I am sure that many of you have heard about Fundamental Analysis, or fundamental view in the context of stock picking.

Sometime back, I released a video explaining the concept of Investment Fundamental Analysis where I spoke about financial facts and qualitative opinions and concluded that “The standing of an enterprise is in part a matter of FACTS and in part a matter of OPINION”.

Something more basic than that which I did not discuss was the importance of defining the word ‘INVESTMENT’ well for yourself. Different people have different definitions for the word investment. And why not? Investment could mean different things to different people. When you invest in a business or a new venture, your intention is to make a high rate of return on your investment, so that’s money well invested. In the financial world (the context in which I am writing this article) investment typically refers to investments made in stocks, bonds, bullion and other financial products.

No matter what your approach and where you invest, in all cases the idea is to earn a good rate of return on your investment. You hope that in future, the principal that you invest today (i.e. investment = principal) will grow. Unless you have a clear idea of your investment goals, you are very likely to do harm to your principal in the financial world.

If you are serious about long term investing, you will benefit immensely from this definition:

“An investment operation in one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative”.

– Graham & Dodd (Security Analysis 1st Edition 1934)

If you focus on the highlighted words, you will see that investment is defined as an operation, in the sense that it requires detailed analysis and research as opposed to buying something which a friend or a stock broker feels will do well in future. If you are not researching and analysis yourself, you are not investing, you are either speculating or just gambling. Now I am not saying that either of that is a bad idea. In fact, personally, I know some very well informed and sophisticated speculators who have made a lot of money by predicting and anticipating future events.

What differentiates speculation from investing is detailed research and the power of knowledge. So unless you research and manage your risks well you are doing anything but not investing.

Now focus on the other highlighted word – Satisfactory return. This is subjective. You have to ask yourself – What kind of returns are you looking to make and must keep in mind that investment is all about risk-reward. Higher the risk, great the reward. Of course, if you are looking to make 35X in under 3 minutes, then you should be in a country which allows casino roulette. Needless to say that you may find the subject of fundamental analysis a little far from reality. At the same time, if you are happy making 7-8% return per annum then you should get to the closest bank and enquire about the available fixed income schemes but remember, nobody they say ever became a millionaire by investing in fixed deposits.

So who should be interested in Investment fundamental analysis?

If you are someone who is willing to take educated risk to make high returns, you may find the stock markets an extremely rewarding place.

How do you start?

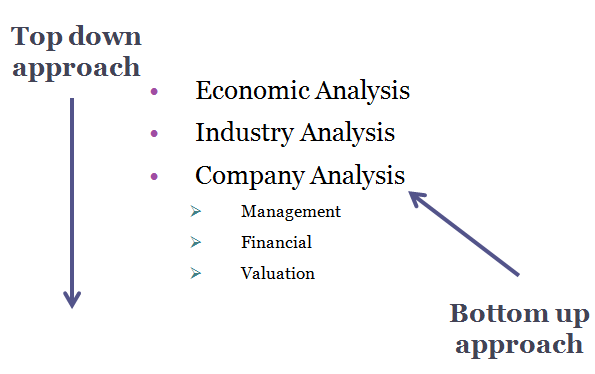

Once you learn how to start investing in stocks, you will find that there are 2 approaches to study the stock markets — The Top Down Approach and The Bottom Up Approach.

In top down approach, the idea is to analyse the state of the economy as a whole by looking at variables like the GDP, interest rates, unemployment and industrial production figures etc. Once you are convinced that the economy is not overheated and is not showing any signs of slowing down, you come to step 2 i.e. Industry analysis; wherein you try to ascertain particular sectors or industries which are likely to do well in a given economic environment. For example, if you are convinced that future economic policies will provide a big boost to the education sector in India, you will look at companies in the education sector, if you think that the interest rates are going to come down in future, you will look at the banking sector. Once you ascertain the sectors which are likely to do well, you finally start looking at various companies in those sectors. By contrast, in bottom up analysis you start by looking at the business of the individual company. You choose stocks based on individual valuations and growth potentials of the company instead of looking at the state of the economy or the sector in which the company operates.

Which of the 2 approaches is better?

It is not easy to answer this question. In different economic cycles, different approaches work well. If you follow too much of the top down approach, you might miss out on buying companies which are operating in sectors which are temporarily not doing well because of a bad economy, or due to some industry specific problems. On the other hand, if you pay too much emphasis on the bottom up approach, you may end up with stocks in companies which underperform despite their strong fundamentals, on account of problems in the broader economy or the specific industry in which they operate.

I can safely say that where we are right now (in 2013), the bottom up approach (i.e. the approach followed by value investors) will do well because the economy overall is trying to recover from a slowdown. However, you should never ignore the overall economy. Mostly because, unless the overall investment and business climate is good, stocks as an asset class do not perform well irrespective of the individual merits of a company.

Of course, it is extremely difficult to predict economic cycles. Think about it, if it were easy to predict economic cycles, the 2008 crisis may never have happened. Nevertheless, those who manage to predict them often find a dedicated Wikipedia page for themselves and become the darlings of financial media.

Certainly, I don’t mean that you should be blind to the overall economic environment. One easy way to assess the economy in the context of stock investing is to look at the long term trend of the market. (Please note that I don’t mean for this to sound like technical analysis or chart analysis). When I say trend, I mean the relative valuation of the stock market over a 10-15 year period. Any such chart will highlight an enduring lesson of investment history – The fact that markets move in cycles of recession, recovery and boom!

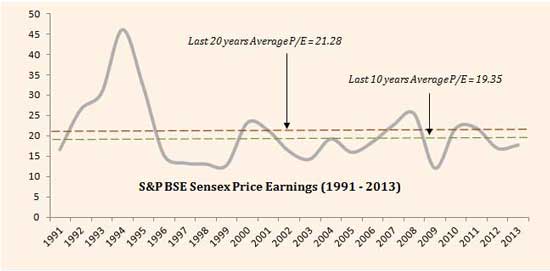

For example, look at the chart below:

It shows the average price earnings of the Bombay Stock Exchange for the last 20 years. It does not take much beyond a brief look at the chart to understand that we are currently trading below the average PE for both the last 10 and 20 years (current Sensex PE = 17.8). So the broader economy itself gives you indication about the investing environment. Interestingly, evidence suggests that the pace of investment picks up once the black worm climbs over the average PE and remains sluggish when it’s below that average. Why that happens may well be discussed in an article on human psychology.

Nice Information I Also Want To Add Something By Myh Side Thus, after above discussion we can say that 3 components are at the heart of fundamental analysis

1)Economic Analysis

2)Industry Analysis

3)Company Analysis

Thus, after the above discussion, we can also say that 3 components are at the heart of the fundamental analysis

1)Economic Analysis

2)Industry Analysis

3)Company Analysis