What markets do day to day is overwhelmingly driven by random chance. Ascribing explanations to short term moves is like trying to explain lottery numbers.

It’s no secret that in the short term – investor sentiment is arguably the only driver of stock prices. Their sentiment may turn positive or negative based on news flow, majority analyst opinion, good or bad corporate results, F&O expiry levels etc. Like weather, Investor sentiment turns hot and cold many times in a year, often without explanation which makes it difficult to judge.

If at all, this should reaffirm the fact that no one can predict what the markets will do in the short term. Period.

Yet, I have lost count of the number of times I have heard this on TV – I can hold this stock for 2-3 months or that I want to ‘INVEST’ for 1 month.

First, you do not ‘invest’ in stocks for 1 month; you can trade for 1 month and at best you can indulge in educated speculation based on whatever convinces your heart. The truth is – the best of companies, with the soundest business plans, most able management and well laid out future plans may decline by anything between 5-50% over a 2-3 month period. In the market, this happens repeatedly.

While investor sentiment drives stock prices in short term, over a longer term prices move based on how much the company manages to generate for its shareholders.

The only rule of long term investing – ‘Capital Flows Towards Returns’. Hide the return in the remotest corners of the world and capital will find its way.

Judging Investor Sentiment

The average investor begins to invest long after return generation cycle has kicked in and hardly ever when the company is planning its future. Mostly this is because of a fascination with stock prices rather than the underlying value. I bet if 10 big investors tomorrow start buying a defunct company and the stock goes up by 10-15%, thousands if not more will jump in to buy it.

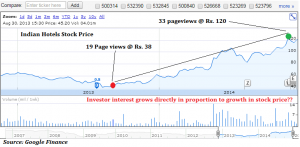

The perfect case in point (and one from my personal picks) – Indian Hotels Company Limited (IHCL). I first recommended this stock when it was trading at Rs. 62 on 23 January 2013. By August of that year it was down @ Rs. 38. I reiterated my buy position at that time. Not for once did I doubt that the stock should trade much higher.

Not many wanted to buy a single share in IHCL in August 2013. In fact, I came under some criticism from a television news anchor for my recommendation. This morning IHCL share is trading @ Rs. 121/- That’s more than 218% return in 16 months! I think it’s a good time to sell this stock. That said, I do believe that IHCL will cross its all time high of Rs. 161 over a period of time. But again, for now, there are better opportunities.

Now, here is the interesting thing. Look at the page views for the Indian Hotels Report page (below). Notice how many people were interested in this stock in August 2013 when we first recommended it and how many were interested in December 2014.

(click on images to enlarge)

Further bear in mind that for August 2013, we recommended the stock so most of these page views must have come from subscribers who visited this page.

Moral of the graphs: “Investor sentiment is driven and it grows directly in proportion to growth in stock price.” At best, I will say this – people may or may not buy a stock but a rising share price surely gets eye balls and with more eye balls, some of those eyes will undoubtedly jump in.

Conclusion – you will find that it is impossible to judge investor sentiment accurately every time but the longer you look at, in terms of trends, better is your chance at being more accurate.

Are you trading with an Investor’s psychology?

A basic difference between trading and investing psychology is that investors do not really care much about the short term sentiment in the stock market. Surely, if the macro economic outlook is bad, they will keep their money in fixed income products but short of that – right now is as good a time to buy stocks as any. The problem with most people is that they jump into the markets with no clarity about their own self. Are you here for trading or investing for a long term?

Mostly such people have only one goal – I will buy today and sell when I am making a profit. 3-6 months later they realize that they cannot wait 5 years for the profit to come by, something they should have known before investing. Markets continuously frustrate such people. In fact, big investors with deep pockets thrive on this mentality.

Do this experiment:

Tell me where you would have sold this stock:

Recommendation @ Rs. 252

3 Months later Price = Rs. 202 – (Here?)

6 Months Later Price = Rs. 152 – (Here??)

Would you have waited further?

15 Month later the stock traded @ Rs. 500 +. This is exactly what happened with IHCL stock over the last 16 months. I just expressed it in higher value but in same percentage terms.

Let’s be honest, if you were a pure trader, you would have surely sold the stock long before it hit Rs. 202. It is an investor’s mentality to wait until the price bounces back. Traders will book losses and try their hand elsewhere. They will also be happy to speculate with companies with bad fundamentals if they believe that the trend is on the up. This is where people go wrong with judging investor sentiment, particularly stock specific investor sentiment.

The Golden Rule of Sentimental Investing

Traders, especially momentum traders have a simple rule – jump on something that is appreciating/ depreciating ferociously and try to ride the trend for a day or 2, may be a week and. Then get out of it. Irrespective of whether you make a profit or loss. Chances are that when you spot trends, 6 out of 10 times you will be able to sell after riding a favorable trend. There are no guarantees however!! Investors will find it hard to sell at a loss. Further, they will often not sell for a small percentage of profit.

If you know you are an investor at heart then a sure way to benefit from investor sentiment in stock market is by doing the opposite. Read the rule below.

Follow this Rule – Negative investor sentiment in an otherwise positive market (+) coupled with fundamental strength in the underlying stock.

Ben Graham said it best in his book Security Analysis. Talking of General Electric Company’s stock price between 1937-38, he said – “General Electric sold at 64.9 because the public was in an optimistic frame of mind and at 27.2 (12 months later) because the same people were pessimistic. To speak of these prices as representing `investment values` or the `appraisal of investors` is to do violence either to the English language or to common sense, or both.”

The Next IHCL

A perfect example for this rule is a stock which is suffering purely on account of negative investor sentiment caused in turn by a sharp fall in the price of crude oil. Note that the long term trend of the market is positive, the company has the strongest fundamentals and yet the stock has declined sharply over the last 6 months. Read here for my full report on cairn India.

Hi, thank you for your valuable information.

Request if you could please also advise on the pledging of the shares by promoters (65%) in Cairn India. Is it a red flag for the moment? I have been waiting for so many months to buy Cairn, and now I believe is the time to start accumulating.

I look forward to hearing from you.

Regards,

Puru

The Ultimate Promoter Vedanta holds its equity in Cairn India via – Twin Star Mauritius Holdings Limited (Which is the foreign promoter of Cairn India).

Twin Star Mauritius Holdings Limited is 100% subsidiary of Twin Star Energy Holdings Limited. The latter has pledged its entire shareholding to refinancing its existing loan facilities. By virtue of that Cairn India’s equity is pledged. This has little to do with Cairn’s business which as you said is debt free. That said, if Twin Star defaults, the financiers may sell the pledged shares. Not only is it unlikely to happen, but under the circumstances, a change in management may actually be good news, what do you think?

If you see note 2 of the pledge disclosure here you will see what this means. Also in case it is of interest also see the facility agreement of Twin Star for which the pledge was created.

I got your point.

Now, I am more convinced to start investing in Cairn. Simultaneously, hoping that the crude does not go below $45, as now it is moving on its long term support.

Well between the 2 of us – I have been convinced since it traded at 350+ levels. 🙂