Even before the Coronavirus pandemic hit the world, the global economic output was on the downward trajectory with an expectation that the recession is just around the corner. Contrary to the macroeconomic factors, the equity markets across the globe were trading at extremely high valuations. The COVID-19 broke the momentum as markets crashed resulting in massive portfolio outflows.

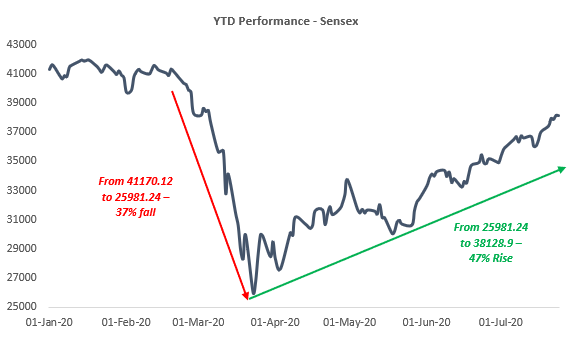

During March and April 2020, the markets witnessed sharp selloff, every stock, every sector, every geography, every factor fell at the same pace. Everyone was comparing this massive sell-off to the 2008-2009 market crash related to the global financial crisis.

What I believe is that this time, the fall in the market was fast and even the blue-chip companies operating with strong moats fall, as if there is no tomorrow. Human fear resulted in such a huge crash. While the earlier crash or sell-off in the market was more of a result of economic crises, the current one has been caused by a health crisis, which makes it significantly different.

Another thing which is different this time is the quick market recovery. Generally, after a steep market selloff, markets generally take time to recover, but given the fact that the government has responded quickly and pumped trillions of dollars into the financial system, this time market recovered quickly. It seems that the efforts of government combined with central banks paid off well and have resulted in a somewhat V-shaped recovery in the stock market.

Where Investors Have Put their Money?

With the increased volatility, investors shifted from equities market to gold, considering it as safe-haven assets. Gold is considered as a safe investment during political or economic turmoil. On July 27, 2020, gold price hit a fresh record high of Rs 51,833 per 10 grams. Gold prices are likely to continue its rally over the coming months amid continued uncertainty over the outlook for the global economy. Uncertainty in equity and bond yields and weak global economic outlook will continue to support the metal.

Where Investors Should ParkTheir Money?

The recent sell-off has given an entry point to many investors who were earlier reluctant because of high valuation. We believe that new investors should take this opportunity to put their money to work in the stock market if they were holding off their decision due to high valuations.

Trends suggest that overall retail participation has increased in terms of ‘Cash Average daily turnover’. The daily average turnover in the last 3-months indicates higher retail participation in the market.

| Average Daily Turnover

(Rs. Cr.) |

Equity – Cash Segment | Equity Derivatives | Currency Derivatives | |||

| Year | NSE | BSE | NSE | BSE | NSE | BSE |

| 2020-2021 (Apr – June) | 54,791.00 | 3,662.78 | 14,93,845.93 | 6,378.74 | 41,381.60 | 18,296.75 |

| 2019-2020 | 36,432.00 | 2,675.69 | 13,98,345.57 | 1,061.82 | 41,004.47 | 27,503.18 |

| 2018-2019 | 32,052.00 | 3,127.38 | 9,58,028.12 | 9.07 | 35,054.94 | 30,256.27 |

| 2017-2018 | 29,410.00 | 4,402.31 | 6,70,670.16 | 13.26 | 20,778.93 | 18,332.36 |

| 2016-2017 | 20,387.00 | 4,025.24 | 3,80,525.41 | 27.98 | 20,070.56 | 13,105.98 |

| 2015-2016 | 17,154.00 | 2,996.31 | 2,62,452.77 | 18,117.44 | 18,602.83 | 11,421.18 |

| 2014-2015 | 17,818.00 | 3,517.88 | 2,28,833.14 | 83,797.29 | 12,705.49 | 8,019.09 |

Companies with innovative products, increasing distribution reach, technology-driven processes, and healthy balance sheets will be the first to revive. There are many companies that have been least impacted by the outbreak of coronavirus and their prospect looks promising ahead with the improvement in the economy. Essential businesses like FMCG, Telecom (earlier considered as beaten down) and defensives bets of pharma, healthcare and IT should be in investor’s portfolio to generate good returns.