3 reasons why investing in debt funds is the best thing to do right now:

- Bond Prices are low and everyone got hurt: About 2 years back when more and more companies started tapping into debt capital markets to raise capital, debt funds were just beginning to get popular. There was a bit of frenzy and paper quality was consistently deteriorating. I for one was amongst the first (and few) to point out that investing in this space was a bad idea. That was in September of 2017:

Those who invested in this space to make FD like (or better than FD returns) have all suffered. Most debt funds have delivered sub-par returns, in fact in many cases – NEGATIVE RETURNS!

For this reason, many investors are even redeeming their debt investment which is further putting redemption pressure on these funds. A majority of bonds and debt instruments held by fund houses are trading significantly below their face value presenting a great buying opportunity. Capitalise on this opportunity!

- Interest Rates: In the year 2018, RBI raised REPO rates twice from 6% to 6.5%. With elections around the corner and retail inflation slowing down to lowest in 18 months @ 2.28% for the month of November, there is every possibility that the RBI will cut interest rates at least once if not twice in calendar year 2019. Hence, chances are that you may make higher than (historic) average returns in debt instruments this year.

Consider this, ICICI Prudential All Seasons Bond Fund made ~ 16.8% return in calendar year 2016 period when RBI cut interest rates twice.

- Stocks are expensive: Stocks are as expensive as they get. At PE multiple of over 26 on trailing Nifty (it shot over 28 more than a few times in the year 2018), markets have rarely been as expensive as this in the past 2 decades and each time, they ended badly. Surely, in future markets will present an opportunity to buy these stocks at cheaper prices. U.S. Markets have corrected ~ 22% over the last 4 months. Indian markets on the other hand have been resilient despite sluggish corporate earnings growth. This will correct in future. Further, given that in 4 months, we will have a new Government at the centre; things are likely to get impacted by the outcome of the general elections. Ideally…., hold more and more in fixed/ debt funds until there is some meaningful correction in stock prices. Making 8-10% p.a. (tax free in 3 years) is not a bad return at all!

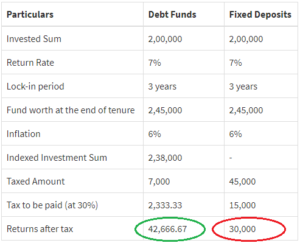

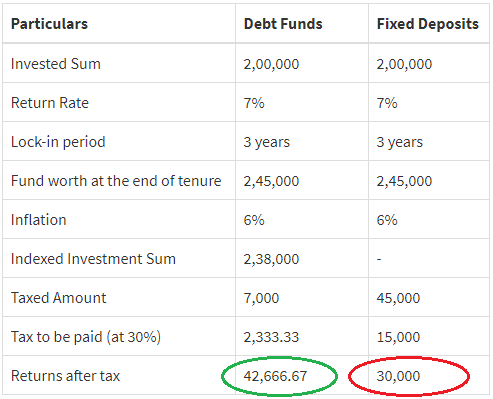

Debt Funds: Comparative lustration vis-à-vis Fixed Deposits

Typically over a 3 year period, (on annual basis):

- The average annualised return of debt funds is 8-9%

- While FDs will deliver between 7-8%.

A bigger advantage of investing in debt funds over Fixed deposit is that the returns become (nearly) tax free in 3 years because of indexation. Even assuming a similar rate of return on FD and Debt funds, this is how the difference will look (calculated at 7% annualized return):

A final word: As always, what is of prime importance is – ‘Fund Selection’. If you wish to get in touch with us to discuss opportunities in this space, drop me a WhatsApp message 9833905054 (preferred) and I will be happy to take things forward. My email and other contact details are published on the site.

Hi Rajat,

I think in your comparison between FD and Debt Funds over Income Tax, better to tone down inflation of 6%. Indexation for next coming 3 years may not be as high as been in past.

Very good point. I agree!

This is just a comparison prepared by the guy doing the research. I am hoping that people will call me before buying 🙂