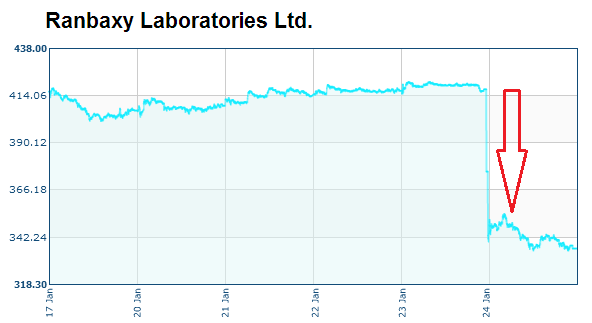

Imagine if you knew of this decision before it was announced. You could have short Ranbaxy stock futures and made a huge profit (in this case, you could have doubled your money based on the Ranbaxy’s lot size and margin requirement).

Yes – double your money with the help of a little stock tip. Or, would this be considered insider trading? On paper, the answer is simple but in reality the dividing line between insider trading and stock tips in Indian stock markets in particular is very fine, if one exists at all.

Consider each scenario below and try to think which ones qualify as (illegal) Insider trading:

- A friend of yours who worked at the USFDA passed on their decision on banning Ranbaxy products one day in advance of their public announcement? Further, he did not trade on this information but you did.

- At a coffee shop, you happen to sit next to the USFDA official visiting India to inspect the company’s premises. You heard him talk to someone over his phone where he said – “Yes we will ban Ranbaxy from tomorrow”.

- An Indian official at Ranbaxy who has been closely involved with this issue gets the sense that all efforts will fail and that a ban is inevitable. He tells you about this over a beer. Next day, you both heavily short lots in future markets.

- In scenario 3. above, neither you nor the official trades on what he ‘sensed’. You however went ahead and told another friend about what the Ranbaxy official told you. He doesn’t know if you even know someone like that. In fact, he thinks most of your stock tips are useless and you know nothing about the Indian stock markets in general. Nevertheless, he went ahead and sold a large number of future lots in the company hoping that you would for once have an idea. The stock tanks the next day, he becomes a very rich man.

- You keenly follow the company. Over the last few months you have been following this developing story. You have also read about some bad practices at the company. You firmly believe that sooner or later, a ban on the company’s products is inevitable. You also run a website called – “Stock tips in Indian stock markets”, where you tell subscribers to sell Ranbaxy shares, stating that a ban is inevitable. You and many of your subscribers (about 80% of them) sell a large number of stock futures. A day after, this announcement is made, the stock tanks 20%. Are you guilty? What about the subscribers?

The problem is not one of answering these questions with a simple yes or no. It is much bigger than that. How do you prove the reason for a trade?

Think of this – Stock tip or not, I am anyways going to sell Ranbaxy shares tomorrow. Now suddenly one director from the company called me and told me about the forthcoming ban. Damn!!

What do I tell him? WHAT ARE YOU DOING, I WAS GOING TO SELL!!! Now that you have told me that I should sell, I can’t sell. I just lost some money here!!

The bottom line– Everyone knows when they are breaking the law. This however remains an area where almost everyone hopes to get a chance to break the law. For a stock tip to be genuine, its origin must be illegal (i.e. it must be born from some inside information somewhere). If that is not the case, then stop calling it a stock tip. By doing so, you may just be diminishing the value of your (or someone else’s) hard work and analysis.

Both, insider trading and stock tips in India (and even overseas) are a reality. Personally, I believe no matter how stringent the law or how heavy the penalty, these practices are never going to change. Stock market operators who work in cahoots with the insiders will keep finding innovative ways to communicate with each other.

An afterthought – There is almost a whole online industry for stock tips in Indian stock markets. I am sure they are doing a fine job. Remember that even if you believe them to be genuine, what you are essentially saying is this –“these guys source genuine insider information; somehow they always get to know. I want to be part of the crime so let me sign up”. On my part, I do not base my buy/ sell decisions on stock tips but on high quality ‘research’. This research could well be conducted both in and out of office. I buy and sell after I am convinced that my trades are clean.

How on earth do you stop this?

Must say that you have given a list of scenarios which can happen and one will be in a catch 22 situation. Your concept that entry in trade based on a reason is a must which will lead to a disciplined approach and one is assured of profitable trades.

Regards

Your content is very good, nice post.

Thanks.

Your content is very nice, Keep it up.

We agree with your analysis and we feel extensive volume analysis is required to make a judgement on who is buying and when ??

Sure. I think this however should be best left with the regulators.

This week Sensex & nifty both were cross their highest reach and make new records. This was the happiest news for all investors and traders.

Now they know very well where stock markets are going and where they can invest for more profit from the market.

I found that your post helps a lot to all investors & traders to understand the market, then invest in the right stock

Nice update and i really liked your posting,the way you present each and every point is quite fantastic

Thanks for sharing.

This post is so informative for investors. It is very helpful for beginners, who want to invest in the equity market. I’m very glad after read this post.

Then stop giving stock tips and posting spam.

Your post is very informative and useful. Keep it up!

Investing in stock needs constant analysis of market’s ups and down. You must speculate the market exactly and constantly for gaining high ROI. For a common man it is not possible to do so.

Investing in stock needs constant analysis of market’s ups and down. You must speculate the market exactly and constantly for gaining high ROI. For a common man it is not possible to do so.

I love reading the content on your website. Legally speaking there is insider trading going on everyday in India.

Thanks Pankaj. So long as you stay out of it, you will be safe 🙂

Its good to be here, very nice post, the content is amazing, keep posting friend it will be very helpful for everyone, Thanks for sharing…

I love reading such engaging posts. Thanks!

Great post thanks for sharing.

Effective and ready to use share market tips. I read your blog on regular basis and try to apply the awesome tips.Thanks to providing such a great strategies. Thanks!

Great informative post.

Thank you all.

Share Market trading is a complex work for individuals with different opinions. You can definitely expect the unexpected here. Additionally, there are a few tricks which we need to learn.

Investing needs constant looking about the ups and down. I read your blog and found it really informative. Keep sharing such interesting content and help everyone who are trying to make fortune in trading. Thanks for the share!!