Lupin Q4 Results: Lupin limited will declare its Q4 results on May 10, 2023

CMP: 710

View: Buy

Target: 1210 (12 months)

What to watch out for – Revenue growth & commentary with regard to expansion and USFDA observations.

Disclaimer: I, and all my clients have invetments and are interested in Lupin stock.

_________

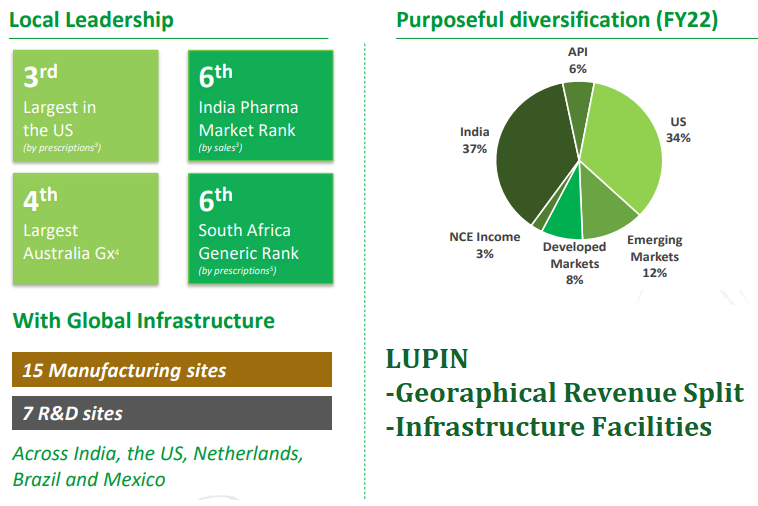

Lupin Limited is a pharmaceutical company based in Mumbai, India. It is primarily engaged in the development, manufacturing, and sale of generic and branded formulations, biotechnology products, and active pharmaceutical ingredients (APIs) globally. According to an April 2023 report by International Market Analysis Research and Consulting Group (IMARC Group), Lupin is the 7th largest generic drug company in the world. In India, Lupin has a market share of around 5.5% in the overall pharmaceutical market, making it the 3rd largest player in the market. Lupin’s key products in India include Lupihaler (asthma inhaler), Glycocheck (diabetes drug), and Maxgalin (pain management drug).

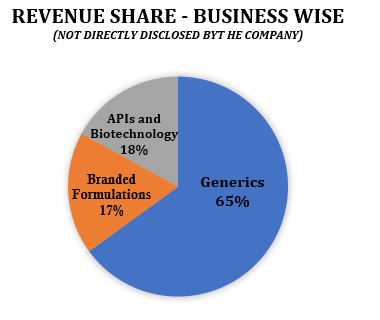

Generics and Active Pharmaceutical Ingredients (APIs): Lupin has a diverse portfolio of generic products, including oral solids, injectables, ophthalmics, and inhalation products.

Active Pharmaceutical Ingredients (APIs): Lupin is a leading manufacturer of APIs, with a portfolio of over 80 APIs. The company has a strong presence in the global API market, with a focus on high-value and complex APIs.

Branded Drugs and Biotechnology Products: Branded rugs have a higher margin than generics.

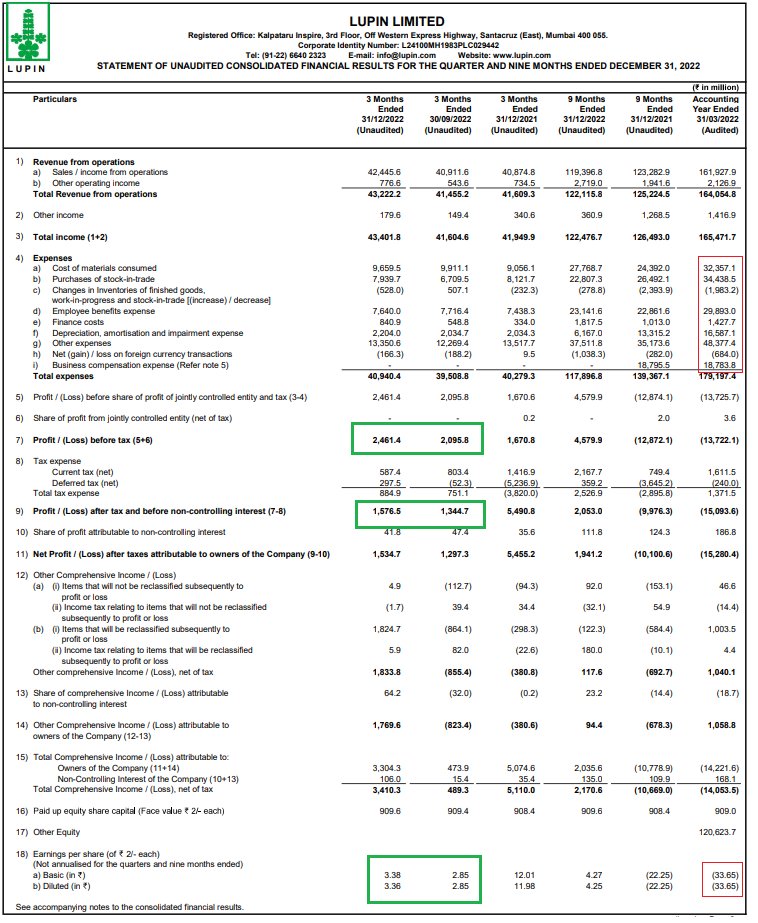

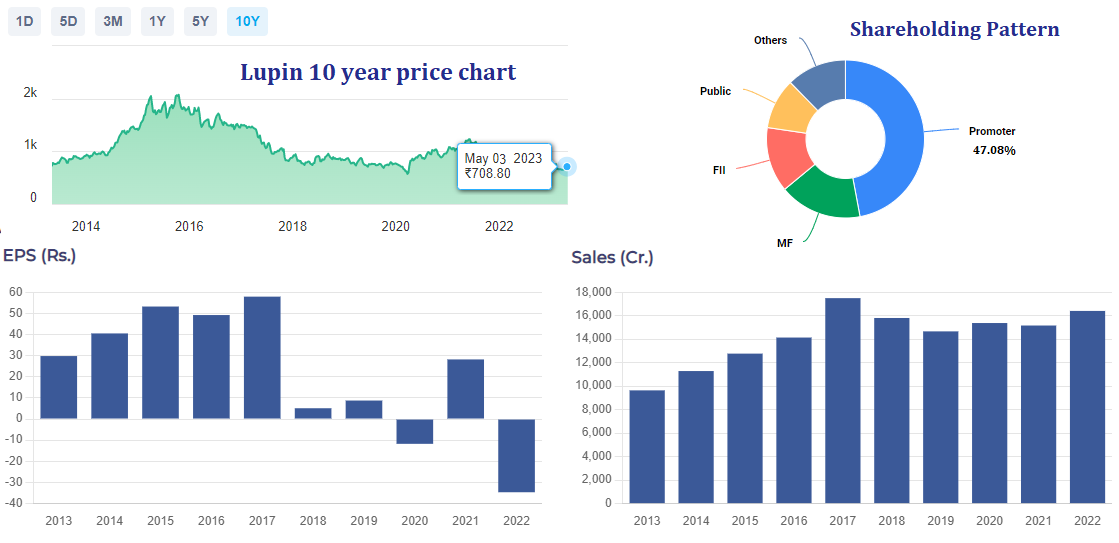

Lupin Limited’s earnings per share (EPS) for the fiscal year ended March 31, 2022, showed a decline compared to the previous year. According to Lupin’s financial statements, the company’s EPS for the year ended March 31, 2022, was INR 10.50, down from INR 18.28 for the previous year ended March 31, 2021. This represents a decline of approximately 42% in EPS year-over-year.

The decline in Lupin’s EPS can be attributed to several factors, including increased competition, pricing pressure, and the impact of COVID-19 on the global pharmaceutical industry. The company has also faced challenges related to compliance with regulatory standards, which have resulted in disruptions to its manufacturing operations and increased expenses related to remediation efforts.

Despite the decline in EPS, Lupin has continued to focus on expanding its product portfolio, investing in research and development, and pursuing strategic partnerships and acquisitions to drive growth. The company has also implemented cost-cutting measures and operational efficiencies to mitigate the impact of the challenging business environment.

In the first 9 months for FY 2023, Lupin’s financial performance has improved and the reason for a decline in EPS in previous quarters is being reversed on account of cost efficiencies and increase in overall revenue. Total revenue from operations should improve going forward as Lupin deals with observations from USFDA (see below) and increases its market share particularly in the U.S. Further, growth in revenue is likely to be augmented by recent aquisitions made by the company.

Setbacks on account of United States Food & Drug Administration’s (USFDA) warning letters

While receiving observations or warning letters from the USFDA is not uncommon in the pharmaceutical industry and does not necessarily mean that a company’s products are unsafe or ineffective, Lupin has received a particularly high number of warnings and in some cases repeated warnings for the same facility.

In all Lupin has 15 manufacturing sites and 7 R&D facilities across India, U.S., Netherlands, Brazil & Mexico. Over the past few years, Lupin has received a series of USFDA warnings and observations. Here’s a list of the more recent ones.

Note: Form 483 is issued by the USFDA upon the conclusion of a site inspection and relates to violations of the Food, Drug, and Cosmetic (FD&C) Act and other Acts or regulations in the United States. It impacts a company’s ability to sell and market the drugs manufactured at the concerned sites in the U.S.

- In 2015, the USFDA issued a Form 483 to Lupin’s Goa facility in India, listing several observations related to deficiencies in the facility’s quality systems, equipment maintenance, and laboratory controls.

- In 2017, Lupin’s Somerset facility in New Jersey received a warning letter from the USFDA citing violations of GMP regulations. The warning letter was related to the manufacture of topical products and included concerns about the facility’s quality systems, laboratory controls, and data integrity.

- In 2018, the USFDA issued a Form 483 to Lupin’s Pithampur facility in India, listing several observations related to deficiencies in the facility’s quality systems, equipment maintenance, and laboratory controls.

- In 2019, the USFDA issued a Form 483 to Lupin’s Tarapur facility in India, listing several observations related to deficiencies in the facility’s quality systems, equipment maintenance, and laboratory controls.

- In September 2022, the USFDA issued a warning letter to Lupin’s Tarapur, Maharashtra facility. The federal agency had inspected Lupin’s Tarapur site from March 22, 2022 to April 4, 2022.

- In November 2022, the USFDA issued Form-483 with 8 observations each for product and raw material production centers at Lupin’s Mandideep-based manufacturing facility.

- In March 2023, the USFDA issued a Form-483 with 10 observations after inspecting Lupin’s Pithampur Unit-2 manufacturing facility. USFDA inspected this plant from March 21 to March 29. 3 of the 10 observations could be classified as serious and the remaining 6 as not very serious. These observations were issued for practices across the board, including s production, quality and lab controls, equipment, and investigations.

Some of these warnings are the result of heightened scrutiny post Covid, and many pharmaceutical companies are facing similar heightened scrutiny. Lupin has addressed many of these observations and has lately received approvals for several of its products from the USFDA. Most recently Lupin got approval for its new drug application Brexpiprazole Tablets (0.25 mg, 0.5 mg, 1 mg, 2 mg, 3 mg, and 4 mg, a generic drug which will be manufactured at Lupin’s Pithampur facility. As things begin to normalize post Covid, I expect the situation to improve going forward, both in terms of relaxation of USFDA warnings and with regard to redressal of the above observations.

Valuation: Lupin’s Price / Earnings Multiple (PE) Lupin historically traded at PE multiple of 25-30

Lupin stock made an all-time high of Rs. 2129 in the year 2015. Since then, the share has been falling consistently, first on account of slowdown in global pharmaceutical industry and thereafter due to intense pricing pressure and the outbreak of Covid.

While gross revenue for Lupin has not grown at the same rate as it did in prior years, the revenue has not fallen over the last 5 years. There is a negative sentiment around the stock even though the promoters have been increasing thier holding in the company from (46.6% TO 47.08% over the past 5 years). The stock is currently trading at its 10 year lows and I believe that going forward any positive trigger will take the stock price higher.

While Lupin’s gross revenue has suffered on account of factors mentioned above, the bottomline (net profit) has struggled because of higher finance costs and depreciation. Recent aquisitions and the fact that sales have not kept up with higher spendings due to tough regulatory environment particulrly in the U.S. have all had a negative impact. Going forward, Lupin will benefit from its recent aquitions which shhould augment the overall revenue – the key metric to look out for.