Here’s a look at the Invesco India RISE Portfolio. The basic portfolio strategy aims at investing in companies with:

R: Recovery in Demand

I: Idle Capacity with interest costs declining due to declining financial leverage

S: Superior business models with healthy balance sheets and a potential for earnings to jump back quickly

E: Earnings Recovery and PE Expansion.

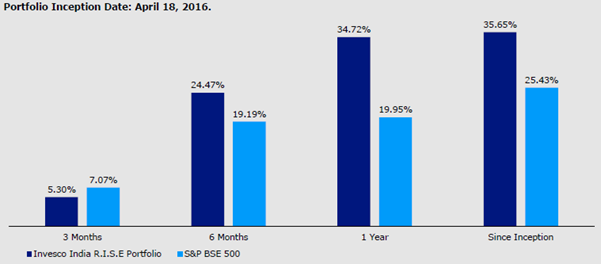

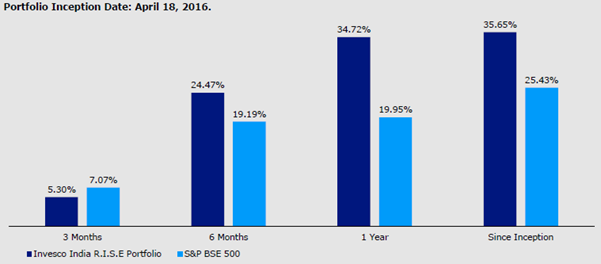

Track Record as on 31 July 2017

Since this is a relatively new strategy it’s not the best thing to compare its performance with other similar strategies in the market. Invesco’s Caterpillar strategy (started in 2009) provides a better comparative framework with other PMS schemes. We will do a separate post on the Caterpillar strategy (About Caterpillar portfolio strategy: invests in mid and small cap stocks that can get re-rated either because of growth in earnings, change in business environment, or companies that may have been overlooked or are out of favour). For now, let’s look at top holdings in Invesco India Rise Portfolio:

Invesco PMS charges a fixed management fee of 2.5% annually. In addition the fund charges on boarding fees of 2.5% (one time).

LOOKING TO INVEST IN THIS SCHEME?

Here’s 3 benefits of investing in this scheme through a financial advisor like Sana Securities

[1] We don’t charge 2.50% upfront fees for this scheme (or for any other PMS scheme) which helps the investors get maximum upside.

[2] Your Commission Structure/Management fee and all other expenses will remain same or will be lower – CALL US TO CHECK! Its real.

[3] We will also throw in a free subscription to our website.

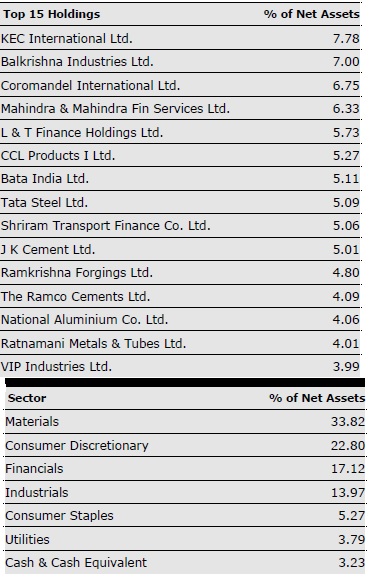

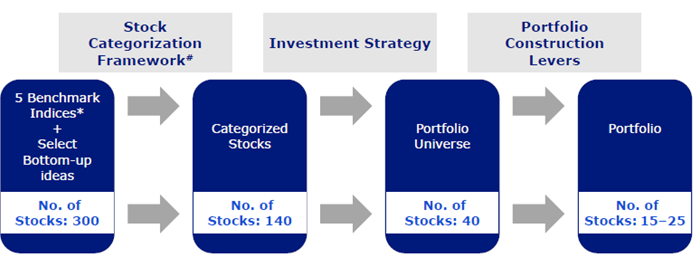

Concentration: The portfolio typically consists of 15-25 mid cap stocks selected on the following basis:

PMS Review

In the current environment, the strategy of this portfolio should work in so long as the primary rationale of stock selection is to look for companies where the balance sheets are strong which give the business its staying power even though the P&L feels the pain on account of delay in recovery of earnings cycle. At the same time, at this point there is delay in recovery of earnings for most if not all companies in India.

Universe: Essentially the managers select stocks from the universe of S&P BSE 200 index, Nifty Free Float Midcap 100 index, Nifty Infrastructure Index, Nifty Bank Index and S&P BSE PSU Index. In addition there is select bottom up stock picking approach.

In current environment, this fund is likely to outperform its peer schemes and its benchmark of S&P BSE 500. That said, depending on your investment amount you should choose diversified allocation between the various strategies by Invesco (Note: The Rs. 25 lac minimum PMS ticket size can be split between RISE and Caterpillar strategies or other strategies).

FOR BENEFITS OF INVESTING IN PMS SCHEMES CALL – +91 8368931743.

In general, It is Impossible to save on the management fee (of~ 2.5%) by purchasing disclosed portfolio stocks on your own. Typically, by the time the fund makes a disclosure of the stocks they are holding, these stocks have already run up by well over 5-10%. Naturally, the fund manager wants you buy it on your own to take the prices higher after he purchases.

CAN YOU SEND ME THE FACT SHEETVAS ON 1 ST FEB 2018 ON DAWN & RISE PORTFOIO OF INVESCO AND ALSO FACT SHEET OF INDI AOPPORTUNITY FUND V2 SERIES OF MOTILAL PMS BY MAIL.

Sent. You can call me on 9833905054 to dicsuss any aspect.

Which of the following PMS schemes are good for investment

a) Invesco RISE

b) Invesco Caterpillar

c) Emkay Capital builder

d) Equity intelligence

e) Vallum capital

Sent you an email. Please check.

Hi

Can you please share latest fact sheet on different PMS schemes by INVESCO, Motilal, ASK, Porinju etc.? Also, suggest which one is good to buy at this point.

Best regards,

Mudit

Please suggest which organisation PMS service Performance Better and what is % of upfront Commission they Pay to the Agents.