Last week witnessed the 10th big departure from Infosys in little over a year as president and board member B.G. Srinivas made his exit.

In December last year, V. Balakrishnan, Infosys’ head of BPO operations had quit. He was one of the front runners to become the CEO at Infosys after the current CEO, S. D. Shibulal resigns, as he plans to in March 2015. As an investor, of course you should be concerned about why the current CEO wants to resign and why the guy most likely to take over from him ends up resigning even before.

When a company tries to shake things up and tries to alter its course, some changes are bound to happen. The problem with Infosys however is not only that it is losing its top management but even at execution level, the attrition rate is really high which in turn negatively affects client relations.

Infosys financials consistently missing estimates

If attrition and lack of growth was the only cause for concern, one could then argue on the whole turnaround theory with Narayana Murthy taking center stage again.

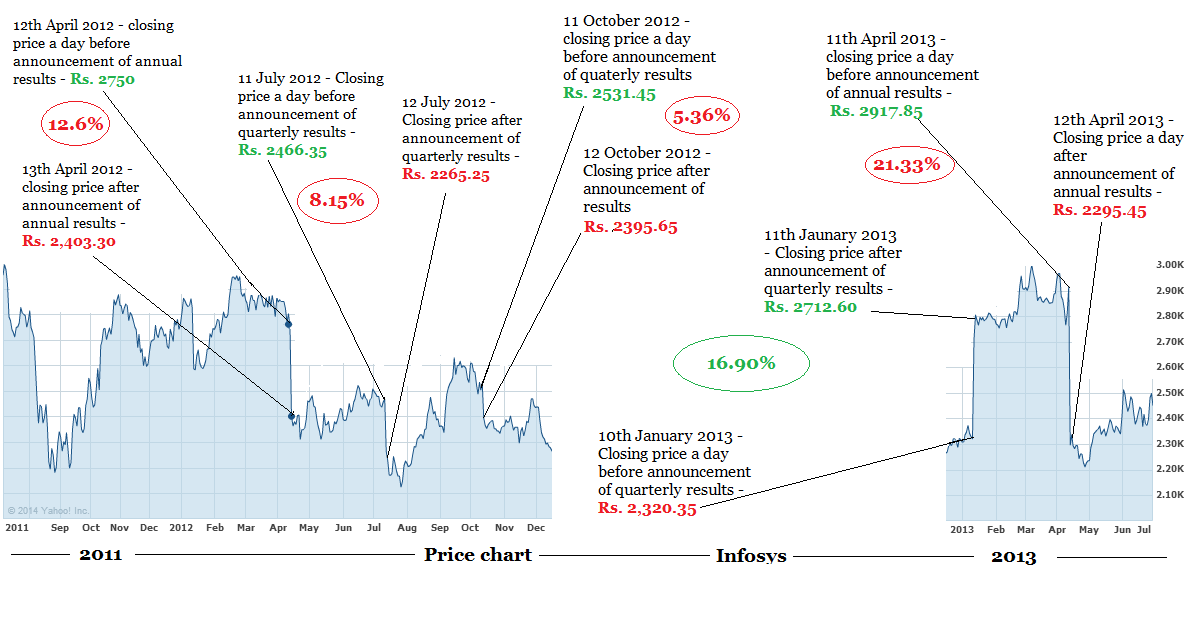

However, I am fascinated at the way Infosys has been handling news flow and price sensitive information. Below I have the share price chart of Infosys for over 2 years. Notice the number of times, the stock has moved up or down by in excess of 6-10 %. Also notice the number of times this happened immediately before or after Infosys announced its financials.

(Click on image to enlarge - use back button to come back)

Surely, nobody expects a company to present anything other than the true picture but how is it that the projections and reality keep changing in such short spans of time. Anyone trying to come up with some sort of intrinsic value based on Infosys financials and reporting patterns will surely need to pick up a set of quarterly statement, then average them out and then make equally erratic future predictions.

What is even more interesting is that every time Infosys downgrades their estimates or projections, it is followed by some good news either financial or otherwise. Even those who have very little idea about the accounting practices at Infosys and the company’s internal policies could based purely on the news flow over the last 6-10 quarters, should be able to figure out that something is terribly wrong somewhere.

Only time will tell whether Infosys is able to navigate itself out of this difficult situation, for the time being I am not keen to be a shareholder at Infosys, not at Rs. 3400/ share nor at Rs. 2500/ share.

I have for long held that mid and small sized IT companies will lead the way in the long term, is this beginning of a long term downward trend for big IT space?