.69 | 65.07 | 508.93 | 227.05 | 317.00 |

| PAT (In Rs. Cr.) | 89.67 | 24.06 | 135.58 | (23.66) | 511.98 |

| PAT Margin | 14.52% | 2.91% | 11.41% | -2.44% | 47.54% |

| EPS (In Rs.) | 8.21 | 2.00 | 11.21 | (1.96) | 41.89 |

| Historic P/E (Closing Price of 31st March) | 75.44 | 419.66 | 68.40 | – | 28.06 |

| CURRENT P/E (based on price of 18th September – Rs. 1549.95) | 37.00 | ||||

| D/E | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Coverage | NA | ||||

| ROCE | 15.48% | 3.75% | 33.37% | 14.41% | 15.63% |

| ROE | 18.26% | 4.60% | 32.99% | 14.26% | 15.50% |

WHAT’S DRIVING THE STOCK?

Pure Internet Player.

Strong Performance of Naukri | Cash Cow of Info Edge

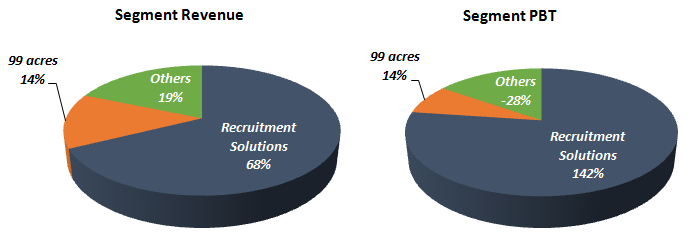

Naukri continues to enjoy a leadership position with mid 74% traffic share of the job portals market. In Q1 FY 2019, resumes on Naukri.com increased by 2 million to 59 million and continue to be higher than FY 2011-2016 average of 33.6 million. Unique customers grew 11.5% YoY to 52,663. While total cash generated from the recruitment business since inception has been Rs 2,423 Cr., only 14% of it has been used to fund 99 acres, Jeevansathi and Shiksha till FY 18.

Investee Company Portfolio Status (as of July 31, 2018)

| Investee Company | Website | Book Value of

Investment (Rs. Cr.) |

% Holding on fully diluted basis |

| Zomato Media | www.zomato.com | 152 | 30.9% |

| Applect Learning Systems | www.meritnation.com | 135 | 65.7% |

| Etechaces Marketing and Consulting | www.policybazaar.com | 389 | 13.6% |

| Happily Unmarried Marketing | www.happilyunmarried.com | 26 | 47.2% |

| Mint Bird Technologies | www.vacationlabs.com | 6 | 26.1% |

| Rare Media Company | www.bluedolph.com | 11 | 43.9% |

| Unnati Online | www.unnatihelpers.com | 4 | 31.6% |

| VCARE Technologies | www.dirolabs.com | 4 | 15.1% |

| Ideaclicks Infolabs | www.zippserv.com | 5 | 45.3% |

| Wishbook Infoservices | www.wishbooks.io | 4 | 25.7% |

| NoPaperForms Solutions | www.nopaperforms.com | 6 | 39.9% |

| International Educational Gateway | www.univariety.com | 13 | 31.4% |

| Agstack Technologies | www.gramophone.com | 6.4 | 27.8% |

| Bizcrum Infotech | www.shoekonnect.com | 3 | 21.4% |

| Printo Document Services | www.printo.com | 20 | 23.5 |

| Total | 784 Cr. |

Info edge Investment Strategy – the Company has traditionally restricted its investments to seed/early stage funding and has opted for scaling down its stake (through divestment or by not participating in the late stage funding) as valuations expand. This has been evident in Zomato where its holding has come down to 30.9% from a peak of 58%.

WHAT’S DRAGGING THE STOCK?

Competition –

- Naukri – Indeed co.in, Monsterindia.com, Timesjobs.com, Shine.com, Linkedin

- 99acres – Magicbricks, Commonfloor, Housing

- Jeevansathi – Bharat matrimony (leader), Shaadi

Poor performance of three of Info Edge’s four core businesses

Real estate portal 99 acres, matrimonial portal Jeevansathi and education portal Shiksha are still in losses.

Declining Promoter’s Stake

- June 2018 – 41.35%

- March 2018 – 41.40%

- June 2017 – 41.99%

- March 2017 – 42.43%

- June 2016 – 43.09%

- March 2016 – 43.11%