Lately, I have been getting some questions on investing in IPOs. This morning, it just occurred to me that despite working on IPOs and drafting offer documents for 5 years of my life, I have not written a single post about it.

Just goes to show how much you ignore things that you know the most about. They somehow never naturally occur to you.

_______________________________________

For all the theoretical reasons why companies come out with IPO’s and why they are good for business and economy you can refer to my post here on – Need for raising equity capital.

Practically, IPOs happen for one of the 3 reasons:

- Genuine Expansion Plans

- Private Equity players need an exit / a huge loan needs to paid

I had covered the first 2 points in great detail in my post on private equity funding.

- Just Unlocking Value – IPO is a great way for price discovery. Once the shares of a company get listed on an exchange, the market decides a fair price for the share and consequently for the company. As the saying goes – A thing is only worth what someone is willing to pay for it.

That said, oftentimes, when promoters want to profit by selling part of their business, it is fancily termed as ‘unlocking value’.

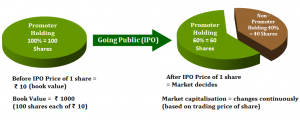

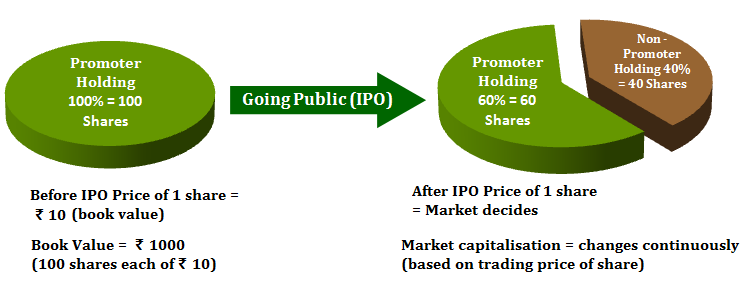

Why the above chart does not reflect how IPOs happen

In the example above each share of the company was Rs. 10. In the IPO, the promoters sold of a part of their holding. In practice this will almost never happen. Think about it – Who will buy into an issue where the promoters say this – “even though the business does not need any money for expansion and despite operating very profitably we would like to sell some of our stake, please buy it from us.”

What Really Happens?

The company increases its authorized capital and issues new shares to those who invest in the IPO. Based on the price at which allotment of shares are made to the IPO investors, more money comes into the company. While promoters stake has gone down in the business (to 60%), the company is richer by the amount brought in by the IPO investors. Effectively, in monetary terms, the promoters do not suffer as the monetary value of their shares will increase by the amount brought in by the IPO investors. The promoters can now sell some shares in the open market.

*** Of course, this explanation is simplistic and does not take into account the valuation given to the company, i.e. the price at which new shares were allotted in the IPO. Further, there will be a 1 year lock-in period during which the promoters cannot sell their holding. That said, there are enough enterprising financial intermediaries who will find ways to get you around this problem.

Is Investing in IPO’s a Good Idea?

While ideally and analysis should be done on case by case basis, remember that most Issuers, along with their bankers, will always have more information than you. It is extremely difficult for an investor, no matter how sophisticated, to assess the fairness of price when investing in an IPO.

Most IPOs will burn you. People with more information than you have want to sell. Think about that”.

Also note that, more than 50% of what is offered in an IPO is mandatorily to be bought by large qualified investors such as institutions, mutual funds etc. Often this number is as high as 70%. These institutions are in a far better position to conduct a deep diligence on the issuer company. That said, before you get cues from what happens to the institutional tranche of the offering, remember, these institutions could have their own reasons for buying the stock which may have nothing to do with appreciation of share price in the short, medium or long term, or at all.

Further, the complexity of a company’s valuation at the time of an IPO makes it more likely that the IPO price will be tilted in favor of the promoters.

A Word About IPO Valuation Techniques

Over the years, I have seen as many quick fire company valuation techniques as the number of investment bankers I have met. Their principles and approach to valuation differs based on a multiplicity of factors including – economic scenario, state of the industry and most importantly, their issue management fees.

In an ideal world, valuations should be based on discounting of future cash flows, and each company should be looked upon based on its individual merit. In the real world, this hardly ever happens.

‘Follow the industry average’ has pretty much become the norm across the banking industry.

Step 1

Under this approach, value is based on the Price Earning multiple for the entire industry in which the company operates. You can get this figure in any finance newspaper, magazine or on a finance website, though the capital market publication seems to be the market standard for this number.

Step 2

The industry PE Multiple becomes the benchmark for IPO valuation.

Say a new company in the cement industry wants to come out with an IPO. The Industry PE for cement companies is ~ 28. This becomes the starting point to value the new company’s IPO.

Step 3

The new company reported total earnings (i.e. Profit After Tax) of Rs. 20 Cr. in the latest financial year and the issue management team along with the company decide to split ownership in 1Cr. shares **, the EPS of the company will come to 25 (i.e. total earnings / number of shares).

Price / EPS for this company should = 28 (based on industry PE)

Price = 28 *EPS = 28*25 = 700

Step 4

Each share would be worth Rs. 700. The bankers will do a French auction style book built with a price band of 670-730 and hope to get enough buyers at 700 as to sell out the entire issue.

** Note 2 things here –

First, based on how liquid you would like the script to be, you could increase or decrease the total number of share (for example, if you increase the total number of issued shares to 10 Cr., each share would be worth Rs. 70).

Second, the EPS number is of prime importance. Based on this number, valuations will differ considerably. Follow any approach such as – current year EPS with a 10% mark up, forward EPS estimates, trailing 4 quarter EPS increased by X%, where X is the age of the promoters eldest son.

It all gives you some sort of an answer.

Conclusion

Is there a possibility that future earnings projection would be tilted in favor of promoters who pay the fees of those who make these projections?

– Surely Yes.

If you are confident that enough value is being left on the table by the company then of course, investing in IPOs is the best way to make listing gains. The trouble is that of being sure, that too, based on financials which were prepared keeping the IPO in mind and released in an offer document worked upon by experienced lawyers on the payrolls of the issuer.